Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 15 October 2018 01:39 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

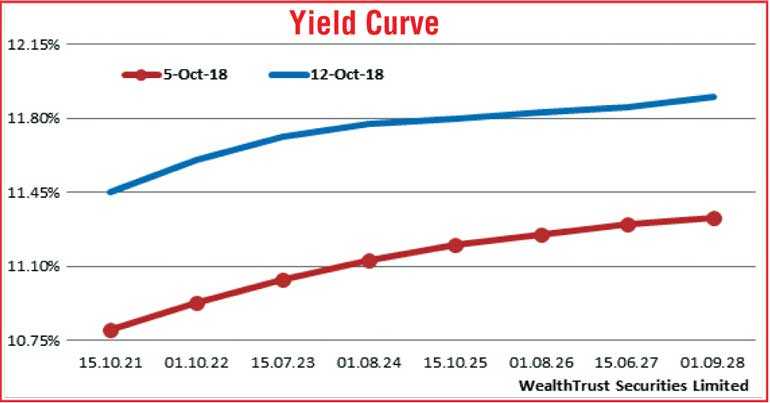

The secondary bond market witnessed volatility during the week ending 12 October as yields increased drastically during the mid to latter part of the week and dipped late on Friday.

The increase in yields was driven by the outcomes of the primary bill and bond auctions while the dip was on the back of renewed foreign and local buying interest.

The majority of the activity during the week was witnessed on the liquid five-year maturity of 15.07.23 as its yield was seen hitting over a 17-month high of 12.05% against its previous week’s closing levels of 11.00/08.

Furthermore the maturities of 01.03.21, 15.10.21 and 01.08.26 were seen hitting highs of 11.70%, 11.90% and 12.25% respectively against its previous week’s closing levels of 10.70/80, 10.75/85 and 11.15/35. However, renewed foreign and local buying interest at these levels curtailed any further upward movement in yields with the market closing the week considerably lower from its weekly highs.

The week-on-week increase in yields though led to a parallel shift upwards of the yield curve while foreign selling in rupee bonds was witnessed until 10 October to the tune of Rs. 6.27 billion.

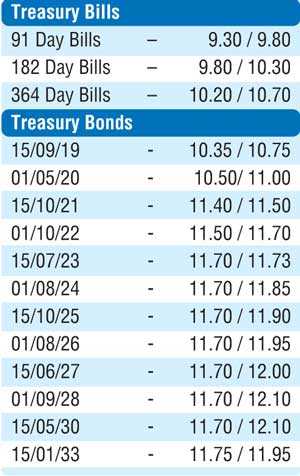

The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 9.44 billion. In money markets, the Open Market Operations (OMO) Department of the Central Bank was seen injecting liquidity throughout the week by way of an overnight and 7-15 days reverse repo auctions at weighted averages ranging from 8.21% to 8.28% as the net liquidity shortfall in the system averaged Rs. 20.23 billion for the week. It further injected liquidity by way of outright purchases of Treasury bills for durations ranging from 168 days to 203 days at weighted averages of 9.43% to 9.61%. The call money and repo rates averaged 8.43% and 8.34% respectively for the week.

Rupee closes the week at nine-day high

In the Forex market, dollar inflows coupled with export conversions on Friday saw the USD/LKR rate on spot contracts close the week sharply higher at a nine-day high of Rs. 169.40/60 against its previous week’s closing of Rs. 170.35/55. This was subsequent to hitting a new low of Rs. 171.60 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 48.60 million.

Some of the forward dollar rates that prevailed in the market were one month - 170.50/80; three months - 172.50/90 and six months - 175.40/80.