Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 3 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market witnessed moderate activity yesterday as well with limited trades taking  place.

place.

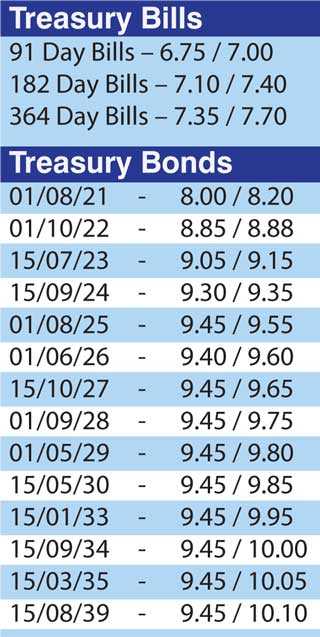

The liquid maturities of 01.10.22, 2023s (15.07.23 and 15.12.23) and 2024s (15.03.24 and 15.06.24) were seen changing hands at levels of 8.88%, 9.17% to 9.20%, 9.25%, 9.35% and 9.35% to 9.45% respectively.

However, continued demand for secondary market bills saw October 2020, December 2020 and January 2021 maturities changing hands at levels of 7.45%, 7.61% and 7.50% to 7.65% respectively.

In money markets yesterday, the DOD (Domestic operations Department) of Central Bank was seen injecting liquidity of Rs. 17 billion yesterday for a period of 88 days at a weighted average of 7.31% subsequent to offering Rs. 50 billion.

The overnight injection of Rs. 30 billion drew no bids. Overnight call money and repo averaged 6.76% and 6.82% respectively as the overnight liquidity stood at Rs. 63.14 billion.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)