Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 13 June 2019 00:07 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

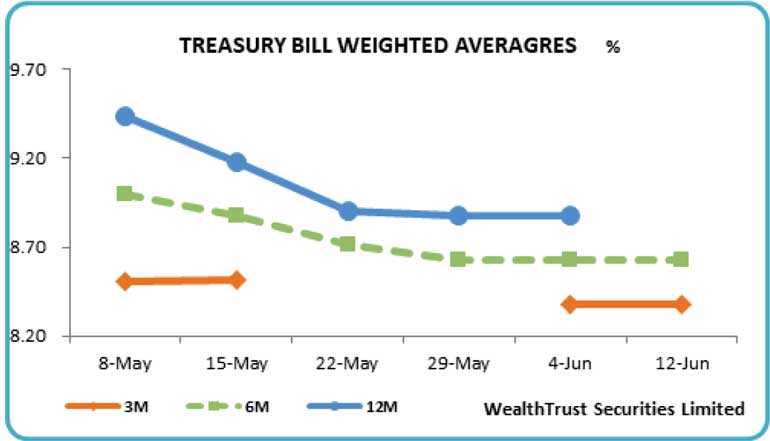

At yesterday’s weekly Treasury bill auction, all bids that were received for the 364-day maturity were rejected, with only an amount of Rs. 17.73 billion consisting of Rs. 6.8 billion on the 91-day and Rs. 10.9 billion on the 182-day maturities being accepted, with their weighted average yields remaining unchanged at 8.38% and 8.63% respectively. The bid to offer ratio at the said auction increased to a three week high of 2.77:1.

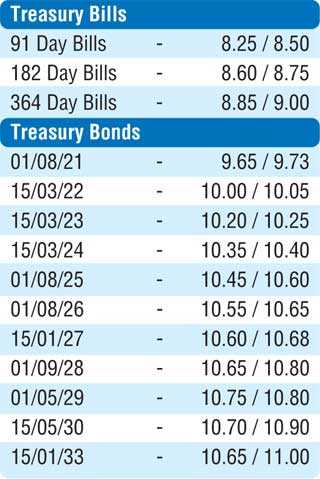

The secondary bond market continued to remain active yesterday, with yields of the 15.12.21, 15.03.22, 15.03.23, 15.03.24, 15.01.27 and 01.05.29 maturities increasing during the morning hours of trading to intraday highs of 9.80%, 10.00%, 10.25%, 10.43%, 10.65% and 10.77% respectively against its previous day’s closing levels of 9.65/75, 9.95/05, 10.30/35, 10.55/65 and 10.65/75.

However, buying interest at these levels subsequent to the bill auction curtailed any further upward movement. Furthermore, maturities consisting of the 01.05.20, 01.08.21 and 01.08.26 were also seen changing hands at levels of 8.86%, 9.60% to 9.70% and 10.55% respectively.

Today’s Treasury bond auction will have on offer a total an amount of Rs. 70 billion, consisting of Rs. 30 billion on a two-year and four-month maturity and Rs. 40 billion on an eight-year and nine-month maturity. The weighted average yields at the auction conducted on 29 April for maturities of 15.03.2024 and 15.03.2031 were 10.98% and 11.27% respectively.

The total secondary market Treasury bond/bill transacted volumes for 11 June was Rs. 4.15 billion.

In money markets, the Open Market Operations (OMO) Department of the Central Bank, drained out liquidity by way of an overnight and seven days repo auction at weighted average yields of 7.80% and 8.11% respectively as the overnight net surplus liquidity in the system increased to Rs. 59.62 billion. The overnight call money and repo rates averaged 7.91% and 8.06% respectively.

Rupee dips marginally

In the Forex market, the USD/LKR rate on spot contracts depreciated marginally yesterday to close the day at levels of Rs. 176.50/60 against its previous day’s closing levels of Rs. 176.45/55 on the back of buying interest by banks.

The total USD/LKR traded volume for 11 June was $ 118.55 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month – 178.25/40; 3 months – 178.80/00 and 6 months – 180.95/15.