Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 2 August 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

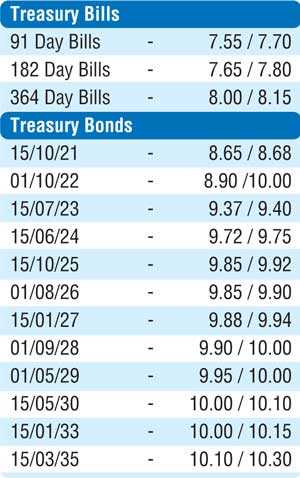

The fresh month commenced on a positive note as renewed buying interest across the yield curve saw secondary market bond yields decline yesterday. The yields on the liquid maturities of 2021’s (i.e. 01.03.21, 01.05.21, 01.08.21, 15.10.21 and 15.12.21), the two 2023’s (i.e. 15.03.23 and 15.07.23) and three 2024’s (i.e. 15.03.24, 15.06.24 and 01.08.24) declined to intraday lows of 8.47%, 8.55%, 8.60%, 8.65%, 8.70%, 9.30%, 9.39%, 9.72% each and 9.80% respectively against its previous days intraday lows of 8.60%, 8.65%, 8.70%, 8.75%, 8.80%, 9.35%, 9.45%, 9.74%, 9.77% and 9.85%. In addition, the 01.09.23, 15.12.23, 01.01.24 and 15.10.25 maturities were seen changing hands at levels of 9.50%, 9.55%, 9.65% and 9.87% respectively as well. In the secondary bill market, February and July 2019 maturities were traded at lows of 7.75% and 8.02% respectively.

01.08.21, 15.10.21 and 15.12.21), the two 2023’s (i.e. 15.03.23 and 15.07.23) and three 2024’s (i.e. 15.03.24, 15.06.24 and 01.08.24) declined to intraday lows of 8.47%, 8.55%, 8.60%, 8.65%, 8.70%, 9.30%, 9.39%, 9.72% each and 9.80% respectively against its previous days intraday lows of 8.60%, 8.65%, 8.70%, 8.75%, 8.80%, 9.35%, 9.45%, 9.74%, 9.77% and 9.85%. In addition, the 01.09.23, 15.12.23, 01.01.24 and 15.10.25 maturities were seen changing hands at levels of 9.50%, 9.55%, 9.65% and 9.87% respectively as well. In the secondary bill market, February and July 2019 maturities were traded at lows of 7.75% and 8.02% respectively.

The total secondary market Treasury bond/bill transacted volumes for 31 July was Rs. 12.76 billion.

In the money market, despite the overnight net liquidity surplus remaining at a high of Rs. 38.09 billion yesterday, the OMO Department of the Central Bank refrained from conducting any auctions for a second consecutive day in order to drain out liquidity. The overnight call money and repo rates averaged at 7.70% and 7.79% respectively.

Downward trend in rupee continues

In the Forex market, a globally strengthening dollar saw the USD/LKR rate on spot contracts losing further yesterday to close the day at a level of Rs.176.50/60 against its previous day’s closing level of Rs.176.30/35.

The total USD/LKR traded volume for 31 July was $ 82.91 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 177.00/15, 3 months - 178.20/40 and 6 months - 179.95/15.