Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 12 December 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

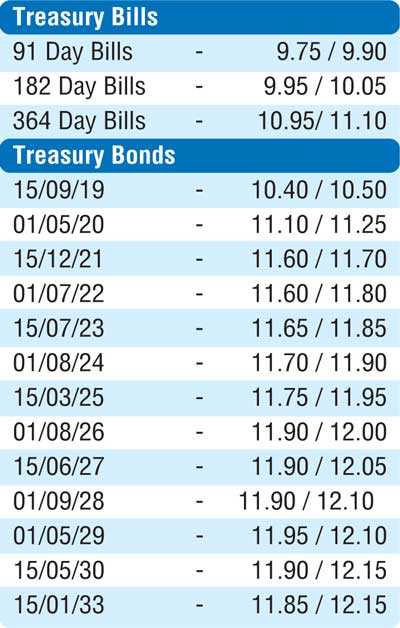

The secondary bond market yields increased marginally yesterday, with the liquid maturities consisting of the two 2021’s (i.e. 01.03.21 and 01.08.21) and 15.06.27 hitting highs of 11.50%, 11.55% and 12.00% respectively against its previous day’s closing levels of 11.40/55, 11.50/60 and 11.90/95. Furthermore, limited amount of activity was witnessed of the 15.09.19 maturity at 10.50%. Meanwhile, in the secondary bill market, March, May, October and November 2019 maturities traded at levels of 9.60%, 10.00%, 11.00% and 11.05% respectively.

At today’s auction, the total offered amount will be at a nineteen week high of Rs. 23 billion, consisting of Rs. 7 billion on the 182 day and Rs. 16 billion on the 364 day maturities. The 91 day maturity will not be on offer. At last week’s auction, the weighted average yields of the 182 day bill increased to 10.01% while the 364 day bill remained steady at 11.20%.

The total secondary market Treasury bond/bill transacted volumes for 10 December was Rs. 3.25 billion.

In the money market, the overnight call money and repo rates averaged 8.92% and 9.00% respectively, with the net liquidity shortfall standing at Rs. 65.58 billion.

The OMO Department of the Central Bank, conducted two reverse repo auctions of Rs. 10 billion and Rs. 15 billion for durations of one and seven days, which were successfully subscribed at weighted average yields of 8.69% and 8.71%. In addition, a further amount of Rs. 48.87 billion was injected at the Standing Lending Facility Rate (SLFR) of 9.00%. However, all bids received for the five outright purchases of Treasury bills totalling Rs. 20 billion were rejected for a third consecutive day.

Rupee loses further

The USD/LKR rate on spot contracts depreciated further yesterday, amidst moderate trading, to close the day at Rs.179.20/50 against its previous day’s closing levels of Rs.179.00/25.

The total USD/LKR traded volume for 10 December was $ 117.52 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 180.25/65; 3 months - 182.25/75 and 6 months - 185.25/75.