Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 15 December 2020 00:00 - - {{hitsCtrl.values.hits}}

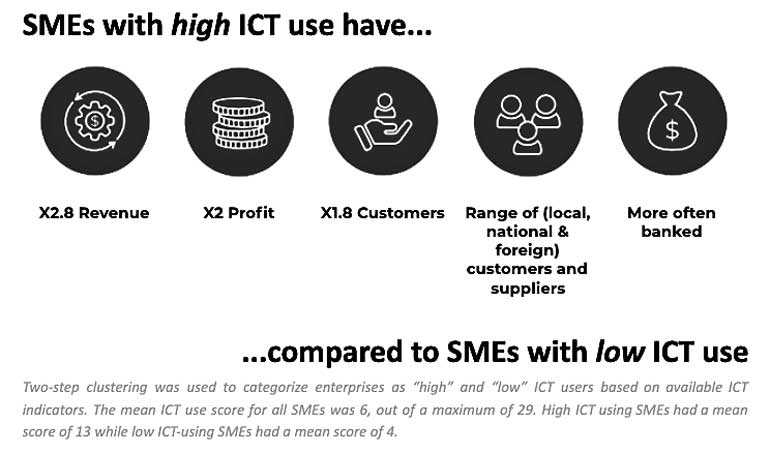

Figure 1: How SMEs classified as high ICT users are different to those classified as low ICT users (Source: LIRNEasia AfterAccess SME survey, 2019)

Small and medium-sized businesses (SMEs) represent over half of the businesses in Sri Lanka. They also provide an important source of employment for a large part of the labour force. They have been dubbed the ‘backbone’ of the economy in national policy frameworks. Supporting this sector and helping small businesses to grow should be an important part of the national strategy for post-COVID economic recovery.

Small and medium-sized businesses (SMEs) represent over half of the businesses in Sri Lanka. They also provide an important source of employment for a large part of the labour force. They have been dubbed the ‘backbone’ of the economy in national policy frameworks. Supporting this sector and helping small businesses to grow should be an important part of the national strategy for post-COVID economic recovery.

This article is the second in a multi-part series by the Advocata Institute and LIRNEasia on what needs to be done to empower Sri Lanka’s micro, small medium businesses for post-COVID economic recovery. In Part 1, the Advocata Institute examined the barriers faced by small businesses to formalisation and what needs to be done to lower them. In this part, LIRNEasia looks at what is holding SMEs back, through the lens of digital exclusion.

Connectivity is related to better business performance

A 2019 LIRNEasia survey of SMEs across Sri Lanka showed that businesses classified as ‘high’ ICT users performed considerably better on a number of indicators such as revenues, profits, number of customers, etc. (Figure 1). Perhaps most interestingly, they were also connected to a global value chain in some way.

Globally-connected SMEs can boost foreign revenue

Being connected to a global value chain gives businesses access to wider markets, and enables them to earn higher income. Not only does this give the SMEs a chance to grow, but can also help Sri Lanka boost its foreign exchange reserves. For an economy whose SMEs are said to contribute over half its GDP and account for three-quarters of the number of enterprises in the country, this is certainly a compelling case for encouraging the digitisation of these businesses.

But few SMEs are connected

While connectivity may have improved recently due to COVID-19 lockdowns, LIRNEasia’s 2019 survey showed alarmingly low levels of access and use among Sri Lankan SMEs. Ninety-one percent of SMEs said they used mobile phones for business, but only 65% had a contact number for customers and suppliers to reach them.

More importantly, the data showed that a large number of SMEs remained unconnected to the internet and far-removed from the ability to conduct business successfully in the new safety-focused environment. Of the SMEs that used mobiles at the time of survey, just 51% used smartphones for business purposes. Moreover, just 40% of SMEs said they used the internet or social media for business purposes.

The information gap must be closed

While those who did use the internet for business thought that access was “important” or “very important”, those who did not remained unconvinced of its benefits. At the time of survey in 2019, 79% of SME owners said there was “no need” to use the internet for business. This points to a wide information gap that must be closed if more SMEs are to operate successfully in COVID-19 conditions. SMEs must be given ready access to analogue training materials, accessible in all local languages, on how to select and set up the digital tools they require. The planned district-level one-stop-shop service centres can provide key access points for these training materials as well as support personnel.

Mobile-enabled payments are an untapped opportunity

Anecdotally with the COVID-related lockdowns, we have seen a small shift in SMEs taking to some form of rudimentary ecommerce, ranging from taking orders over messaging platforms like WhatsApp, to registering on platforms like PickMe and UberEats. But cashless, and even better, contactless payments are still somewhat of a sticking point. LIRNEasia’s survey found that by 2019, only 35% of Sri Lankans aged 15-65 had a debit card and only 3% had a credit card. Reciprocally, just 6% of SMEs had any facility to accept card payments.

But the case for mobile-enabled payments is striking: by 2019, 87% of Sri Lankans aged 15-65 had a mobile phone. Yet uptake of mobile payments by individuals and businesses has been slow. To take advantage of these contactless forms of payments and foster seamless ecommerce growth, we need a greater understanding of why SMEs do not take up card payments or mobile-enabled payment options.

‘Analogue’ complements also need to be addressed

The case for digitising SMEs is quite clear. In the chaos of a lockdown, or even going forward in a contactless future, enabling SMEs to digitise and adopt ecommerce will go a long way in keeping the economy going, and in minimising disruptions in supply of food and other essentials. Digital technologies are, however, no silver bullet. They are one part of an ecosystem, and complementary ‘analogue’ needs must also be met for the sector and economy to grow.

The general needs of SMEs include access to finance, simpler business registration processes, the necessary/right amount of legal frameworks in place for ecommerce (e.g., online online consumer protection, data protection, etc.), as well as sufficient internet use and digital skills among consumers. Sector-specific needs (such as cold storage and crop insurance in the agricultural sector, for example) must also be considered and addressed.

(The writer is a Senior Research Manaer at LIRNEasia. LIRNEasia is a regional digital policy and regulation think tank active across Asia. Learn more about its work on small businesses at https://lirneasia.net/SMESL and follow it on Twitter @LIRNEasia. The Advocata Institute is an independent public policy think tank. The opinions expressed are the author’s own views. They may not necessarily reflect the views of LIRNEasia or the Advocata Institute.)