Thursday Feb 19, 2026

Thursday Feb 19, 2026

Saturday, 16 May 2020 00:05 - - {{hitsCtrl.values.hits}}

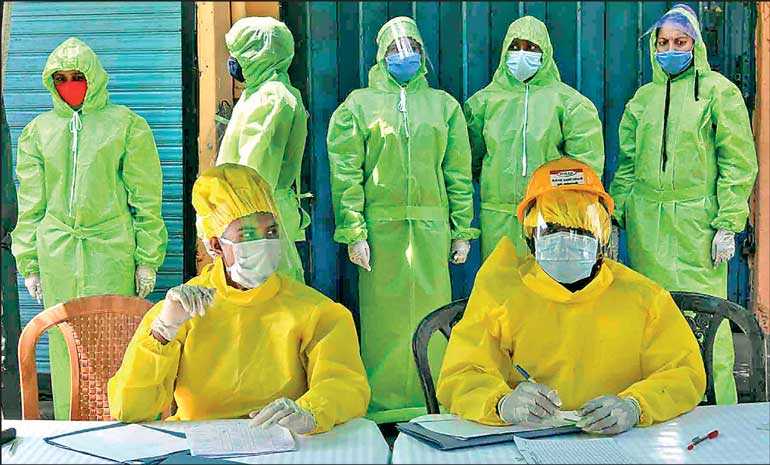

A troubling reality we must accept is that this will not be the last pandemic we face in our lifetimes; similar events with similar reactions by governments can be expected every few years. How well we fare after this and future lockdowns is up to us; a historic opportunity is on offer. Sri Lanka can transform into a truly digital economy, even though we are two decades late to the party – Pic by Shehan Gunasekara

The 2020 coronavirus (COVID-19) pandemic and social lockdowns by governments have come as a massive economic shock to businesses around the world.

The 2020 coronavirus (COVID-19) pandemic and social lockdowns by governments have come as a massive economic shock to businesses around the world.

Sri Lanka suffered a double whammy as our economy was just starting to recover from the impact of the Easter attacks of April 2019. For businesses everywhere, it is fair to call this pandemic an extinction-level event; many will not come back on the other side of the lockdowns.

Falling like flies

The business news from around the world feels apocalyptic. Airline companies are falling like flies; South African Airlines, the national flag carrier, has shut down after 86 years in operation; many private airline companies are failing, including major brand names like Virgin Australia.

The big American airline companies will only survive by taking massive bailouts from the US Government. The same is true for major national flag carriers like Alitalia and Lufthansa in Europe and other parts of the world.

International air travel is never going to be the same again – many budget airlines will be gone, medical checks will become a requirement and ticket prices will go up.

The airline collapse has had a huge negative impact on companies like Airbus and Boeing (the largest single exporter of the United States) – these companies will only survive on massive government bailouts. Even the sports brand Adidas has asked for a bailout. Many retailers in the United States like JC Penney and Neiman Marcus were already struggling, and will now almost certainly file for bankruptcy. Due to the way their Chapter 11 bankruptcy process works, it is difficult for retail companies to declare bankruptcy during a lockdown but may be lining up to do so once business resumes.

Some analysts estimate that as many as 70% of the restaurants in the United States may shut down. The economic impact on industries like travel has already been devastating and many bankruptcies are sure to follow. The companies that are surviving are slashing their workforces – even online companies like Booking.com and Tripadvisor.com are cutting back. All the major international banks have created provisions in the billions of dollars for loan defaults.

Parallel universe for oil

In a bizarre turn, WTI (West Texas Intermediate) crude oil contracts even traded at -$40 per barrel on 21 April – oil sellers paid buyers to take oil off their hands. This phenomenon may repeat in May when contracts rollover. The glut of oil in storage facilities around the world and the drop in demand is forcing producers to shut down – some are going bankrupt, and many will probably follow. This pandemic may bring about a paradigm shift in our attitude towards continuing to rely on fossil fuels.

“We won’t pay our rent!”

One in three American tenants and a full 50% of the small businesses missed their last rent payment. There were already over seven million Americans unemployed before the pandemic hit. 26.5 million Americans filed for unemployment benefits in the last five weeks.

This puts the total number of unemployed in the United States at over 20%, with the expectation that things will get worse in the coming weeks. If this is the impact on the world’s largest economy, the impact on Sri Lanka would naturally be far more severe.

As Sri Lanka does not have sophisticated real-time reporting systems like the United States, it is hard to measure the true economic impact of the Coronavirus on our economy, which is largely made up of small and medium businesses. As Sri Lanka is heavily dependent on sectors like apparel and tourism, the economic devastation is likely to be catastrophic.

The garment industry, which employs nearly one million people, no longer has a market as shopping malls and outlets are closed nearly everywhere in the world. Even after lockdowns end, consumer demand will not return to previous levels for many months. It is likely that many smaller garment factories will close down and a substantial percentage of this workforce will be out of work. With airports closed, tourism is at a total standstill.

