Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 19 November 2018 00:00 - - {{hitsCtrl.values.hits}}

Activity picks up considerably

Activity picks up considerably By Wealth Trust Securities

The week ending 16 November saw the secondary bond market end on a positive note despite the market witnessing an increase in Central Bank’s policy rates and an increase in the weekly Treasury bill weighted averages.

Activity picked up considerably across the yield curve as the reduction in the SRR applicable to all licensed commercials banks saw a substantial amount of liquidity been released to the market which offset the above increases and led to buying interest across the yield curve.

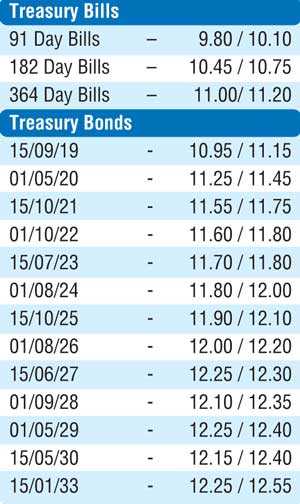

Yields on the liquid maturities of 01.03.21, 15.07.23, 01.08.24, and 15.06.27 dipped to weekly lows of 11.50%, 11.70%, 12.00% and 12.25% respectively against its week’s highs of 11.70%, 12.00%, 12.10% and 12.40%. Buying interest in secondary market bills saw October to November maturities change hands from levels of 11.20% to 10.96% as well.

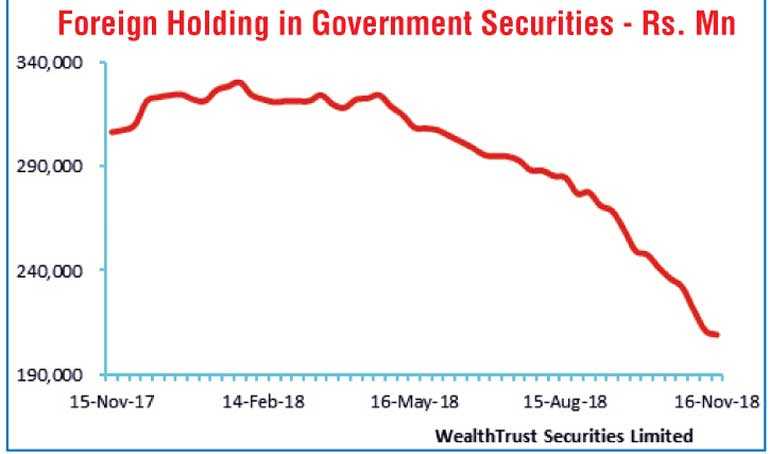

The foreign outflow from the rupee bond market slowed down during the week ending 14 November to record Rs. 1.95 billion against its previous week of 9.99 billion.

Furthermore, today’s (19 November) Treasury bill auction will see a total amount of Rs. 15.5 billion on offer, consisting of Rs. 3 billion on the 91 day, Rs. 3.5 billion on the 182 day and Rs. 9 billion on the 364 day maturities.

The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 9.11 billion.

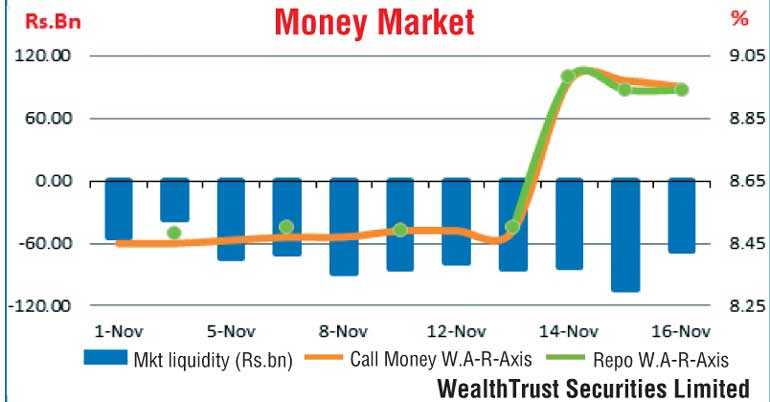

In the money market, the base rate increase resulted in overnight call money and repo rates increasing during the week to average 8.77% and 8.84% respectively for the week, as against its previous week’s average of 8.47% and 8.50%. The OMO (Open Market Operation) Department of the Central Bank of Sri Lanka injected liquidity throughout the week on an overnight and term basis for periods of two to seven days at weighted averages ranging from 8.43% to 8.74% and 8.47% to 8.95% respectively. The daily average net liquidity shortfall in the system stood at Rs. 83.57 billion.

Rupee dips during the week

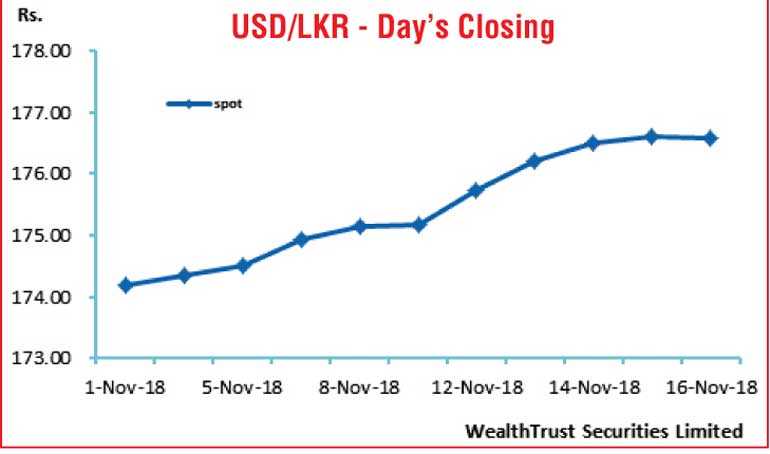

The rupee on spot contracts closed the week lower at Rs. 176.50/65 in comparison to its previous weeks closing levels of Rs. 175.10/25 subsequent to hitting an intraweek low of Rs. 176.80 and a high of Rs. 175.60 on the back of importer demand and buying interest by banks.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 88.01 million.

Some of the forward dollar rates that prevailed in the market were one month – 177.50/90; three months – 179.65/05 and six months – 182.80/30.