Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 16 August 2019 00:00 - - {{hitsCtrl.values.hits}}

A promising lifestyle encompasses of key essentials such as protection, health, retirement and savings. Once these four essentials in life are met, life’s journey becomes a truly privileged one. With this in mind, HNB Assurance PLC (HNBA) announced the launch of PrivilegedLife, a lifestyle product for every step in life’s journey.

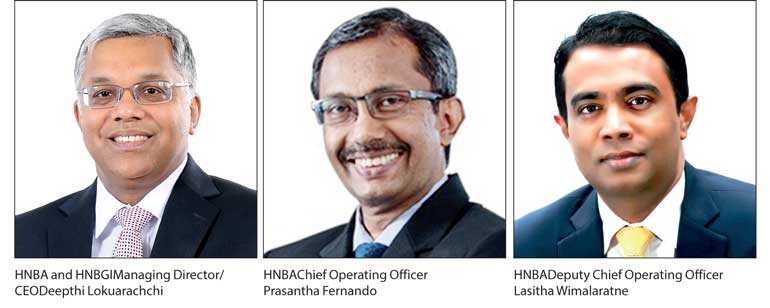

Sharing his thoughts, HNBA and its fully-owned subsidiary HNB General Insurance Limited (HNBGI)Managing Director/CEO Deepthi Lokuarachchi stated: “PrivilegedLife is another unique product from HNBA which addresses the needs of protection, health, savings and retirement. As a business built on the pillars of protection and focused on taking care of our people, it is our belief that PrivilegedLife would strengthen the core pillars of a thriving life.PrivilegedLife has been developed by carefullyanalysing and diving deep into customer insights and theevolving consumer needs to provide the ultimate insurance solution.”

Expressing his views, HNBA Chief Operating Officer Prasantha Fernandostated: “PrivilegedLife is not only a product with multiple benefits, it also becomes your go to at times of need as it offers the options of partial fund withdrawals. One of the most significant features of this insurance plan is the Top-Up premium option which protects the fund’s value over time with attractive annual dividends, and we firmly believe that this innovative plan is one that could improve the quality of lifestyle as it offers a range of incomparable benefits.”

HNBA Deputy Chief Operating Officer Lasitha Wimalaratnestated: “This comprehensive insurance plan is another revolutionary product of HNBA’s product portfolio, with bouquet ofspecial benefits includinga number of protection benefits, attractive annual dividends, loyalty dividends and many more. The journey with PrivilegedLife continues even after the policy reaches itsmaturity stage as it allows the Maturity Fund to be obtained as a lump sum or to be converted to Health Fund, which could be used for medical needs through cashless bill settlement. Or the policy’s Maturity Fund could be obtained as a life-long pension to spend the golden eve of life with peace of mind. In addition to the main benefits, Protection Benefits such as Additional Life Benefit, Accidental Death Benefit, Critical Illness Benefit (covering 29 illnesses), Hospitalisation Benefit, Surgical Benefit and Medical Reimbursement Benefit (SupremeHealth Benefit) with an annual worldwide coverage of up to Rs. 50 millioncould be obtained.PrivilegedLife could be tailored to suit every need in life’s journeyand has been designed to ensure that you and your loved ones are well taken care to face the challenges of tomorrowwhether or not you’re here for them.”

HNB Assurance (HNBA) is the one of the fastest growing insurance companies in Sri Lanka, with a network of 59 branches. HNBA is a life insurance company with an A rating (lka) by Fitch Ratings Lanka for ‘National Insurer Financial Strength Rating’, and has been recently included in the S&P SL20 Index. Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Ltd. (HNBGI) was created and commenced its operations in January 2015. HNBGI continues to specialise in motor, non-motor and takaful insurance solutions and is a fully-owned subsidiary of HNB Assurance. HNBA is rated within the Top 100 brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for Brand Excellence, Digital Marketing and HR Excellence, as well as many awards for its Annual Reports by the Institute of Chartered Accountants of Sri Lanka and SAFA (South Asian Federation Accountants).