Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 28 November 2019 03:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

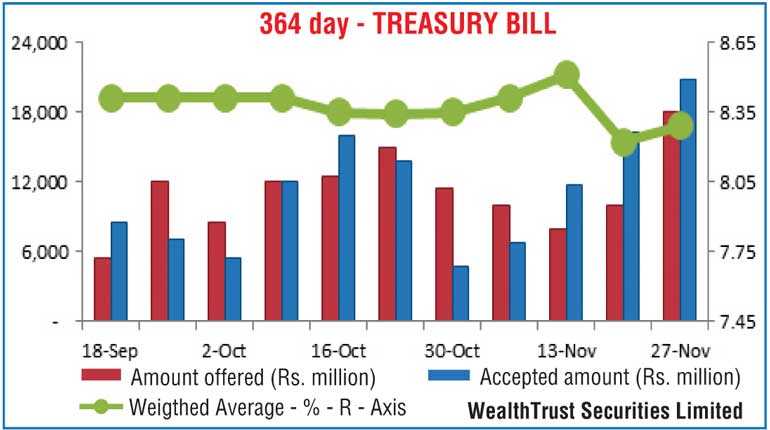

The market favourite 364-day bill weighted average was seen increasing once again at its weekly auction held yesterday, reversing the steep dip it witnessed during the previous week.

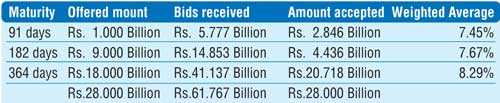

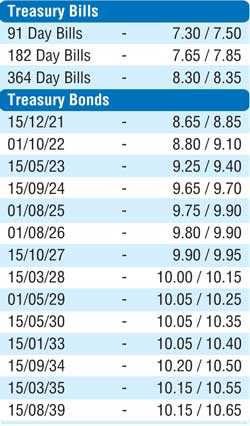

It recorded an increase of seven basis points to 8.29% while the 182-day bill weighted average increased by nine basis points to 7.67%. Nevertheless, the weighted average on the 91-day bill decreased by two basis points to 7.45%. The total offered amount of Rs. 28 billion was successfully accepted at the auction as the bids to offer ratio stood at 2.21:1. Given below are the details of the auction.

In the secondary bond market, yields were seen decreasing during the latter part of the day mainly on the 15.06.24 and two 2027 maturities (i.e. 15.01.27 and 15.06.27) to intraday lows of 9.60%, 9.93% and 9.90% respectively against its day’s opening highs of 9.75%, 10.00% and 10.05%. In addition, the maturities of the 01.05.20, 2021s (i.e. 01.05.21 & 01.08.21), 15.07.23, 01.08.24, 01.08.26, 15.03.28 and 15.09.34 were seen trading within the range 7.70%, 8.65% each, 9.30% to 9.36%, 9.85% to 9.95%, 9.95% to 10.05%, 10.25% and 10.30% respectively as well.

The total secondary market Treasury bond transacted volume for 26 November 2019 was Rs. 9 billion. Meanwhile in money markets, the Open Market Operations (OMO) Department of the Central Bank conducted an overnight repo auction for the first time since 30 October 2019 and successfully drained out an amount of Rs. 7.95 billion at a weighted average rate of 7.51% as the overnight net liquidity surplus in the system increased to Rs. 39.07 billion yesterday. The overnight call money and repo rates decreased to average 7.44% and 7.50% respectively.

LKR appreciates

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating yesterday for the first time in five days to close the day at Rs. 180.80/00 against its previous day’s closing levels of Rs. 181.65/85, subsequent to trading at a high of Rs. 180.90 and a low of Rs. 181.65.

The total USD/LKR traded volume for 26 November 2019 was $ 190.67 million.

The following are some forward USD/LKR rates that prevailed in the market: one month - 181.30/50; three months - 182.20/50 and six months - 183.90/30.