Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 22 February 2021 00:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

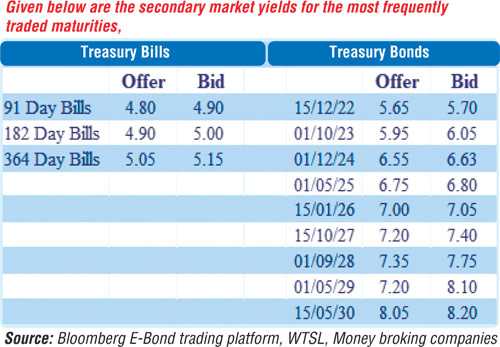

The secondary bond market saw its yields closing the week ending 19 February mostly unchanged in comparison to its previous week’s closings, subsequent to increasing during the first half of the week while reversing four consecutive weeks of increases.

The secondary bond market saw its yields closing the week ending 19 February mostly unchanged in comparison to its previous week’s closings, subsequent to increasing during the first half of the week while reversing four consecutive weeks of increases.

The liquid maturities of 15.12.22, 15.09.24, 01.12.24 and 15.01.26 saw its yields increasing to weekly highs of 5.85%, 6.80%, 6.85% and 7.12%, respectively, in comparison to its previous weeks closing levels of 5.60/65, 6.55/63, 6.60/65 and 6.95/20.

The increase in the weekly Treasury bill weighted average rates for a third consecutive week coupled with an undersubscribed auction for a fourth consecutive week were seen as the main reasons behind the increase.

However, renewed buying interest at these levels led to a downward momentum as yields were seen decreasing once again to hit intraweek lows of 5.70%, 6.60% each and 7.03%, respectively, on the said maturities.

In addition, activity across the yield curve saw maturities of 2021’s (i.e. 01.05.21, 01.08.21 and 15.10.21), 01.10.22, 15.01.23, mid 2023’s (i.e. 15.05.23, 15.07.23, 01.09.23, and 01.10.23), 15.12.23, 2024’s (i.e. 15.06.24 and 01.08.24), 2025’s (i.e. 15.03.25 and 01.05.25), 01.02.26, 15.08.27, 01.09.28 and 15.05.30 been traded at levels of 4.73% to 4.93%, 5.65% to 5.67%, 5.85% to 5.90%, 6% to 6.08%, 6.05% to 6.20%, 6.70% to 6.75%, 6.79% to 6.95%, 7.03% to 7.18%, 7.36%, 7.85% to 8.05% and 7.95% to 8.30%, respectively.

The foreign holding in Rupee bonds was steady at Rs. 7.42 billion.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 5.59 billion.

