Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 13 November 2018 00:00 - - {{hitsCtrl.values.hits}}

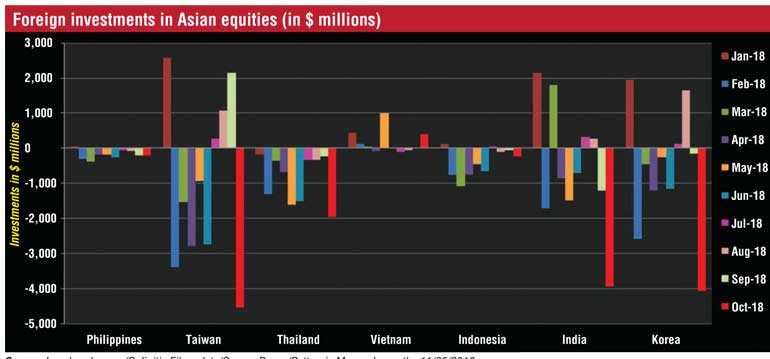

Reuters: Foreign investors sold Asian equities heavily in October on concerns over slowing earnings, higher US interest rates and trade tensions between the United States and China.

Data from regional stock exchanges showed foreigners sold a net total of $14.54 billion in Taiwan, South Korea, India, Thailand, Philippines, Indonesia, and Vietnam equities in the last month.

The total was the highest in at least 7 years, the data showed.

The outflows were led by Taiwan, South Korea and Indian equities, with each market seeing net sales of about $4 billion or more in the last month.

“It is a run for the doors as risk sentiment was heightened on the backdrop of aggravated concerns over both trade tensions and tightening monetary conditions,” said Jingyi Pan, a Singapore-based market strategist at trading and investments provider IG.

The region’s growth worries were highlighted by the International Monetary Fund in the last month, which cut its projection for next year, citing trade wars and monetary tightening in some economies.

At the start of this month, the US President Donald Trump said that he will likely make a deal with China on trade, but warned that he still may impose more tariffs on Chinese goods.

Refinitiv data showed 54% of Asian companies have missed consensus earning forecasts for the third quarter so far, underscoring a lacklustre earnings performance and worries about the impact from the US-China trade war.

MSCI’s broadest index of Asia-Pacific shares outside Japan shed more than 10% in October to extend its 2018 losses to 17%. However, the index is up 2.6% so far this month.

“The sell-off had rendered Asian equities cheaper and certainly boosted the attractiveness of the region, but the outlook remain overcast with the uncertainties of US-China trade ties among others that could continue curbing the return of foreign flows,” Pan added.