Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 21 September 2017 00:00 - - {{hitsCtrl.values.hits}}

The general public is concerned about the high level of interest rates prevailing in the recent past. Interest rates influences the day-to-day life of ordinary people as it is the benchmark for all economic decisions.

The level of interest rates not only directly influence capital investment decisions (i.e. building a house or purchasing white goods) but also indirectly has an impact on the general level of consumption through the availability of funding.

Though the interest rate is the price of money, determined by the market forces of demand and supply of capital, the level of interest rates is a function of monetary and fiscal policy.

The interest rates quoted for day to day transaction is called the nominal interest rates. In addition to the real component, it includes a premium to compensate for the expected inflation. If the inflation expectation is high, the interest rates tend to be higher due to the large inflation premium.

Expected inflation

The central bank (or monetary authority) of a country is vested with powers to regulate the direction of the interest rates in order to control inflation. The central bank uses short-term interest rates, known as policy interest rates to set the direction of the general level of interest rates depending on their expectation about the future inflation.

While a plethora of other reasons contribute to the decision on interest rates, if the central bank through researching the general economy understands that the economy is overheating and price pressure is building in the economy which could lead to higher inflation in the future, the bank is compelled to increase the interest rates to combat future expected inflation. This might propel general level of the interest rates to move upwards.

There is a direct link between the inflation and interest rates. Higher interest rates discourage the level of investment and consumption in the economy and applies a break on the economic growth. The central banks use the level of interest rates to discourage unwanted borrowers and curtail demand for credit. The higher interest rates push up borrowing cost, increasing the cost of conducting business and thereby lowering aggregate demand of the economy to bring down the inflationary pressure. There is always a tradeoff between keeping inflation in check and the growth rates.

Expectations play an important role in determining the shape of the yield curve of the government securities (Treasury bills and bonds). When the yields corresponding to each maturity is plotted, it is called yield curve. The shape of the yield curve indicates among other things a premium for expected inflation. If the expected inflation is positive and higher, then the yield curve is upward slopping along the maturity structure. This means long maturity bonds will have a higher rates than short maturity bonds.

Fiscal deficit

There are two type of borrowers in the economy; the government including SOEs and the private sector. The government is generally insensitive to cost of borrowing, however higher cost may preclude their ability to borrow more through high interest cost exhausting the Gross Borrowing Limit. Even if the interest rates are higher, the government is compelled to borrow fulfilling its budgetary requirements.

Sri Lanka has been running a fiscal deficit (expenditure in excess of income) since the independence. Large portion of recurrent expenditure of the government is predetermined and only a limited space is available to curtail.

When a country runs a large fiscal deficit, the government need to borrow more and the interest rates of the country tends to move higher. Historically, the government had to rely on deficit financing options, which were mostly expansionary, and such deficit financing had contributed to the inflation in the economy. Thus, discretionary fiscal policy of the government indirectly influences inflation expectation and the interest rates in the economy

Interest rate cycle

When the central bank decides that the expected inflation is higher, the bank increase its policy interest rates. If the central bank continues to raise its benchmark policy rates, it is considered a tightening cycle.

Since April 2015, the Central Bank of Sri Lanka (CBSL) has been tightening interest rates. In contrast, if the Central Bank calculates expected inflation is receding and the economy is operating below its full potential, the Central Bank decides to lower interest rates in order to stimulate borrowings and new investments. As such, if the Central Bank continues to soften in policy interest rates, the cycle in known as softening cycle.

Focus on monetary policy

Central banks use short term, mostly overnight interest rates as a monetary policy instrument to manoeuvre the level and direction of interest rate towards desired level. The Federal Reserve (the Fed, central bank of the United States) uses Federal Fund Rates while the CBSL uses interest rate corridor consisting of two rates – rates on Statutory Deposit facilities (SDF) and rates on Statutory Lending facilities (SLF) as benchmark policy interest rates.

The global financial crisis in 2007 forced central banks around the world to resort to innovative ideas for fighting the deflationary condition and liquidity crises. The Fed, under the leadership of Chairman Ben Bernanke, started a series of unconventional and unprecedented monetary policy action.

