Friday Feb 27, 2026

Friday Feb 27, 2026

Wednesday, 26 February 2020 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields remained mostly unchanged yesterday ahead of the weekly Treasury bill auction due today.

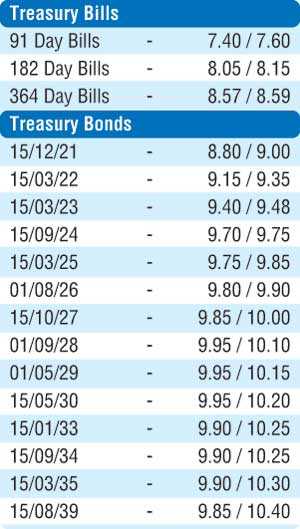

The maturities of 01.05.21, 15.03.23, 2024s (i.e. 01.01.24, 15.03.24 and 01.08.24) and 15.06.27 were seen changing hands within the range of 8.60% to 8.70%, 9.46% to 9.50%, 9.72% to 9.90% and 9.95% to 10.12% respectively. In the secondary bill market, renewed buying interest resulted in the latest 364 day maturity changing hands at levels of 8.55% to 8.57%.

Today’s bill auction will have on offer a total amount of Rs. 27 billion, consisting of Rs. 7 billion of the 91 day maturity, Rs. 7.5 billion of the 182 day maturity and Rs. 12.5 billion of the 364 day maturity. At last week’s auction, the weighted average yields increased to 7.44%, 8.06% and 8.60% respectively on the 91 day, 182 day and 364 day maturities.

The total secondary market Treasury bond/bill transacted volume for 24 February 2020 was Rs. 8.43 billion.

In the money market yesterday, the net overnight liquidity in the system was seen increasing further to cross Rs. 33.18 billion for the first time since 30 January. The overnight call money and repo recorded weighted average yields of 6.99% and 7.02% respectively.

In the Forex market, the USD/LKR rate on spot contracts was seen trading within the range of Rs. 181.70 to Rs. 181.80 yesterday before closing the day mostly unchanged at Rs. 181.65/75.

The total USD/LKR traded volume for 24 February was $ 60.98 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 182.20/35; three months - 183.25/40 and six months - 184.75/00.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)