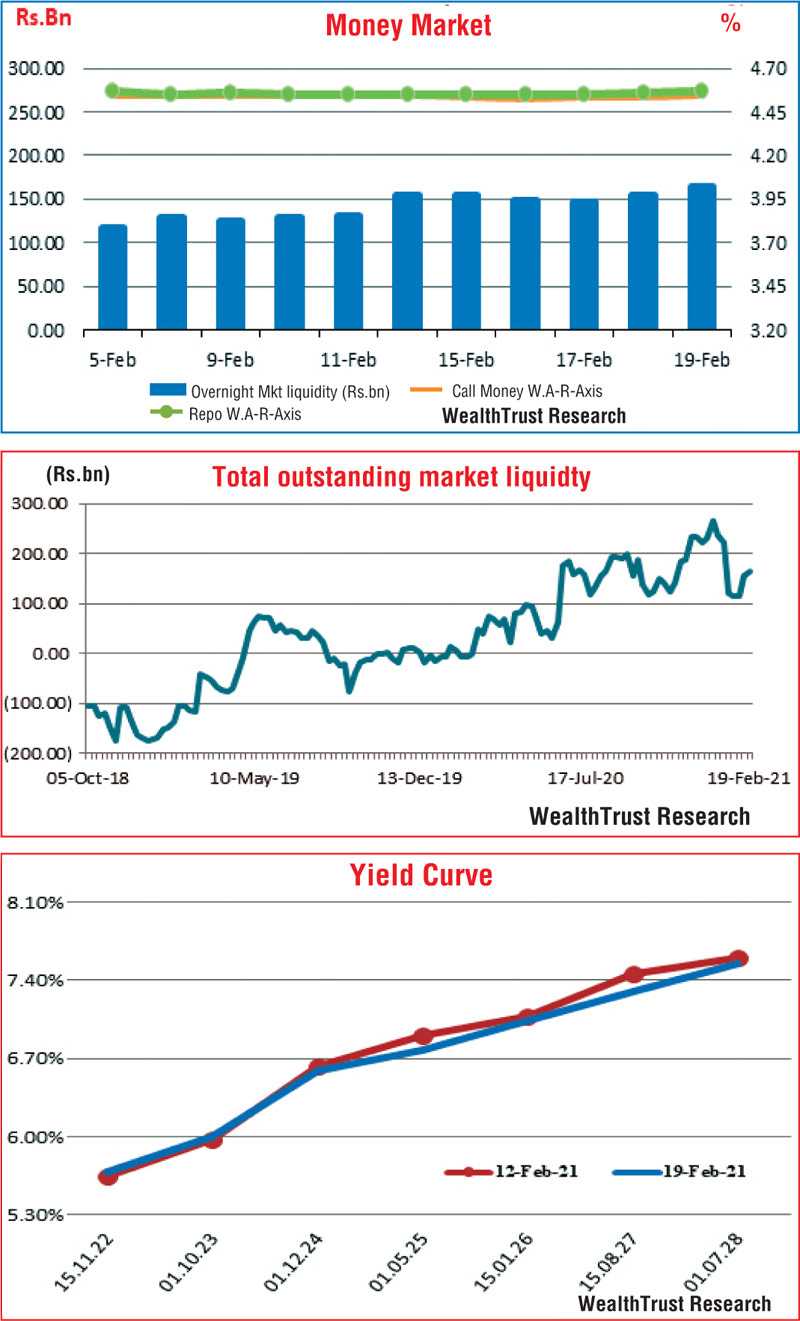

In money markets, the total outstanding market liquidity was registered at Rs. 165.29 billion while the weighted average rates on overnight call money and repo remained mostly unchanged to average 4.54% and 4.56%, respectively, for the week. The CBSL’s holding of government securities stood at Rs. 784.27 billion.

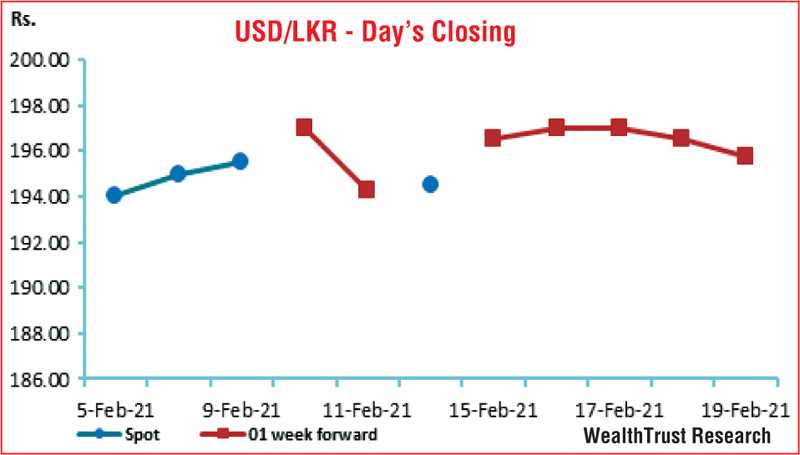

In Forex markets, USD/LKR rate on the more active one week forward contracts were seen closing the week at Rs. 195.50/196 in comparison to its spot closing of Rs. 194/195 the previous week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 47.01 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)