Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 7 February 2019 01:06 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

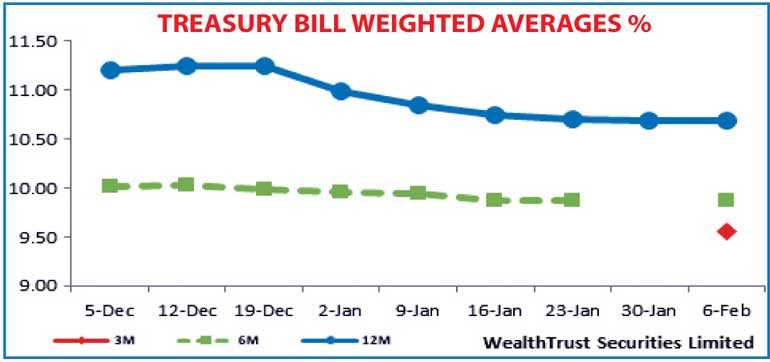

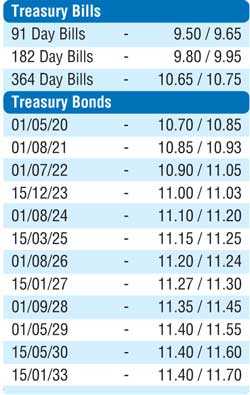

The 364 day bill weighted average was seen holding steady at 10.69% at its weekly Treasury bill auction conducted yesterday following six consecutive weeks of decreases. Similarly, the 182 day bill weighted average remained steady at 9.87%, which was accepted after a lapse of one week. The 91 day bill which was offered after a lap of nine weeks recorded a weighted average yield of 9.55%. The total offered amount of Rs. 24 billion was fully met at the auction despite the bids to offer ratio dipping to a seven week low of 2.40.

In the secondary bond market, selling interest on the maturities of 01.08.21, 15.12.23, 01.08.26, two 2027s (i.e. 15.01.27 and 15.06.27) and 01.09.28 resulted in its yields hitting intraday highs of 10.86%, 11.03%, 11.19%, 11.28%, 11.30% and 11.32% respectively on the back of moderate volumes changing hands.

The total secondary market Treasury bond/bill transacted volumes for 5 February was Rs. 9.56 billion. In the money market, the overnight call money and repo rates averaged at 8.99% and 9.00% respectively as the OMO Department of the Central Bank of Sri Lanka was seen injecting an amount of Rs. 30 billion at a weighted average of 9.00%, by way of an overnight reverse repo auction. The net liquidity shortfall in the system increased to Rs. 101.33 billion yesterday.

Rupee strengthens

The USD/LKR rate on spot contracts strengthened yesterday to close the day at levels of Rs. 177.65/80 against its previous day’s closing levels of Rs. 178.25/35 on the back of selling interest by banks. The total USD/LKR traded volume for 5 February 2019 was $141.23 million. Some of the forward USD/LKR rates that prevailed in the market were one month - 178.50/80; three months - 180.40/70 and six months - 183.35/65.