No more jobs

Some large blue-chip companies have imposed a total hiring freeze for 2020 and have also decided to severely control costs, causing many projects to be put on hold. Large hotel chains have decided to stay closed for three months and have indicated they may not re-open all of their properties once they resume operations.

Many of our small travel companies, and possibly some of the large ones, are not going to survive. They do not have the same flexibility as companies in developed economies to lay off employees based on economic demand, due to our obsolete labour laws. This is a fundamental flaw in Sri Lanka’s statutory framework, as companies will be forced to retain employees even if they can’t afford to pay them and have no work to give them.

While this may reduce unemployment in the short term, it will increase the number of companies that will go bankrupt; in the long term, this would also translate into a higher unemployment rate. Existing labour laws will also severely handicap the creation of new jobs as companies may be reluctant to hire employees they can’t easily let go, particularly with an economic outlook that is mostly negative.

Often our Department of Statics data tends to be more than two years out of date. The Government then runs the risk of compounding the problem by making policy decisions based on obsolete data. When the question arose about how many daily wage earners were in the Western Province, the best official data we had appeared to be several years out of date – since then companies like PickMe have revolutionised ride hires and created jobs for hundreds of thousands of taxi drivers; none of them represented in the count of daily wage earners.

Money for the breadline

An unemployed American worker gets $378 per week in unemployment benefits for up to 6½ months. This converts to nearly Rs. 300,000 per month (at the current exchange rate), which is more than what most employed Sri Lankan workers get. Sri Lanka has no unemployment benefits system. The small amount the Government has managed to arrange for daily wage earners is woefully inadequate for them to support their families. While we do not know what our actual unemployment rate is, it is most likely going to be worse than in developed economies like the United States.

The Sri Lankan Government has neither the resources nor the historical practice of bailing out private sector companies. At most, the Government may bail out our banks and finance companies, as deposits are guaranteed by the Government to some extent. The rest of the companies, no matter how large and how many people they employ, will be allowed to fail. For small and medium businesses, it is not a question of if they will fail, but rather when and how many; and there are no bailouts on offer for them. If a sufficient number of companies fail, it will have a knock-on effect across the economy, pushing healthier companies also to the brink of collapse.

While a two-month working capital relief loan at low interest rates has been mandated by the Government, it is unlikely to save many businesses. Sri Lankan banks are notorious for denying loans to small businesses, for demanding unreasonable levels of collateral and for being so bureaucratic that it is virtually impossible for a business to get the cash needed in time for it to be of practical value. In other countries banks drive economic growth; in Sri Lanka, they are one of the factors dragging down growth.

Sri Lanka also took the unprecedented step of shutting down the Colombo Stock Exchange, a drastic measure that almost no other country has taken. The loss of investor confidence from this move can only be truly measured after the CSE reopens. Due to the global carnage in financial markets, foreign investors will probably be looking for safer investments elsewhere. As a result, the foreign investment funds available for Sri Lanka would already be severely limited. Except for potential support from China, we can expect to be on our own for many months after the lockdown is over as far as any major influx of foreign exchange is concerned.

Demand destruction

International business commentators refer to “demand destruction”, meaning that some consumer demand will be permanently erased; things will not go back to the way they were before the pandemic. Some consumer behaviours will permanently change. I have been a regular user of e-commerce for over 20 years, yet, even I have been in the habit of engaging in more conventional consumer behaviour, for example when shopping for my groceries or medicine.

During the past six weeks in lockdown, I have become accustomed to ordering everything online. I used to pay my utility bills over the counter, but all my latest payments were done online. Nearly all of our clients used to pay us by cheque. This is no longer the case as even the most traditional companies have rapidly adopted and switched to paying by online bank transfer. While I can be treated as a “power user” for whom this is a perfectly natural evolution, what is fascinating is that many people who had never used the Internet much have now become heavy users.

Even after the lockdown is over, our airports can be expected to remain closed for inbound tourists for several weeks or even months. Even after the airport is re-opened tourism will not pick up for many months; leisure travellers will be cautious due to virus fears, and the massive global reduction in employment and salaries will prevent people from travelling.

Within the country also people will avoid crowded venues, including cinemas, theatres, sports stadiums, restaurants and possibly even places of worship. After the Easter attacks, our hotels survived by encouraging local guests to stay with them – this customer base will also be severely depleted post-Corona. A fundamental shift has happened and it is here to stay. We are now living in that strange dystopian future that was once in the realm of science fiction.

Digital laggard

Sri Lanka has been lagging far behind the world in Internet use and had an official count of something north of seven million users. The lockdowns caused a massive increase in the use of the Internet globally. Some estimates put the increase at over 30%, which is a huge jump in developed economies which were already close to saturation. It may be several months before we can properly measure the increase in Sri Lanka.

The data from many major websites we manage indicates that there is a huge increase. Our estimate is that Internet use may have increased by as much as 50%, putting the total number of users in the country at over 10 million. Sri Lanka also has a large number of users dependent on their office systems for internet access – so once people go back to work, we can expect another surge. Previously we were expecting Sri Lanka to add about two million internet users a year. We would now have to revise our estimate and expect that we may get to 15 million a lot sooner than anticipated. Businesses should take note of this sudden “new” customer base of many millions.

