Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 14 June 2019 00:00 - - {{hitsCtrl.values.hits}}

First Capital has upgraded its outlook on the exchange rate given external and internal developments.

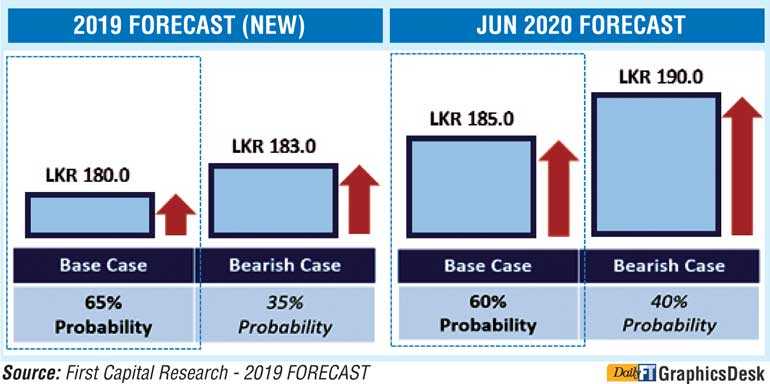

As per the upgrade Exchange Rate Outlook for 2019E to $ 1: Rs. 180.0 (from 194.0) as the 65% Base Case scenario. Further, it is introducing a 12-month target for June 2020E of $ 1: Rs. 185.0 as a 60% Base Case scenario.

It said the US is signalling signs of concern over its GDP growth which is expected to slow down partly due to the trade war. However, inflation continues to remain stable in the desired level of 2%. Analysts expect a higher probability for a rate cut which could be as much as 50 bps, in the 2H2019. Thereby, the dollar is expected to weaken during the 2H2019 possibly favouring the rupee.

Noting that Sri Lanka consumer demand to remain weak maintaining weaker imports, it said Sri Lanka’s consumer confidence index compiled by Neilson recorded a major plunge in the last couple of months subsequent to the Easter Sunday attacks which we expect could lead to a further dent in imports amidst lower consumer demand. Following the 50 bps rate cut by CBSL, there is a tendency for the rupee to weaken as demand in the system is expected to improve.

However, First Capital Research expects the recovery in demand to be at a significantly slow pace considering the severity of the impact to all sectors by the Easter Sunday attacks and the subsequent incidents. “We expect demand to normalise by 4Q2019 supported by the possible improved sentiment with the announcement of the Presidential Election,” it added.

First Capital also said CBSL targets dollar debt inflows to maintain reserves.

CBSL’s foreign reserve position is key in building confidence in the exchange rate. Currently as at May, Foreign Reserves stood at $ 6.7 billion which is estimated to be above the targeted four months of imports. Heavy dip in imports has reduced overall comfortable level of foreign reserves.

In order to maintain reserves at $ 6.5-7 billion range CBSL needs to raise a further $ 2 billion for which Cabinet approval has already been obtained. CBSL also targets an additional $ 2.5 billion to be raised to meet payments falling due in 2020 before the election season which starts in 4Q2019 and may continue up to 2Q2020 (Presidential, General and Provincial Elections).

“If Sri Lanka is successful in raising the required funds via foreign debt over next couple of months, the foreign reserve position could be maintained at a reasonably comfortable level which we believe is $ 6.5 billion considering the prevailing environment,” First Capital said.

Noting that the rupee weakening may soften, it said in spite of the rate cut, the weakness of the rupee may be limited considering the delay in consumer demand while the rupee is also likely to be supported by the weak dollar and targeted debt driven inflows.

“We upgrade our Exchange Rate Outlook for 2019E to 1 USD: LKR 180.0 (from 194.0) as our 65% Base Case scenario. Further, we are introducing a 12-month target for Jun 2020E of 1 USD: LKR 185.0 as a 60% Base Case scenario,” First Capital added.