Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 27 May 2019 00:39 - - {{hitsCtrl.values.hits}}

By Capital TRUST Securities

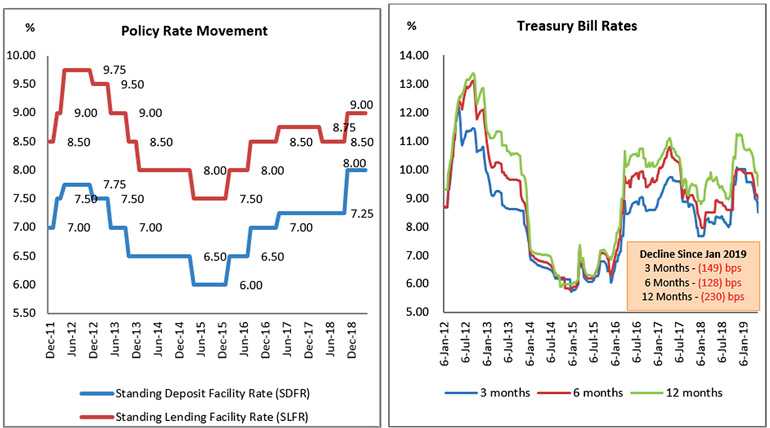

Central Bank Governor Dr. Indrajit Coomaraswamy has hinted a strong possibility of a policy rate cut at the next monetary policy review meeting scheduled on 31 May. According to the Governor, there is a strong case for relaxing monetary policy. “All options are there, it could be a SRR (Statutory Reserve Ratio), it could be a policy-rate reduction, and it could be a combination of the two,” Governor Coomaraswamy told Bloomberg Television during an interview in Singapore.

Since beginning of 2019 the 12-month Treasury bill yield has declined 230bps, while six-month and three-month yields have declined 128bps and 149bps respectively. Treasury bill yields may further decline in response to a rate cut, and the Central Bank expects the lending rates to SMEs to reduce by around 200 basis points in the near term.

The Central Bank requested licensed banks and Non-Banking Financial Institutes (NBFIs) to reduce interest rates on deposits enabling banks to reduce their interest rates on lending products in general.

When interest rates reduce significantly, it will improve corporate earnings due to increase in consumer spending and decline in finance cost, which will cause share prices to rise. Furthermore, decline in interest rates will reduce the yield form fixed deposits and government securities which will drive the demand for stock market investments.

Historically the stock market has risen sharply when the Central Bank reduced policy rates; hence this is an opportune time to invest in the Colombo Stock Exchange (CSE). Moreover most of the fundamentally strong shares are now trading at valuations lower than what was seen before the end of the war, and also economic indicators are much better than what it was during the war. Both these reasons are strong cases for investors to shift from traditional investments to stock market investments.

(The information and the opinions contained herein were compiled by Capital TRUST Securities Ltd., and are based on information obtained from reliable sources in good faith. However, such information has not been independently verified and no guarantee, representation or warranty expressed or implied is made by Capital TRUST Securities Ltd. and its related companies as to its accuracy or completeness. This report is not and should not be construed as an offer to sell or a solicitation of an offer to buy any security. Neither Capital TRUST Securities Ltd. nor its related companies, directors and employees can be held liable whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein.)