Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 23 April 2018 00:00 - - {{hitsCtrl.values.hits}}

Acuity Partners Ltd. recently launched the unique “Huddlestock” offering in Sri Lanka for busy and less sophisticated retail and institutional investors who are able to and keen on tapping overseas investments as well as international investors to explore opportunities in Lankan listed stocks.

Acuity Partners Ltd. recently launched the unique “Huddlestock” offering in Sri Lanka for busy and less sophisticated retail and institutional investors who are able to and keen on tapping overseas investments as well as international investors to explore opportunities in Lankan listed stocks.

In essence Huddlestock is an innovative and award winning Fintech product that enables retail and institutional clients in Sri Lanka to invest in listed foreign stocks in markets such as the US and EU. Huddlestock, developed by a team of top professionals and experts, incorporates many unique features that differentiate and disrupts the traditional brokerage and asset management offerings.

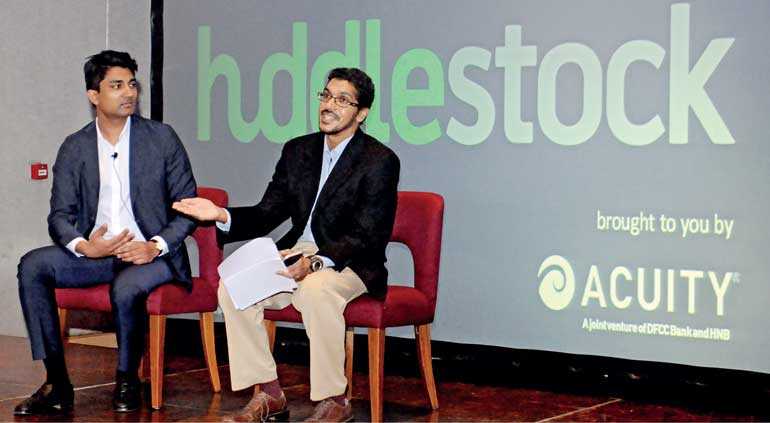

Acuity introduced Huddlestock solution to a select group of its investors and other stakeholders recently where Huddlestock co-founder and Director/CEO Murshid M. Ali guided the participants how the offering works.

Explaining the rationale for the launch of Huddlestock, Ali said most people don’t invest in stocks, even though they should. “People don’t have the time to learn about stock markets to understand how to invest. Globally the participation is low especially among small scale investors,” he said. Furthermore, he opined that traditional stock brokerage model is fast getting outdated with the advent of superior technologies such as fintech. “The traditional brokerage and asset manager offerings is ripe for disruption,” he noted.

“When it comes to investing globally can be prohibitively expensive for small investors,” Ali said adding that global asset managers have high fees and inconsistent performance and that Alpha Capture trading systems are only available to large investors.

Huddlestock is a Fintech company established in 2014 and based in Oslo, Norway and London, UK as of now. It is regulated by the Federal Financial Supervisory Authority (BaFIN) in Germany after it was launched by Crown Prince of Norway.

Its platform is patent-pending for crowd-trading technology but was opened for the public late last year after one and a half years in beta mode.

Given the benefits of enabling financial inclusion and efficient channelling for cross border investments, Huddlestock was recognised by CBInsights as a global game-changer in wealth management and it won the Best Fintech in the Nordics in 2017 by Nordic Start-up Awards.

Acuity Partners Senior Vice President Corporate Finance Shehan Cooray with Murshid M Ali

Ali said Huddlestock provides existing financial advisors and wealth managers with a complete user experience to manage their clientele and reduce cost by digitising their relationship.

The Huddlestock platform publishes their strategies globally to its entire investment community. It pools capital and executes trades, connecting investors and advisors globally.

“Our value proposition is unique for existing financial incumbents,” said Ali adding that the Huddlestock does all the background research and shares insights and investment ideas real time on which stocks to pick and in which sectors. Unlike the traditional broker model, Huddlestock platform empowers greater reach and superior technology providing useful metrics apart from being available 24x7.

Professional investment advisors can also register to Huddlestock as “strategy vendors” and put out an investment strategy idea and make it available to all international investors registered with the system. The latter can also monitor how stocks recommended are performing.

“Essentially Huddlestock is a global market place of markets for professionals and investors alike,” Ali emphasised.

At present, Huddlestock has over 1200 investors and the number is growing with 10-15 investors signing up daily, according to Ali. He estimates by end 2019, Huddlestock will have one million active users.

Acuity is the first B2B client in Sri Lanka as well as globally with discussions on with several in the Middle East and Europe. “We provide fully digitalised and customised solution for financial incumbents, brokerages and investment banks,” he added.

Huddlestock founders are Michel van Tol, Ali and Øyvind Hovland. Michel who is also the Director and Chief Information Officer, has a Phd in Financial Econometrics from the University of Maastricht. He has a decade of experience in the hedge fund industry, and has, since 2012, been an entrepreneur in London and Reykjavik, Iceland.

Ali has a Phd Candidate in Economics from the University of Stavanger and a Masters Degree from Grenoble Ecole de Management. He has previously founded several companies.

Øyvind Hovland who is the Chairman and Chief Operating Officer, is a serial entrepreneur who has founded several companies, notably Cyviz AS – with offices globally, and Vision Io AS, a leading optic camera provider to the Oil and gas industry.

Huddlestock Chief Technology Officer is Nick Gains and is responsible for the overall technical architecture and infrastructure of the Huddlestock platform. He holds a degree in Computer Science from the University of East Anglia and Carleton University in Ottawa, Canada.

Chief Product Officer is Kai Eggert who holds a Diploma/MBA from Germany University of Munster. He brings 15 years of software industry experience, of which he spent six years in Silicon Valley for FactSet responsible for their financial markets solution. He joined Huddlestock from TIDAL, a multi-million user streaming service.

PiX by Gitika Talukdar