Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 30 January 2017 00:20 - - {{hitsCtrl.values.hits}}

Digital business transformation is about significant change; it should be diligently driven by leadership

Overview

Digitalisation has become a wave spreading across the world, revealing multiple varieties. This power to unveil not only transforms human outreach and actions, but also changes our conceptions; about whom we are, about our uses and about human horizons for sense-making (Fors, 2010). In fact, technology has always been an enhancer of our work. From adding machine to the advanced computer this was the case. Today’s column is a reflection the dynamics of digitalisation with due consideration to people factor for progress.

Essence of digitalisation

According to www.gartner.com, digitalisation is the use of digital technologies to change a business model and provide new revenue and value-producing opportunities; it is the process of moving to a digital business.

“We are witnessing profound shifts across all industries, marked by the emergence of new business models, the disruption of incumbents and the reshaping of production, consumption, transportation and delivery systems,” observes Schwab (2014), in his most recent book, ‘Fourth Industrial Revolution’.

As he further explains: “We have yet to grasp fully the speed and breadth of this new revolution. Consider the unlimited possibilities of having billions of people connected by mobile devices, giving rise to unprecedented processing power, storage capabilities and knowledge access. Or think about the staggering confluence of emerging technology breakthroughs, covering wide-ranging fields such as artificial intelligence (AI), robotics, the internet of things (IoT), autonomous vehicles, 3D printing, nanotechnology, biotechnology, materials science, energy storage and quantum computing, to name a few.” (Schwab, 2014: 1)

Obviously the relevance of digitisation to the banking industry is beyond doubt. Many authors have focused on the applicability of digitisation to banking with its financial implications. This paper intends to cover the key essence of digitalisation and its impact on managing people with reference to driving change for better.

6 Fs of Digital Transformation

Six key aspects frame the challenge of digitally transforming business. Bowerzox and others (2007) call these six Fs of going digital. They speak to the mindset that leaders must adopt as they begin to reconfigure every aspect of their organisation to contribute economic value.

i. Fact-based Management

Fact-based management is a commitment to, or even an obsession with developing precise information on every facet of what the organisation does and needs to do. Fact-based management provides answers to questions such as: Why do we provide this service? What value does it add to customers? What are our precise performance expectations? How exactly do we meet and measure these expectations? Facts are not averages. Facts deal with specific performance results in items of specific customers.

Managers must learn to understand and rapidly act on these results at the specific product level and customer purchase location. Such an approach is vital for banks in areas such as customer relationship management where fact-based decisions can be taken.

ii. Flexible

Driven by facts, successful firms demonstrate an inherent ability to rapidly adapt operations to pursue a new course of action. Confronted with a breakthrough opportunity, they are agile enough to make adjustments quickly and commit the resources necessary to capitalise on the opportunity.

Flexibility is crucial for operating in an increasingly competitive business environment. Organisations have to be dynamic dolphins and not dying dinosaurs (Dharmasiri, 2014a). A bank that does not respond to changing customer needs in being flexible would extinct like a dinosaur.

iii. Focus on Cash

This has much relevance to the private sector, and specifically to banks. One of the key meaningful measures at the end of any day, week, month, or year is the cash balance. As they make the digital transformation, companies must remember that cash pays bills. Cash pays salaries and wages, and cash pays shareholder dividends. The focus must be cash first, cash second and cash always.

As Bowerzox et al (2007) elaborate, such an approach would prevent liquidity issues and allows an organisation to work towards better financial leverage.

iv. Fast Return on Investment (ROI)

A business needs to make contiguous investments in new products, services, technology, people and facilities. All investments are made with an expectation of financial return. The new mandate, however, is not just high rates of return fast. Payback periods need to be short and rapidly yield positive returns – which translates to cash.

Speed is the key here. With the digitalisation, rapid processing of information becomes a basic and faster response to customer needs is a sure reality.

v. Fungible

Fungible means that business processes are modular in design with maximum interchangeability. Modularity allows flexibility in process design and maximum incorporation of the principles of postponement and acceleration. The operational characteristics of agility, flexibility, sustainability, scale, scope and responsiveness are all attributes of fungible organisations.

Are our financial institutions fungible? It is worth exploring and in the context of digitalisation. Appropriate actions should be taken in order to enhance the fungibility with the broad business horizon in mind.

vi. Frugal

Capital investment, cash velocity, and a flat organisational structure with focused human resources are characteristics of a frugal enterprise. Frugal enterprises are lean in every conceivable way. Overhead is minimal. Operations are focused on cash generation.

