Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 16 April 2021 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The new and shorted trading week commenced with the weekly Treasury bill auction yesterday, as its total accepted amount increased to a six-week high of Rs. 35.47 billion against its total offered amount of Rs. 45 billion.

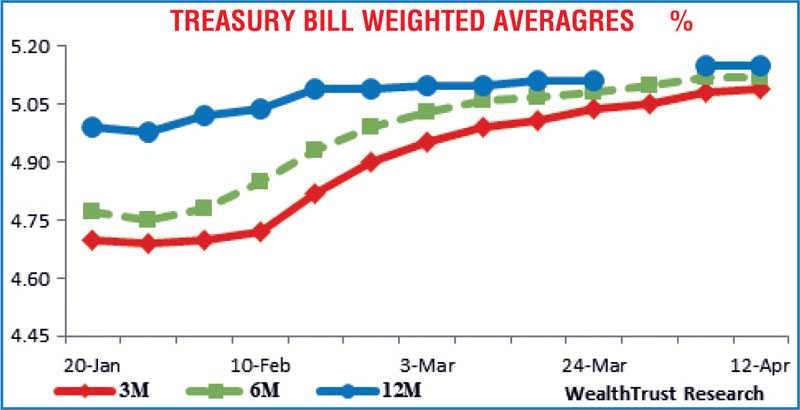

The weighted average rate on 364-day bill was recorded at its stipulated cut off rates of 5.15% while weighted average rate on the 91-day maturity increased by one basis point to 5.09%. The weighted average rate on the 182 day maturity remained steady at 5.12% and the bids to offer ratio increased to1.69:1. Activity in secondary bond market slowed considerably yesterday with two-way quotes across the yields curve increasing marginally ahead of the holiday period. Limited trades were witnessed on the maturities of 15.10.21, 15.11.22 and 15.07.23 at levels of 5.10%, 6.00% and 6.35% respectively.

The total secondary market Treasury bond/bill transacted volume for 9 April was Rs. 14.69 billion.

In money markets, the net liquidity surplus decreased sharply to a 10-month low of Rs. 77.39 billion yesterday with an amount of Rs. 107.39 billion being deposited at Central Bank’s SDFR of 4.50% against an amount of Rs. 30 billion withdrawn from its SLFR of 5.50%. The weighted average rates on call money and repo remained mostly unchanged at 4.65% and 4.67% respectively.

USD/LKR

In the Forex market, the USD/LKR rate on the more active one-week forward contracts were seen closing the day at levels of Rs. 202.50/203.50 yesterday against its previous day’s closing level of Rs. 202/203.

The total USD/LKR traded volume for 9 April was $ 55.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)