First, the Fed moved its benchmark interest rates near zero and then went into injecting vast amount of liquidity into the system through several round of purchasing financial assets (primarily bonds), known as Quantitative Easing (QE). Though conventionally the central bank use short term interest rates as monetary policy instruments to move the general level of interest rates, the Fed action of purchasing long term assets directly influenced the desired area of the yield curve. Subsequently, other central banks including Bank of Japan (BoJ), Bank of England (BoE) and European Central Bank (ECB) followed suit.

Our practice

Sri Lankan history is evident that the interest rates were artificially controlled using captive investors. The Employees’ Provident Fund, Employees’ Trust Fund, National Savings Bank, and other State banks and SOEs with large pool of excess funds are loosely identified as captive investors. The CBSL and the Government used to artificially manage the borrowing cost and the general level of interest rates in the economy using the funds with captive investors.

The artificially-controlled low interest rates could distort economic activity, create assets bubbles and may cause inflation as well as exchange rate fluctuations. In that sense, analysts argue that market determined high interest rates are better than artificially controlled low interest rates.

Economists observe that the low interest rates prevailed in the past has contributed to growth of consumption demand rather than stimulating investments. The credit fuelled consumption in turn affect the exchange rate through increased demand for imported consumer goods such as motor vehicles and fuel. So, the outcome of stimulating the economy through artificially controlled low interest in the long run is questionable. Instead it has contributed only towards creating assets price inflation.

Level of high interest rates

Since the start of the current tightening cycle in April 2015, the level of interest in the country moved upwards noticeably. While variety of reasons are attributed to noticeable increase observed in the level of interest rates, the popular view is that the decision to resort to fully public auction based system for issuing Treasury bonds is the main culprit.

