Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 2 August 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

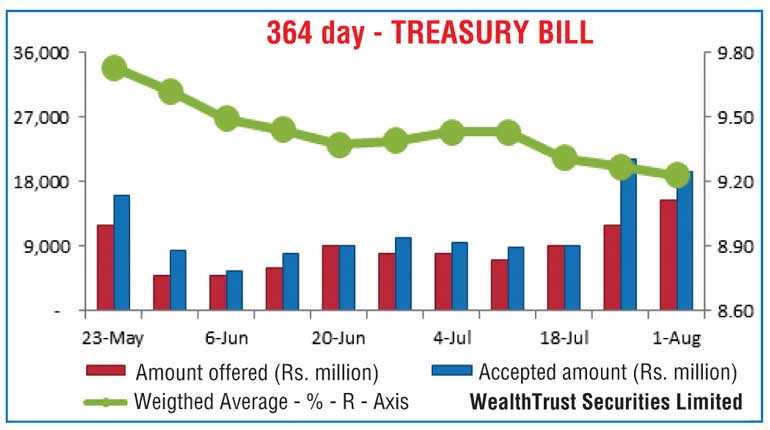

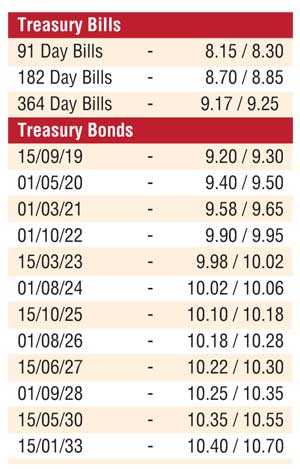

The downward momentum in the weekly Treasury bill auctions continued at yesterday’s auction as well, with the total offered amount of Rs. 24.5 billion being successfully subscribed. The 91 day bill recorded the sharpest decrease of 07 basis points to 8.17% closely followed by the 364 day bill by 04 basis points to 9.23%. All bids received on the 182 day bill were rejected while the bids to offer ratio increased to a 3.2:1.

The secondary bond market witnessed continued buying interest yesterday amidst high activity as yields on the liquid maturities of two 2021’s (i.e. 01.03.21 and 01.05.21), 01.10.22, 15.03.23, 01.08.24, 15.06.27 and 01.09.28 were seen dipping to intraday lows of 9.60%, 9.65%, 9.90%, 9.96%, 10.03%, 10.28% and 10.25% respectively against its previous day’s closing level of 9.68/73, 9.75/80, 9.95/00, 10.02/07, 10.10/15, 10.25/35 and 10.30/35. In addition, activity was witnessed on the 01.07.2019 01.05.20 and 01.08.2021 maturities at levels of 9.20%, 9.45% and 9.65% to 9.76% respectively. In the secondary bill market, January, February, March, May and July 2019 maturities were traded at levels of 8.70% to 8.75%, 8.85%, 8.90% to 9.00%, 9.11% to 9.13% and 9.18% to 9.20% respectively.

The total secondary market Treasury bond/bill transacted volumes for 31 July was Rs. 12.69 billion.

In money markets, the overnight call money and repo rates averaged 8.38% and 8.28% respectively as the net surplus liquidity stood at Rs. 37.12 billion yesterday. No OMO (Open Market Operations) auctions were conducted for a second consecutive day.

Rupee appreciates marginally

The rupee rate on its spot contract was seen appreciating marginally yesterday to close the day at Rs. 159.55/65 against its previous day’s closing levels of Rs. 159.70/80.

The total USD/LKR traded volume for 31 July was $ 65.16 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 160.35/55; 3 Months - 161.95/15 and 6 Months - 164.30/50.