Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 1 August 2019 04:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

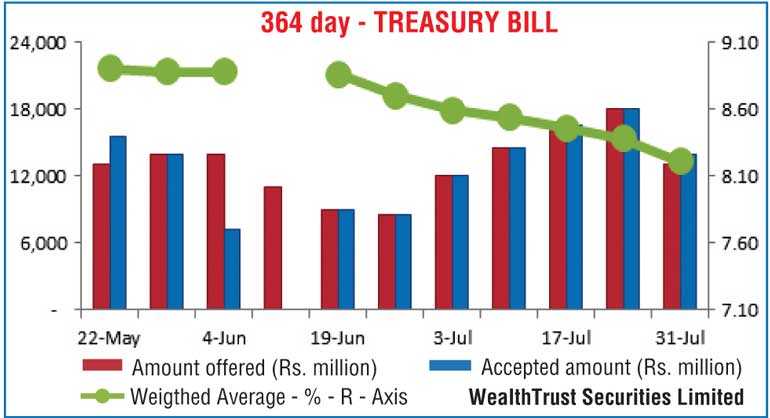

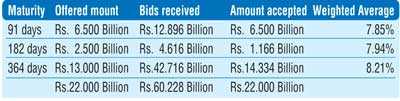

The weighted average yield of the 364 day bill decreased sharply by 17 basis points to an over 3 year and 5 month low of 8.21% at yesterday’s weekly bill auction, while the weighted average yields of the 91 day and 182 day bills were seen decreasing further to 7.85% and 7.94% respectively as well, registering drops of 04 and 02 basis points. The total offered amount of Rs. 22 billion was successfully subscribed at the auction as the bids to offer ratio stood at 2.74%.

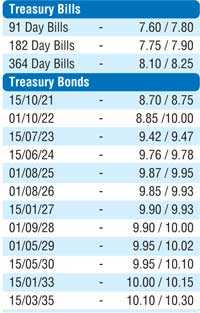

Activity in the secondary bond market increased yesterday, mainly during the pre-auction session where yields of the liquid maturities of 2021’s (i.e. 01.03.21, 01.05.21, 01.08.21, 15.10.21 and 15.12.21), the two 2023’s (i.e. 15.03.23 and 15.07.23) and three 2024’s (i.e. 15.03.24, 15.06.24 and 01.08.24) were seen decreasing to hit intraday lows of 8.60%, 8.65%, 8.70%, 8.75%, 8.80%, 9.35%, 9.45%, 9.74%, 9.77% and 9.85% respectively. Furthermore, the 01.10.22 and 01.09.23 maturities were traded at lows of 9.00% and 9.55% as well.

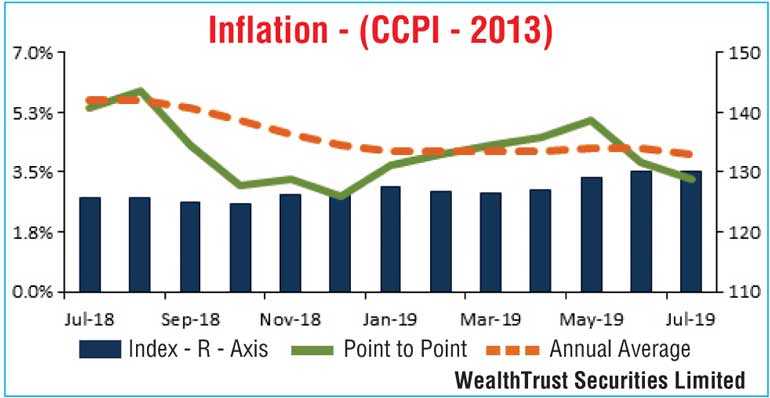

Inflation or the Colombo Consumer Price Index (CCPI) for the month of July was seen decreasing further to hit a seven month low of 3.3% on its point to point while its annual average decreased to a low of 4.0%.

The total secondary market Treasury bond/bill transacted volumes for 30 July was Rs. 4.18 billion.

In the money market, the overnight call money and repo rates averaged at 7.70% and 7.80% respectively as the OMO Department of the Central Bank refrained from conducting any auction yesterday to drain out excess liquidity. The overnight net liquidity surplus stood at a high of Rs. 42.54 billion yesterday.

Rupee loses further

In the Forex market, the USD/LKR rate on spot contracts depreciated further yesterday to close the day at a level of Rs. 176.30/35 against its previous day’s closing level of Rs. 176.28/32 on the back of continued buying interest by Banks. The total USD/LKR traded volume for 30 July was $ 97.71 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 month - 176.80/95; 3 months - 178.00/20 and 6 months - 179.80/00.