Saturday Feb 28, 2026

Saturday Feb 28, 2026

Tuesday, 21 August 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

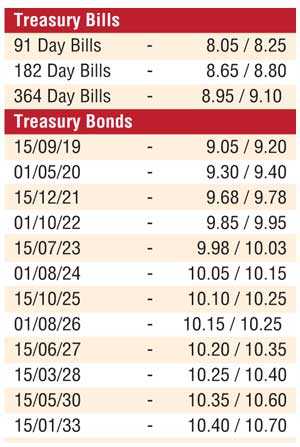

Secondary bond market yields were seen increasing further yesterday, with the liquid maturities of 15.07.23 and 01.08.24 hitting highs of 10.00% and 10.05% respectively against its previous day’s closing levels of 9.93/98 and 9.98/05. Furthermore, a limited amount of activity was also witnessed consisting of the 01.05.21 and 15.03.28 maturities at 9.60% to 9.617% and 10.30%.

At today’s bill auction, a total amount of Rs. 18 billion will be on offer, consisting of Rs. 4 billion of the 91 day, Rs. 2 billion of the 182 day, and Rs. 12 billion of the 364 day maturities. At last week’s auction, the weighted average yields decreased across the boards to 8.10%, 8.62% and 9.00% respectively on the said maturities. The total secondary market Treasury bond/bill transacted volumes for 17 August was Rs. 3.47 billion.

The OMO (Open Market Operations) Department of the Central Bank was seen draining out liquidity by way of a term repo auction and an overnight repo auction, with the net liquidity surplus in the system standing at Rs. 33.51 billion. The four day term Repo auction drained out an amount of Rs. 10 billion at a weighted average of 7.57% while a further Rs. 11.77 billion was drained out by the overnight auction at a weighted average of 7.52%. Call money and repo rates averaged 7.85% and 7.80% respectively.

Rupee closes mostly unchanged

The rupee on spot contracts dipped to an intraday low of Rs. 160.60 during the morning hours of trading on the back of continued importer demand before bouncing back to close the day at levels of Rs. 160.50/60 when compared against the previous day’s closing levels of Rs. 160.50/58.

The total USD/LKR traded volume for 17 August was $ 117.75 million. Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 161.30/45; 3 Months - 162.90/05 and 6 Months - 165.35/50.