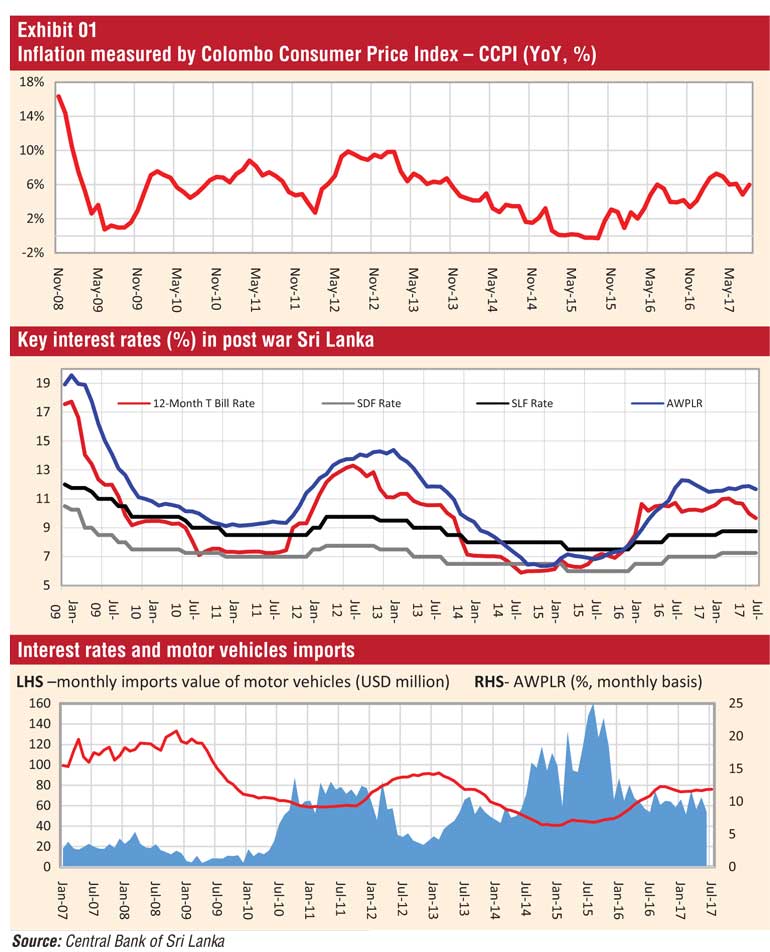

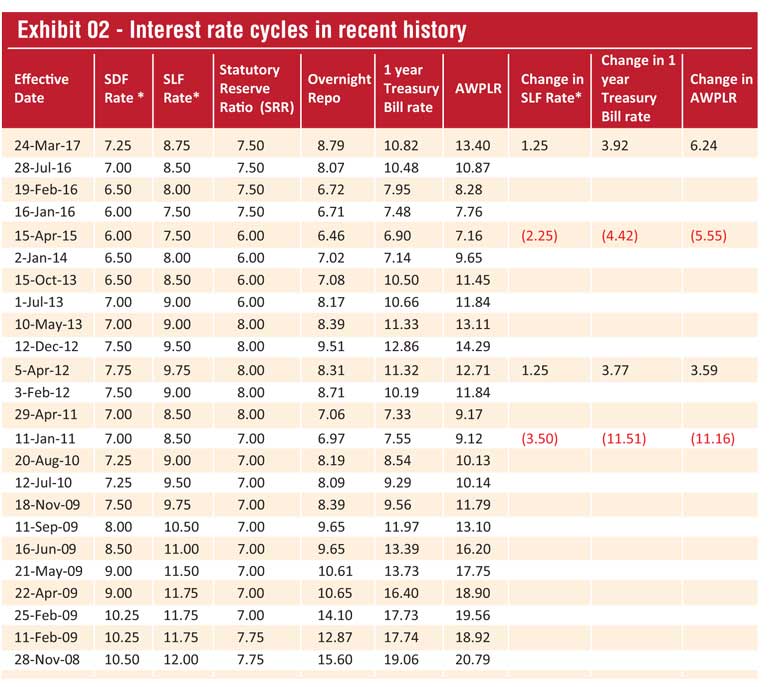

Post-war Sri Lanka has experienced two interest rates tightening cycles and two softening cycles as illustrated in exhibit 2.

1.The CBSL reduced benchmark policy interest rates by 3.5% during October 2008 to January 2011. As a result, interest rates or yield rate of one year Treasury bill experienced noticeable decline of 11.5% with the improvement of investor sentiment along with end of the war.

2.In January 2011, the CBSL started a tightening cycle, which lasted till April 2012. During the above period, the benchmark policy interest rates were raised by 1.25 %. In response to the above policy interest rate changes, interest rate on one year Treasury bills and the average lending rates of the commercial banks as reported by weighted average prime lending rate (AWPLR) on monthly basis increased by 3.77% and 3.59% respectively.

3.The CBSL reduced benchmark policy interest rates during December 2012 to April 2015 by 2.25% and the market interest rates declined markedly as a result. The interest rate on one year Treasury bill declined by 4.42% while AWPLR dipped by 5.55%.

4.Under the new Government, the CBSL started tightening cycle again in April 2015, raising Statutory Reserve Ratio (SRR) by 1.5%. By March 2017, the CBSL raised their benchmark policy interest rates by 1.25%. As a result, interest rates on one-year benchmark Treasury bill has been adjusted upwards by 3.92%. The movement of interest rates on 10 year benchmark Treasury bond is 2.18% while AWPLR increased by staggering 6.24% during the period.

The finding of analysis of interest rate behaviour during the past softening and tightening cycles is apparently contrary to the popular view indicating that there is no abnormal behaviour in the interest rates in this cycle compared to previous interest rate cycles. Though there was a change in the Treasury bond issuance process, movement of Treasury bill rate was higher than the movement of benchmark 10 Treasury bond rates.

Interest rates on private lending – AWPLR moved even higher. While inadvertently indicating that the Treasury bond issuance system could be a reason to the prevailing higher interest rates, the CBSL action in March 2017 to raise interest rates by further 0.25% was contrary to the said observation. If the CBSL believes that market interest rates has increased beyond their intended target level during this cycle, it is difficult to understand the motivation for raising the benchmark interest rates further in March 2017.

Conclusion

The monetary policy action decides the level of the interest rate of general economy. The monetary policy action is initiated based on the central bank’s understanding about the expected inflation. If the expected inflation is high, then the central bank acts to tighten the monetary policy. In addition, fiscal policy and resultant deficit spending directly and indirectly influence the level of interest rates. Though multitude of factors contribute to the short term fluctuations, level of interest rates is a function of monetary and fiscal policy.

(The writer is a CFA charterholder and a capital market specialist. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)