Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 24 March 2020 00:00 - - {{hitsCtrl.values.hits}}

Sri Lankan authorities got serious in anti-COVID-19 measures from 16 March as public and mercantile holidays were declared until 19 March. It was advised to work from home from 20-27 March, while it further escalated to curfew from 21-27 March (so far). Therefore, with the exception of essential services, the rest of the economic activities were either asked to stop altogether or were curtailed sharply.

In this backdrop, the opening of the stock market on 19 March was baffling. Is stock market trading an essential service during a time of absolute panic?

Possibly the worst global disaster since World War II

We are possibly experiencing the worst global disaster of our lifetimes. Not only almost all the countries have been affected by it, but also even developed countries such as USA and Europe are struggling to combat it successfully. It has exposed the unpreparedness at a global scale against the spread of pandemics, despite the technological advancements over decades and centuries.

The unprecedented nature of the disaster would naturally warrant unprecedented actions across the globe.

Panic reigns in stock markets

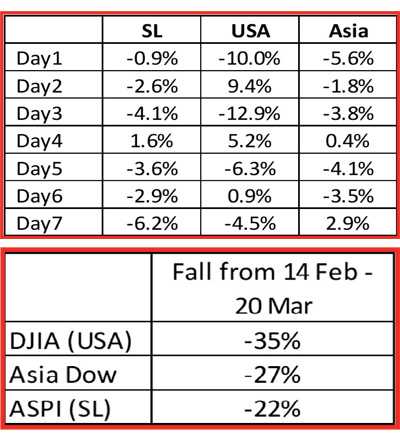

Coming back to the case of the stock market, with the global pandemic still not under control and with global economic activities significantly halted, it is an instance of unprecedented panic among investors. It is an obvious situation where everybody is selling with hardly anyone to buy. The fall of global stock markets since the middle of February is abundantly clear.

This has reached insane levels in the last seven days as stock markets are exposed to be pounded as the attention of authorities has been focused on curtailing the pandemic.

What could happen over the next few days

At times of sharp declines, the triggering of “margin calls” (a directive by lenders to sell shares to reduce the borrowing levels), aggravates the fall in share prices. Even in automated trading systems, the automatic generation of sell calls do the same. This phenomenon would continue to bring down share prices.

Specially with the global situation unclear, it is almost a certainty the fall in share prices over the last few days would continue in the coming few days, if there is no intervention by authorities. Which means the ASPI could fall 200 points (3%) on average on a daily basis – which could easily be as high as 300 points (5%) or even more.

Why the stock market needs urgent attention

While one may think that the Sri Lankan stocks have actually performed better than global stocks, what one should realise is that Sri Lankan stocks have been struggling since 2015, while global stocks performed well from 2017-2019. Therefore while US stocks have fallen to the worst level since early 2017 and Asian stocks have fallen to the worst level since early 2016, the Sri Lankan stocks are at the lowest level since mid 2010.

What this means is, the faithful long-term investors have been battered for almost 10 years. And if the market continues in the coming days, they could also get wiped out a in a matter of a week or two. These could be the “long-term guardians” of the stock market who could be experiencing margin calls right now.

If the authorities let these investors get eliminated in the coming weeks, the long-term impact on the stock market would be severe and irreversible. The pandemic may pass in a month or two, however the stock market may take years or even decades to instil confidence among investors.

What should be done by authorities

It is widely believed that the coming week or two would be the most crucial. If Sri Lanka manages to keep a lid on the spread of the virus during this time, there is a high likelihood of curtailing the spread thereafter as well.

Furthermore, even globally more clarity would emerge in the coming two weeks with regard to the global impact. Many regions are expecting a peak of the virus during this time and/or a clearer idea about the impact or as to when the peak would take place. Hence the global panic could also be curtailed greatly within a week or two. In this scenario, there are several steps available for the local authorities.

1. Firstly, if possible to keep the stock market closed in the coming week or two, until above-mentioned clarity dawns on the local scenario (even global scenario could be clearer by that time). There is no compelling benefit of keeping the market open – especially during globally-unprecedented times.

2. Prevent the triggering of “margin calls” at this depressed level of the stock market – through directives to margin providers and/or through alternative measures.

3. Intervene with State funds to boost demand for stocks. As mentioned earlier, stock prices are at the lowest level since mid 2010 and the valuations are at levels last seen even prior to the ending of the war in 2009. Therefore it is clearly justifiable for State funds to invest at this point.

With urgent action needed to be taken in more important segments, the Government could easily overlook this immediate need in the stock market. One could only wish that they don’t, as the pandemic may pass (in a month or two), but it would take years to resurrect the stock market if the few urgent measures are not taken today.

(The writer can be contacted on [email protected])