Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 28 December 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

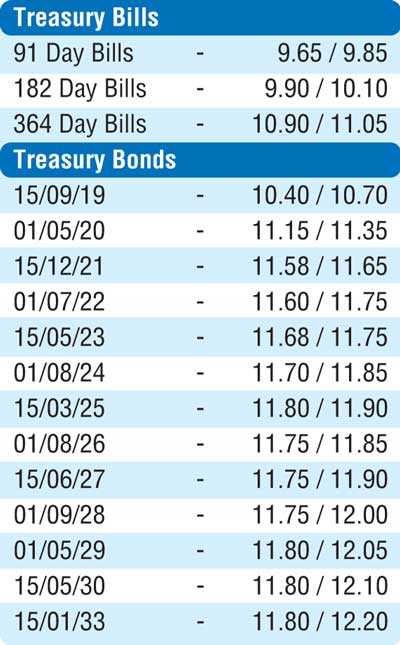

The secondary market bond yields were seen increasing further yesterday on the back of continued selling interest ahead of today’s monetary policy announcement, due at 7.30 am. The Central Bank of Sri Lanka (CBSL) was seen increasing its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) by 75 basis points and 50 basis points respectively to 8.00% and 9.00%, while it slashed its Statutory Reserve Ratio (SRR) by 150 basis points to 6.00% at its seventh review in November. Activity centred on the short end to the belly end of the yield curve with yields on the maturities of 15.12.21, 15.07.23, 15.03.25, 01.08.26 and 15.06.27 increasing to intraday highs of 11.60%, 11.75%, 11.89%, 11.80% and 11.79% respectively against its previous days closings of 11.50/55, 11.61/65, 11.65/75, 11.68/75 and 11.70/77 on thin volumes.

The total secondary market Treasury bond/bills Transacted volume for 26 December was Rs. 14.68 billion. The money market deficit stood at Rs. 96.53 billion yesterday with call money and repo averaging 9.00% and 8.99% respectively. The OMO department of Central Bank infused liquidity on an overnight and a seven day term basis by way of Reverse Repo auctions for amounts of Rs. 30 billion and Rs. 20 billion respectively at weighted averages of 8.97% and 9.00%. However, all bids received for the five outright purchases of Treasury bills totalling Rs. 20 billion were rejected.

Rupee continues to slide

The USD/LKR rate continued to slide yesterday to close at Rs. 182.35/50 against its previous day’s closing of Rs. 181.80/00 on continued demand by banks.

The total USD/LKR traded volume for 26 December was $ 122.07 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 183 15/65; 3 months - 185.15/65 and 6 months - 188.25/75.