Saturday Feb 07, 2026

Saturday Feb 07, 2026

Friday, 17 January 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

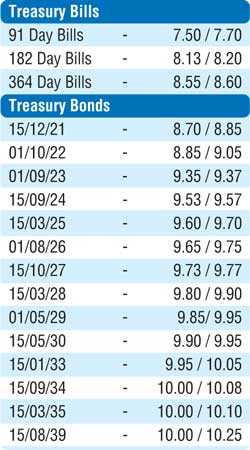

The secondary bond market yields were seen decreasing marginally yesterday across the yield curve. Yields on the liquid maturities of 2023’s (i.e. 15.07.23, 01.09.23 & 15.12.23) and 2024’s (i.e.15.06.24 &  15.09.24) decreased to intraday lows of 9.23%, 9.35%, 9.40% and 9.55% each against its previous day’s closing levels of 9.22/32, 9.35/42, 9.38/48, 9.55/60 and 9.55/60 in addition to the 15.03.25 changing hands within the range of 9.69% to 9.75%. On the longer end of the curve, maturities of 15.05.30, 15.01.33 and 15.03.35 changed hands at levels of 9.91% to 9.97%, 10.05% to 10.09% and 10.08% to 10.10% respectively.

15.09.24) decreased to intraday lows of 9.23%, 9.35%, 9.40% and 9.55% each against its previous day’s closing levels of 9.22/32, 9.35/42, 9.38/48, 9.55/60 and 9.55/60 in addition to the 15.03.25 changing hands within the range of 9.69% to 9.75%. On the longer end of the curve, maturities of 15.05.30, 15.01.33 and 15.03.35 changed hands at levels of 9.91% to 9.97%, 10.05% to 10.09% and 10.08% to 10.10% respectively.

The total secondary market Treasury bond/bill transacted volume for 14 January was Rs. 28.10 billion.

Meanwhile in money markets, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any liquidity management auctions yesterday. The overnight net liquidity surplus in the system decreased to Rs. 17.25 million while the weighted average yields on the overnight call money and repo rates were recorded at 7.44% and 7.50% respectively.

Rupee appreciates

The USD/LKR rate on spot contracts was seen appreciating yesterday to an intraday high of Rs 181.25 against its opening low of Rs 181.45 and closed the day at Rs 181.20/30 against its previous day’s closing of Rs 181.50/60.

The total USD/LKR traded volume for 14 January was $ 91.98 million.

Some forward USD/LKR rates that prevailed in the market are: one month – 181.75/90; three months – 182.70/90; six months – 184.25/55.