Friday Feb 27, 2026

Friday Feb 27, 2026

Friday, 17 January 2020 00:00 - - {{hitsCtrl.values.hits}}

The KPMG Academy conducted a seminar on Tuesday, 14 January at the Ramada Colombo on the recent tax reforms implemented by the regulatory authorities. KPMG Principal – Tax and Regulatory

|

|

Suresh R. I. Perera |

Suresh Perera presented a detailed analysis on the various changes to the tax framework of Sri Lanka and their implications thereon. The seminar which was well received by those in attendance facilitated the unravelling of the complexities stemming from the recent reforms.

Perera commenced his presentation by highlighting the tax revenue earned by the State as per the Inland Revenue Department Performance Report and Ministry of Finance Annual Report for 2018. He emphasised that out of the total tax revenue collected by the Department of Inland Revenue (DIR) revenue from Value Added Tax (VAT) accounted for 51.27% (Rs. 461,651 m) whereas Income Tax accounted for 28.59% (Rs. 257,367 m) of the collection.

According to the Ministry of Finance report, VAT was the largest contributor to the State coffers at 28% (Rs. 461,651 m) closely followed by import based taxes at 23% (Rs. 399,575). The total revenue  collected by the DIR was Rs. 900,348 million whereas the total revenue collection by way of taxes as per the Ministry of Finance report was Rs. 1,712,319 million.

collected by the DIR was Rs. 900,348 million whereas the total revenue collection by way of taxes as per the Ministry of Finance report was Rs. 1,712,319 million.

Perera explained the challenges of moving out of the VAT scheme for a person subsequent to the increase in the VAT registration threshold. Upon cancelation of the VAT registration, the person must hand over the certification of VAT registration to IRD and refrain from issuing VAT invoices as per Section 17(1) of the VAT Act. However the consequence embed at Section 16(5) of the Act may cause a sudden significant cash outflow to a person whose registration is cancelled.

The said Section deems a supply to occur with regard to assets of a taxable activity at a time immediately prior to the date of cancellation. In other words, the VAT Act deems that immediately before the cancellation of the registration the person is selling the assets (stocks as well as the capital assets) in the business. This requires the person to account for VAT for the final taxable period on the basis of sale of all assets of that person.

The rationale for this legal provision is to ensure that the tax office would not be at a loss as the tax payer has already claimed input VAT attributable to assets remaining with the business as of the date of the cancellation of the registration. However the triggering of this legal provision could impact the cash flow of the tax payer adversely as he is called upon to pay VAT without collecting any VAT from the customers.

He also elaborated as to the manner in which a specific amendment was introduced to the VAT Act to reduce the burden of the enterprises leaving the VAT net due to revision of VAT liable threshold on 1 January 2013, an incidence similar to the current upward revision of the VAT liable threshold.

The VAT liable threshold was increased from Rs. 650,000 per quarter to Rs. 300,000 from the beginning of 2013 resulting in many persons moving out of the VAT system.

In order to dilute the impact stemming from the triggering of “deem supply of all the assets forming the taxable activity” immediately before cancellation of registration and a high VAT pay out, the Amendment Act No. 17 of 2013 provided for the liability for the stocks to be eliminated via a formula specified therein. In relation to other assets the CGIR was empowered to determine the deem value based on the depreciation rate used for Income Tax for the purpose of calculating value to be considered for charging VAT.

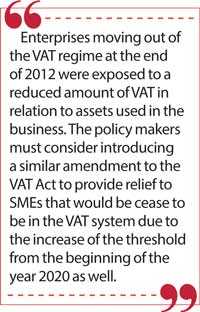

Thus the enterprises moving out of the VAT regime at the end of 2012 were exposed to a reduced amount of VAT in relation to assets used in the business. The policy makers must consider introducing a similar amendment to the VAT Act to provide relief to SMEs that would be cease to be in the VAT system due to the increase of the threshold from the beginning of the year 2020 as well.

As the VAT registrations of more than 50,000 persons have been inactivated by the Department of Inland Revenue, with the lapse of time these persons would be exposed to the above impact unless they opt to be registered under the voluntary registration scheme by making a request to that effect as the inactivation of registration would be followed by cancelation of registration.

In relation to the amendments to the Income Tax regime, more specifically the taxation of individuals and employment taxes, Perera explained, “The Inland Revenue Department has issued a formula to collect the taxes on the employment income for the three months from January to March 2020. If the aggregate gross payment to the employee exceeds Rs. 750,000, the amount in excess would be liable to tax.”

He further clarified that post 1 April 2020, the withholding of taxes by employer will be removed. “Post April 1st 2020, if an employee has earnings exceeding Rs. 250,000 a month, the employee will have to arrange to make payments and file the Return of Income on a self-assessment basis. The compliance obligations will be transferred to the employee post April 2020,” he added.

He explained the reforms in different taxes and mentioned that transitional provisions not being mentioned is a concern. If a tax payer has to embrace the tax reforms, the transitional provisions need to be clear and precise. At present there is ambiguity and no clear direction.

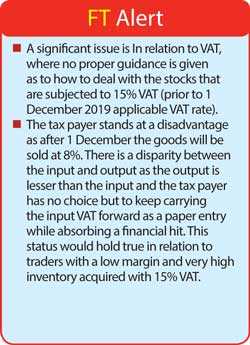

A significant issue is In relation to VAT, where no proper guidance is given as to how to deal with the stocks that are subjected to 15% VAT (prior to 1 December 2019 applicable VAT rate).

The tax payer stands at a disadvantage as after 1 December the goods will be sold at 8%. There is a disparity between the input and output as the output is lesser than the input and the tax payer has no choice but to keep carrying the input VAT forward as a paper entry while absorbing a financial hit. This status would hold true in relation to traders with a low margin and very high inventory acquired with 15% VAT.

The KPMG academy will be conducting further workshops in the future to keep all stakeholders well informed with regard to new developments in the tax arena in addition to other areas of significance.