Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 30 July 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

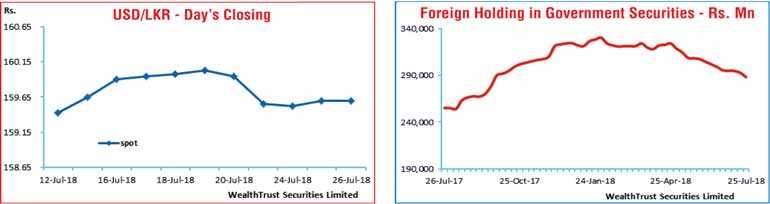

The winding down of the foreign holding in rupee bonds was seen gathering momentum for the week ending 25 July, as it increased to a 10-week high of Rs. 4.61 billion to record an accumulative outflow of Rs. 35.96 billion over the past 13 consecutive weeks, commencing 2 May.

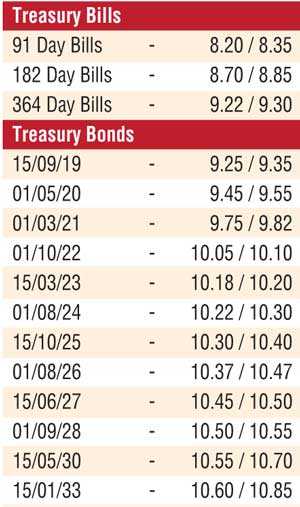

The secondary bond market experienced some volatility during the week ending 26 July, with yields increasing during the early part of the week and reducing mid-week to the latter part of the week while activity dried up at the end of the week. Yields of the liquid maturities of 01.03.21, 15.03.23, 01.08.24 and 01.09.28 increased to intraweek highs of 9.80%, 10.25%, 10.35% and 10.55%, respectively, before bouncing back to lows of 9.75%, 10.16%, 10.22% and 10.50%.

The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 7.96 billion.

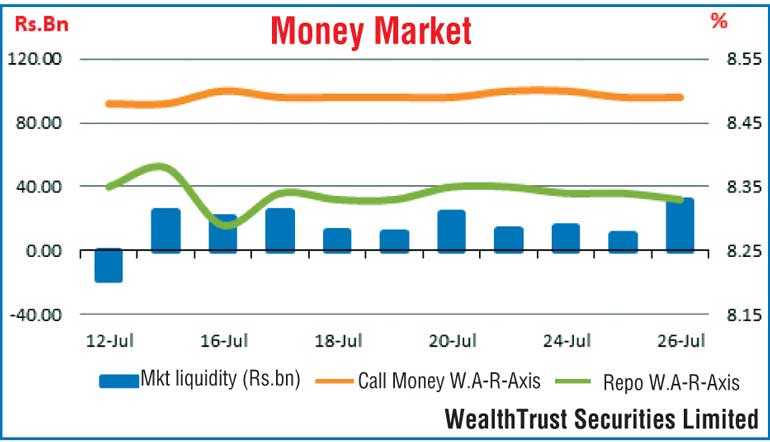

In money markets, the overnight call money and repo rates remained mostly unchanged during the week to average at 8.50% and 8.34%, respectively, as the Open Market Operations (OMO) Department of the Central Bank continuously drained out liquidity by way of an overnight repo auction at weighted average ranging from 7.80% to 8.00%. Nevertheless, the net liquidity surplus in the system decreased to Rs. 17.70 billion on an average against its previous week’s net surplus average of Rs. 18.61 billion.

Rupee appreciates during the week

The USD/LKR rate appreciated during the week to close the week at levels of Rs. 159.55/65 against its previous week’s closing level of Rs. 159.90/00 on the back of export conversions and banks selling interest outweighing importer demand.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 68.60 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 160.40/45; 3 Months - 161.95/05 and 6 Months - 164.40/45.