Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 16 August 2018 00:00 - - {{hitsCtrl.values.hits}}

KPMG has launched its first-ever report on Sri Lanka’s banking sector highlighting industry trends, challenges and opportunities.

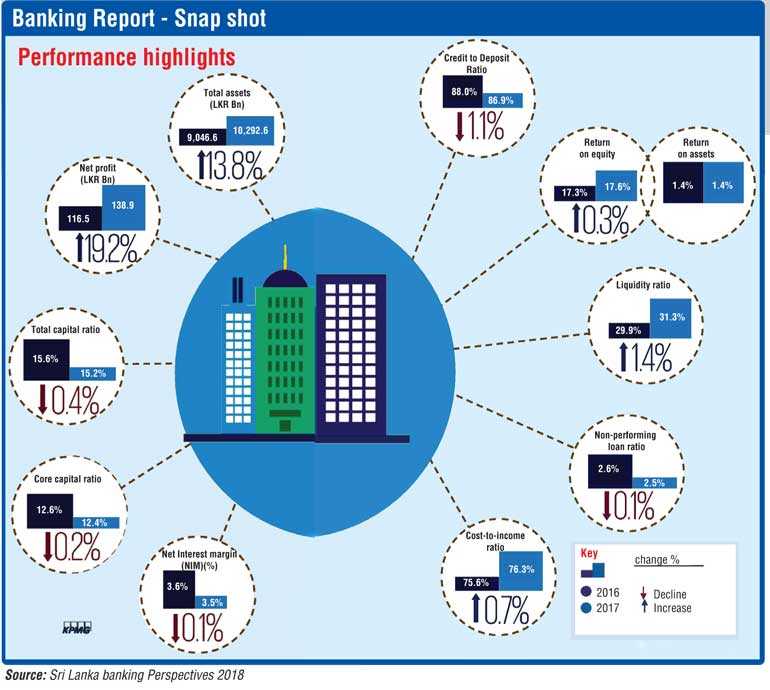

Titled ‘Sri Lanka Banking Perspectives,’ it provides a snapshot of industry performance of last year and first quarter as well as deals with a host of immediate challenges faced by the industry. They include Cyber Security and Regulation especially IFRS9. It also provides a macroeconomic overview and key banking indicators.

KPMG Senior Partner Reyaz Mihular said Sri Lanka team was inspired by the firm’s influential global publication ‘Frontiers in Finance’ and feedback from local clients to have a country-specific version. He added that the release of Sri Lanka Report was timely as the banking industry prepares for IFRS 9 compliance during this year and the BASEL III regulation requirements next year.

“The banking and financial services is a significant sector of the economy hence the publication will help multiple stakeholders,” Mihular added.

KPMG Partner and Head of Banking Services Ranjani Joseph said the launch of Sri Lankan report compliments the firm’s historic local and global expertise. For example locally, KPMG handles seven of the 11 top banks.

“Going forward we hope to issue a half yearly perspective. This is an investment to serve our clients better with credible analysis and perspectives,” Joseph added.

In terms of the industry, the report said major developments in technology and regulation are likely to have a transformative effect on the current and future landscape of the banking sector in Sri Lanka.

In her foreword in the publication, Joseph says in Sri Lanka as well as globally great leaps are being taken in the technology space, be it block chain, Fin Tech or digital transformation.

Although, this makes transactions more efficient, the risk of cyber-attacks has never been bigger than it is now. Not only individual companies but countries are at risk. As a result, there is a greater need for vigilance and continued focus on enhancing existing regulations and introducing new ones in response.

A fraud risk focused approach is necessary to mitigate the potential risk of fraud which may arise from previously benign channels.

These efforts, together with existing international and local initiatives to improve the stability of the global financial system, require continued focus from both regulators and the banking sector. This gets more complicated for those with extensive operations across multiple jurisdictions.

The recent policy reforms affect the overall economy with a knock on effect on the banks, resulting in muted growth forecasts in the near term while the outlook remains positive in the mid to long term.

Against this backdrop, banks are assessing how they can use new and innovative technologies to differentiate themselves from their competitors.

Banks also find themselves having to invest to comply with ever more stringent and complex regulations and tax regimes.