Lean is an enterprise-wide attribute that must permeate every facet of every process. In frugal enterprises, the real benefits are cash dividends, not fringe benefits or luxurious environments. At the end of the day, employees work for income and owners invest for dividends. With business success, both constituents will benefit from the enterprise’s success.

With the above 6 Fs taking place, the nature of the organisations will also change. Let’s look at the characteristics of the emerging organisation.

People barriers for progress

As Bowerzox (2007) observes, the greatest barriers to a digital transformation are not technical or legal. Rather, they relate to prevailing managerial and employee attitudes, practices, and traditions around what constitutes best practice. Most acknowledged best practices were established decades ago using the technology then available to address problems or challenges that for the most part no longer exist. Actions that once were considered best practice are increasingly becoming unnecessary or obsolete. Yet it’s the perpetuation of these traditional practices that thwart significant breakthroughs toward new and more meaningful ways to work.

Digital business transformation is about significant change. It should be diligently driven by leadership. It is the ultimate challenge in change management because it impacts all organisational levels of an enterprise and its extended supply chain. The transformation starts with redefining the firm’s strategic vision—that is, the shared composite of goals, competencies, and capabilities a firm deploy to create and sustain competitive advantage.

At this early stage of the digital transformation, it’s clear that some organisations are having a tougher time getting started on the journey than others. For example it’s evident that A&P, Corning, Kodak, Motorola, Sears, and Xerox, to name a few, waited far too long to adapt to the digital imperative in both products and processes. Others, such as GM, Procter & Gamble, and IBM seem to be well on their way. In any case, one thing is clear: The digital business transformation is best initiated from a position of strength rather than weakness.

As Jonston and Whang (2002) point out, additional considerations in a seamless execution of DBT involve transitioning from traditional ideas about organisational structure. The traditional line-and-command, functionally focused organisational chart is replaced by an integrated supply chain structure built on shared values.

Driving change towards digitalisation

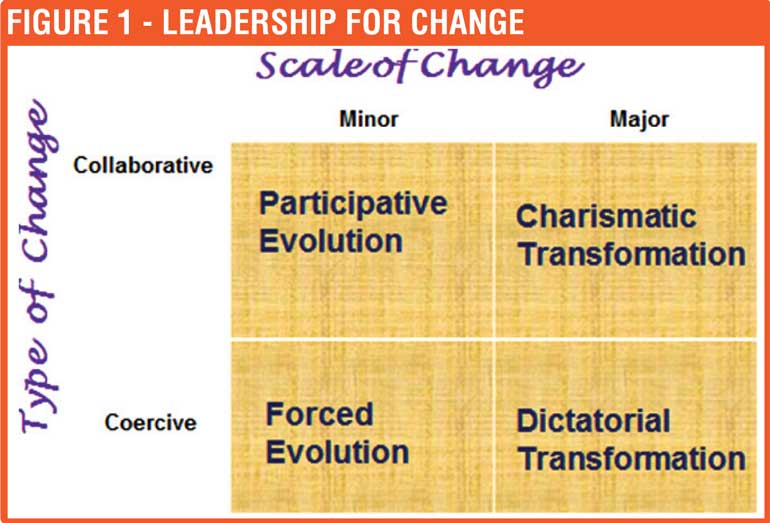

What leadership style will lead to what type of change? It opens us a variety of scenarios. The model developed by Dunphy and Stace (1991) offers many insights with this respect. Figure 1 contains the details.

As the above figure depicts, scale of change can be either major or minor. Minor change initiatives include: fine tuning and incremental adjustments. Fine tuning is getting a better ‘fit’ between what is and what should be. Major change may refer to modular or corporate transformation. Collaborative leadership style involves high levels of participation by followers in making important decisions and implementing such decisions. In contrast, coercive style refers to the application of force.

In order to have sustained digital business transformation, an organisation might need all of the four scenarios highlighted in the above model. However, charismatic transformation that includes a collaborative leadership style with a major scale of change would be the key requirement for sustained results.

Way forward

As we have seen so far, managers should understand the digitalisation dynamics. A comprehensive assessment of what needs to be changed in one’s organisation is a must. Due consideration should be given to people factor in driving change for effective digital business transformation.

It is heartening to see the Sri Lankan workplaces doing the ground work. In essence, we see emerging signs of the “fourth industrial revolution” taking place. Yet, to make it impressive and inclusive, a lot more has to happen. It is a long journey ahead.

(Prof. Ajantha S. Dharmasiri can be reached through [email protected], [email protected], [email protected] or www.ajanthadharmasiri.info.)