Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 10 August 2020 02:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The wait and see policy adopted by most market participants leading to the General Elections and subsequent to it, led to a bearish sentiment in the secondary bond market during the shortened trading week ending 7 August 2020.

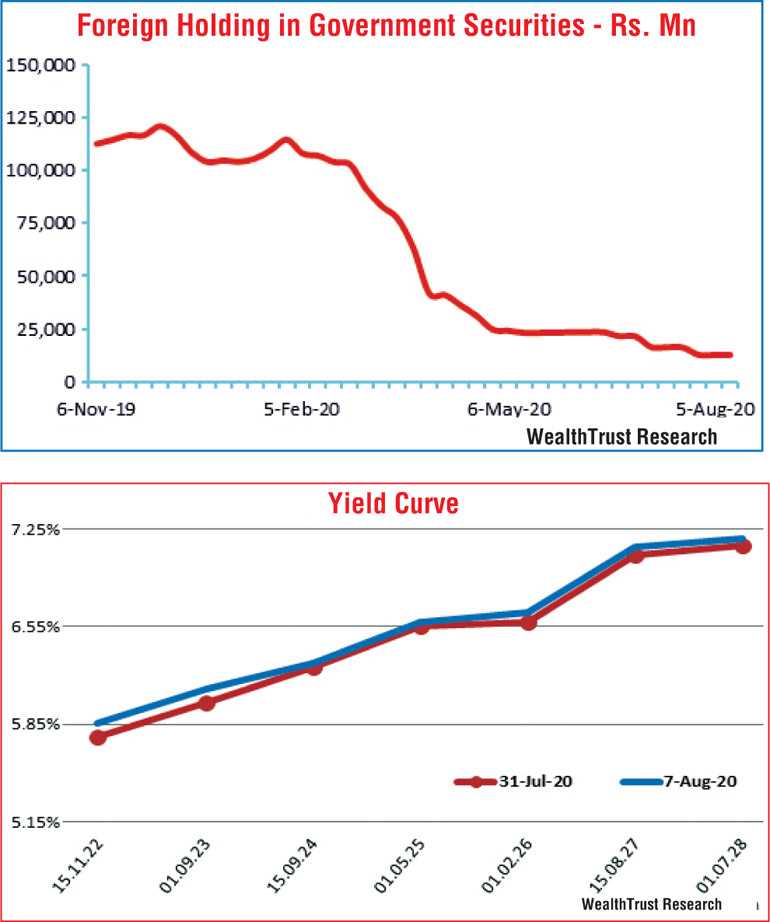

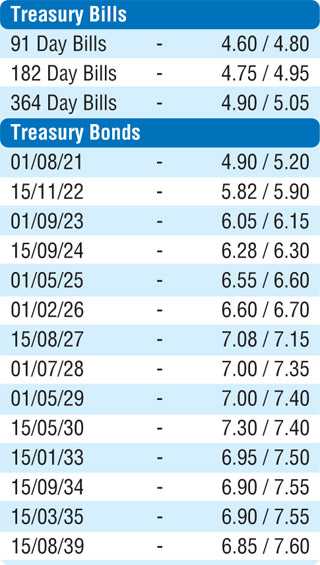

Limited activity was witnessed in the lead up to the weekly Treasury bill auction, with yields on the market favourite maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23 and 01.09.23), 15.09.24 and 01.05.25 increasing to intraweek highs of 5.95%, 6.00%, 6.05%, 6.25%, 6.40% and 6.68% respectively against its previous weeks closing levels of 5.72/80 each, 5.75/85, 5.95/05, 6.22/30 and 6.50/60 respectively. At the auction, stipulated cut off rates were increased to 4.67%, 4.76% and 4.94% respectively on the 91 day, 182 day and 364 day maturities while weighted average rates were recorded at the same, reflecting an increase of 08 basis points each across all three maturities.

However, yields pulled back marginally from these highs as the said maturities hit lows of 5.82%, 5.90% each, 6.12%, 6.25% and 6.58% respectively once gain on the back of buying interest. In addition, maturities of 01.08.25, 2026’s (i.e.01.02.26, 01.06.26 and 01.08.26), 15.10.27 and 15.05.30 changed hands at levels of 6.68%, 6.65%, 6.72%, 6.74%, 7.10% to 7.11% and 7.35% respectively as well.

The foreign holding in rupee bonds recorded a marginal outflow of Rs. 13 million for the week ending 5 August 2020.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged Rs. 5.39 billion.

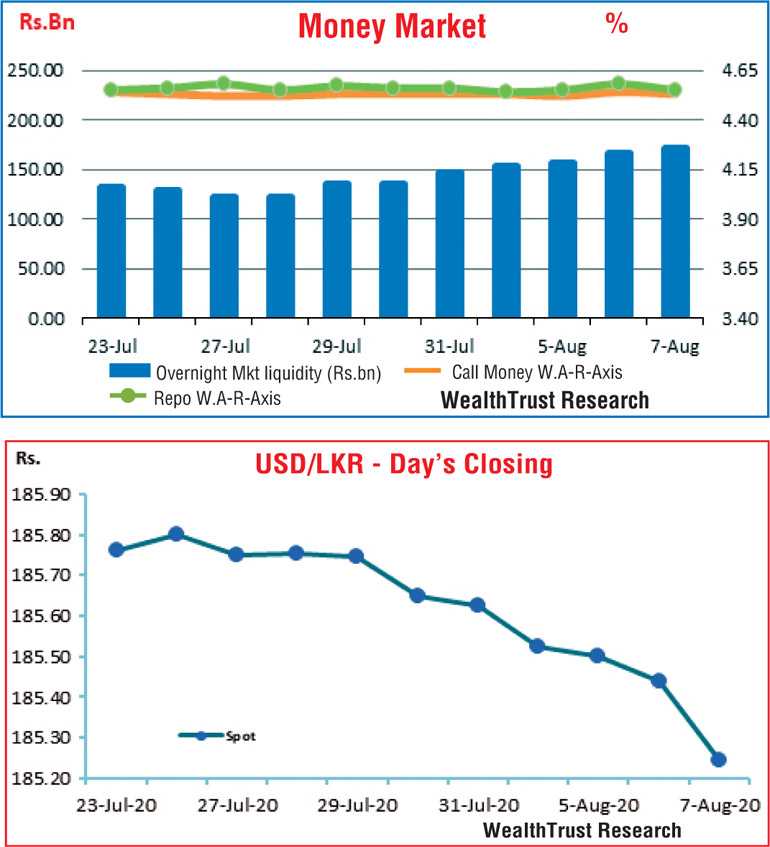

In money markets, the surge in overall market liquidity to Rs. 155.13 billion by the end of the week from its previous week of Rs. 133.79 billion resulted in weighted average rates on overnight call money and repos averaging at 4.53% and 4.56% respectively for the week.

Rupee appreciates considerably

In the Forex market, USD/LKR rate on spot contracts were seen appreciating considerably during the week to hit a high of Rs. 185.28 against its previous week closing levels of Rs. 185.60/65 on the back of selling interest by Banks. It closed the week at Rs. 185.22/27.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 70.54 million.

References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)