Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 1 October 2018 00:38 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

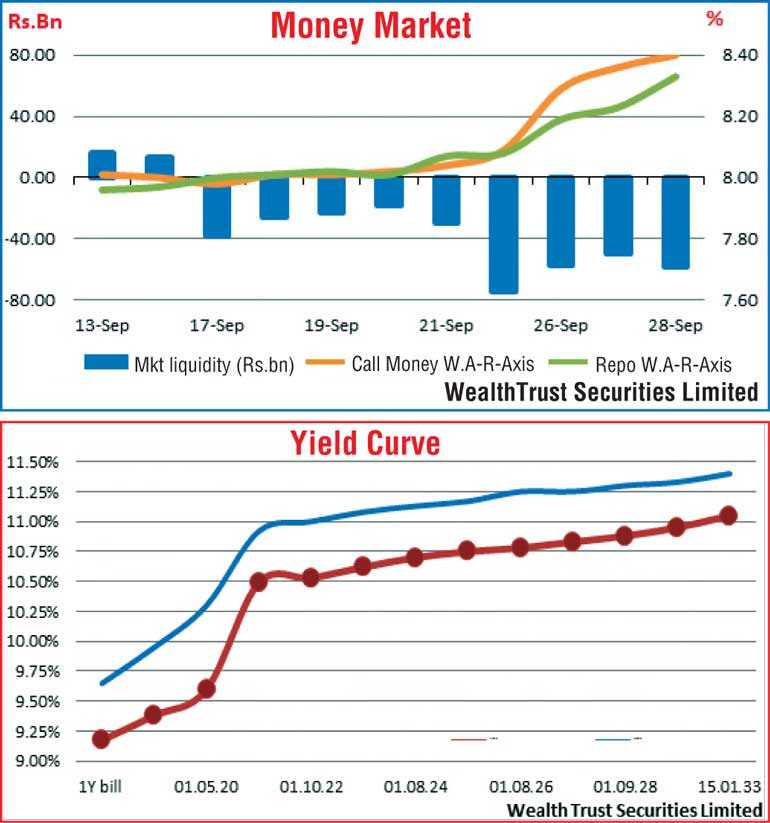

The speculation on the outcome of the monetary policy announcement due on 2October, prevailing high liquidity shortfall coupled with the sharp increase in the weekly Treasury bill weighted averages, led to secondary market bond yields increasing further during the week ending 28 September on the back of continued selling interest mainly by local market participants.

The five-year maturity of 15.07.23 was the most actively traded duration during the week with its yield increasing by 46 basis points week on week to a high of 11.10%, a level last seen in July 2017. The accumulated increase on the five year maturity was over 100 basis points (1%) over the past three weeks.

Furthermore, the 15.10.21 and 01.08.24 maturities were sold up to levels of 10.90% and 11.00% respectively, recording increases of 41 basis points and 30 basis points week on week. In addition, the maturities of 2025’s (15.03.25 and 15.10.25), 15.06.27 and 2028s (15.03.28 and 01.09.28) were seen changing hands at levels 10.70% to 11.02%, 11.05% and 11.08% and 10.80% to 11.10% respectively as well during the week, which led to a bunching up of the yield curve from its belly to the long end. The increase in yields during the week mirrored a parallel shift upwards of the overall yield curve for a third consecutive week.

The foreign holding in rupee bonds was seen decreasing for a fourth consecutive week, registering an outflow of Rs. 10.2 billion for the week ending 26 September. The Colombo Consumer Price Index (CCPI) was seen decreasing for the first time in five month to register 4.3% on its point-to-point for the month of September against 5.9% recorded in August while its annualised average dipped to 5.4% against 5.6%. The daily secondary market Treasury bond/bill transacted volume through the first three days of the week averaged Rs.10.7 billion.

In money markets, the call money and repo rates averaged 8.29% and 8.21% respectively for the week as the Open Market Operations (OMO) Department of Central bank was seen injecting liquidity throughout the week by way of overnight and seven to 14 days reverse repo auctions at weighted averages ranging from 8.15% to 8.30%. Liquidity averaged a net deficit of Rs.59.79 billion for the week.

Rupee continues to slide

In the forex market, continued importer demand saw the rupee on its spot contracts losing further to close the week at Rs.169.20/40 against its previous weeks closing levels of Rs.168.30.70. The daily USD/LKR average traded volume for the first three days of the week stood at $ 99.08 million.

Given are some forward dollar rates that prevailed in the market were: one month – 170.25/65; three months – 172.10/50; six months – 174.60/00.