Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 21 September 2018 00:00 - - {{hitsCtrl.values.hits}}

The Central Bank (CBSL) exists for the sole purpose of price stability. Its controls on the financial system and monetary policy exist to maintain price stability. As put forth many times by the Governor, the failing of the CBSL to control inflation is a fire-able offence. In this light the following text aims to put forth a view on the exchange rate that does not play to the current media narrative and focuses on the objective of the CBSL.

The Central Bank (CBSL) exists for the sole purpose of price stability. Its controls on the financial system and monetary policy exist to maintain price stability. As put forth many times by the Governor, the failing of the CBSL to control inflation is a fire-able offence. In this light the following text aims to put forth a view on the exchange rate that does not play to the current media narrative and focuses on the objective of the CBSL.

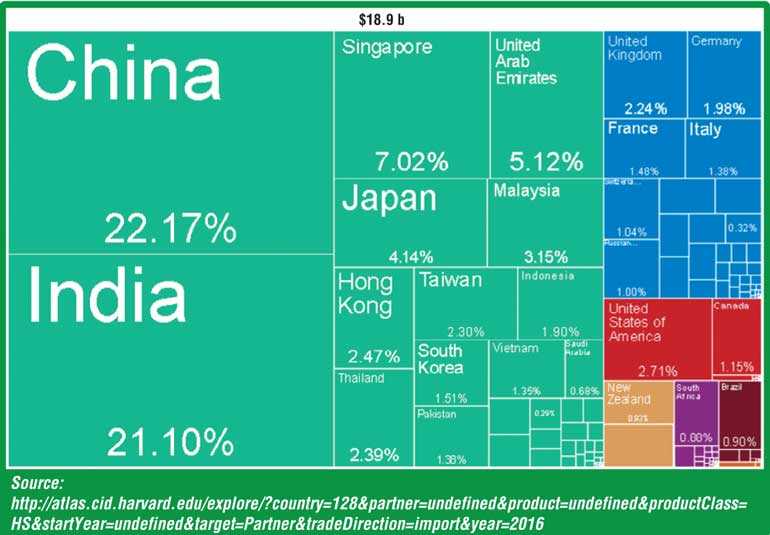

The notion that the exchange rate, more narrowly the USD/LKR rate, having a linear (increasing prices in the same proportion) and systemic (affecting all goods) is misguided. The table shows where Sri Lanka imported its goods from represented in percentage values.

Though our import contracts may be priced in dollars, as it is a reserve currency, the US only makes up 2.71% of this value. A more multivariate approach to analyzing our exchange rate would suggest that the rupees has appreciated in a basket of imports sense. This would be difficult to compute as global supply chains and financial products are more complex outside insular nation states. To put this in a more practical sense the cost of an Indian hatchback would be coming down to a locally salaried person. Inflation via appreciation of the dollar is also hedged by the increasing ability of local producers to compete at higher prices.

The Central Bank looking to contain inflation, which it has done admirably over the last six months, should look at how the exchange rate will affect the basket of goods that have a bearing on inflation. Though exporters may face uncertainty with regards to the value of their contracts they can hedge, borrow at foreign rates, operate completely in USD, and look to the Central Bank to give a broad indication of where rates will be in the future.

In the recent past there has been a false notion that foreigners on a significant basis are withdrawing from Sri Lanka. This is not reflected in the secondary trading of USD national debt listed outside the country. Those rates have been moved in line with projections of rises in US rates. Further there is no recent significant activity in those instruments. Reasons for the foreign withdrawal are more hinged on the growth experienced in the US markets which has caused a global movement of capital back to the US.

The Central Bank however fails on an exchange rate front with regards to the massive informal market in foreign exchange. This market is less efficient and causes volatility. Sri Lanka’s stringent capital controls combined with its low tax collection drives demand for a black market in FX.

The low rates (read high margins by BOC) on FX conversion to our workers in the Middle East leaves them bringing back physical notes to the country. The information available on the BOC website would suggest that they don’t even allow electronic transfers into their account from major employers in the Middle East. These notes are then traded against the many Rs. 5,000 notes (only used by politicians and tax evaders) in circulation. To paraphrase what an IRD man once told me, this money is then taken to Malaysia by rich businessmen using the same channels that the LTTE used in its financing operations.

Though I am in favor of foreign ownership of assets and would vociferously support the ability of any foreign passport holder to incorporate companies locally and retain property rights indefinitely I am suspicious on the Sri Lanka-Singapore FTA. On balance I am broadly still in support of the agreement. My suspicions are because Singapore has broadly liberalised lines of customs duty and there is little trading benefit on a crude trade balance analysis of the agreement.