Monday Mar 09, 2026

Monday Mar 09, 2026

Monday, 11 November 2019 00:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The upcoming Presidential Election kept the secondary bond market on a bearish mode during the week ending 8 November.

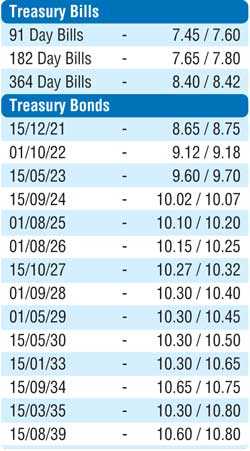

Limited activity was witnessed subsequent to the weekly Treasury bill auction results with yields on the market favourite maturities of 15.09.24 and 15.10.27 increasing marginally to intraweek highs of 10.08% and 10.30%, respectively, against its previous weeks closing levels of 10/05 and 10.27/30. At the auction, the 364-day bill weighted average increased for a second consecutive week by 6 basis points to 8.41%.

However, yields pulled back from these highs as the said maturities hit lows of 10.03% and 10.28%, respectively, once again on the back of buying interest. In addition, the maturities of 2022s (i.e.15.03.22, 01.07.22 and 01.10.22), 2023s (i.e. 15.03.23, 15.05.23, 15.07.23 and 15.12.23), 2024s (i.e. 15.03.24 and 15.06.24), 01.05.29 and 15.09.34 changed hands within the range of 9.05% to 9.20%, 9.55% to 9.80%, 9.98% to 10.07%, 10.30% to 10.33% and 10.65% to 10.70%. Furthermore, foreign buying interest in rupee bonds continued for a third consecutive week with an inflow of Rs. 1.88 billion for the week ending 6 November.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 8.14 billion.

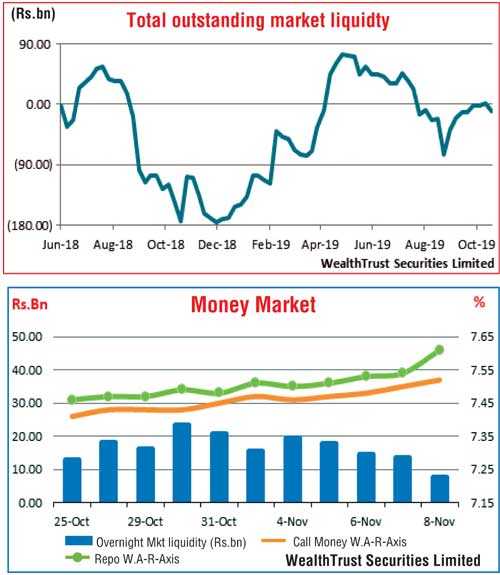

In money markets, overall liquidity in the system was seen turning negative once again to record a deficit of Rs.9.57 billion against its previous week’s surplus of Rs.0.79 billion.

The overnight call money and repo averaged 7.49% and 7.54% respectively for the week as the Open Market Operations (OMO) Department of Central Bank injected liquidity during the week by way of overnight and ten day reverse repo auctions at weighted average yields of 7.55% and 7.65% respectively.

The average overnight net liquidity surplus in the system stood at Rs.14.71 billion for the week.

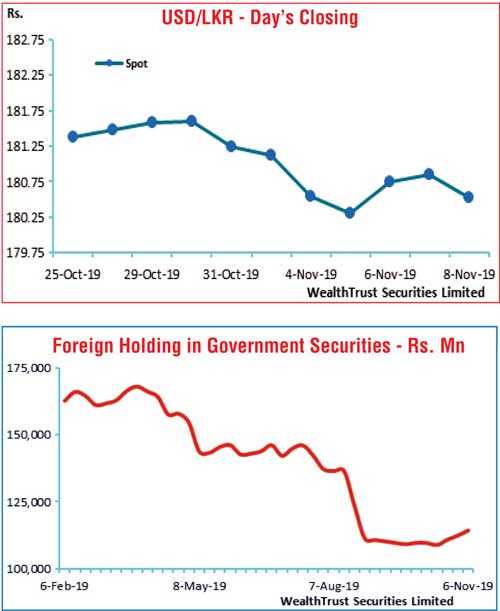

Rupee gains further during the week

In the Forex market, the USD/LKR rate on spot contracts were seen closing the week higher at Rs. 180.45/65 in comparison to its previous weeks closing levels of Rs. 181.05/20, subsequent to trading at high and low of Rs. 179.75 to Rs. 181.05. The daily USD/LKR average traded volume for the first four days of the week stood at $ 77.06 million. Some forward dollar rates that prevailed in the market were one month – 181/30, three months – 182/30, and six months – 183.80/20