Dinosaurs in the boardroom

Many large companies in Sri Lanka still have directors and top-level executives who are not tech-savvy. Up to now, the attitude has been one of smug arrogance; “Look at our success, why should we bother with digital?” has been the surprising message we have often heard, particularly when it came time to invest. This is a fundamental flaw in our corporate cultures and may contribute to 10% or more in lost growth in revenue and profit for these companies every year.

It is high time for companies to take a serious look at themselves and appoint leaders able to understand and leverage digital technologies. A key change that must happen after the lockdown is a thorough cleaning out of the old non-digital guard from corporate boardrooms. As for our members of Parliament, it suffices to say that they cannot competently legislate on something they are not even aware exists. Some shopping malls in Sri Lanka were already struggling and plans were in place to phase them out. Some world-class new shopping malls had just opened up, and Sri Lankan consumers enjoyed the sophisticated new cinemas, restaurants and brand name outlets on offer. These shopping malls are also going to get hit hard.

In an environment where jobs will be lost, tourist arrivals will remain near zero, and everyone will be jealously guarding their limited cash, there will be a massive drop in consumer demand, which will not recover at least until 2021. Retailers need to make hard choices about whether to shut down or invest heavily in e-commerce. Doing business online can no longer be an afterthought – e-commerce should be the default option, and having a brick-and-mortar outlet can be optional.

Even brand name restaurants, which had fully operational websites equipped for online orders, were woefully unprepared and the online ordering experience remains disappointing. Top supermarket websites in Sri Lanka went down and they had to hastily patch together make-shift solutions, which for weeks were unable to handle the deluge of orders that came in. The infrastructure readiness and the speed at which the major players in Sri Lanka responded was disappointing.

Many enterprising e-commerce websites that were previously offering other products like electronics and flowers quickly switched to offering grocery packs and were soon inundated; delivery dates stretched out to nearly two weeks at the beginning of the lockdown. Nevertheless, these companies fared far better than the “dinosaurs” – those large, smug retailers who still hadn’t bothered to develop an e-commerce website two decades into the 21st century. It was heartening to see many companies develop hastily put together e-commerce sites and set up distribution systems to cater to home delivery.

“You want us to do what?”

When the Government gave the order to “work from home” how many Government offices or companies in Sri Lanka were truly geared to do this? Probably 90% were not. Reading your email and taking a few Zoom meetings does not constitute working from home.

Most employees in the private sector were paid their salaries to sit at home and do very little productive work – a practice that is sustainable for at most one or two months. Workers in the apparel sector, hospitality sector and many other similar sectors cannot “work from home” when their companies are totally shut down and earning zero revenue while haemorrhaging cash on regular expenses. Developed economies have been in the practice of letting their employees work from home for decades. Nearly 50% of American workers have some component of working from home. Sweden, one of the most developed nations on the planet in economic, social and political terms, took the bold step of not locking down at all; a policy move that borders on genius. Their economy gave them the ability to take this step as a majority of their office workers can work from home.

When the dust settles most world economies will be in shambles; the Swedish economy may be doing better than most.

Ahead of the curve

At 3CS our staff have been given the ability and flexibility to work from home for over a decade. After the Easter attacks of 2019, we made a deliberate decision to encourage most of our staff to work from home. We provided the necessary infrastructure and training for them to do this. This helped us to become a far more efficient and agile organisation, capable of handling severe disruptions to the economy and normal working processes.

A few old-fashioned staff members took this change negatively and some even resigned; they viewed the aggressive shift we made as strange and incomprehensible. We never anticipated an apocalyptic event like the coronavirus pandemic; we were, however, 100% prepared for it because of the major organisational restructuring we did.

After Colombo was put under a total lockdown and curfew, the 3CS team carried on working as if nothing had changed. We are among only a handful of companies in Sri Lanka who can genuinely say this. We serve some of the top blue-chip companies in Sri Lanka. We are proud to say we continue to serve these clients with zero disruption, even serving requests being made in the middle of the night and on weekends within minutes. We have had one of the best service levels in our industry or any industry for years; we have maintained this service standard even under total lockdown conditions.

An existential choice

The complacent Sri Lankan private sector has had a massive socio-economic shock. Now it is not just “nice” to have a website and an e-commerce site; it is the Darwinian line that separates the species that will survive, and those that will remain only as fossils in the annals of our economic history. Some may say, “We are not a retailer, why do we need a website?” The answer is simple; if you don’t have a website and a strong digital presence, nobody knows you exist, and soon, you will actually cease to exist.

The Sri Lankan economy is tiny compared to other economies. Our total national debt could be settled with about one-third the cash reserves of Apple, Inc. This relativism must be kept firmly in mind by our policymakers. We can’t mimic what the United States or Europe do, and expect to have similar outcomes. Our economy is not as robust as theirs, and therefore will fall harder and take longer to recover.

Adapt or perish

The coronavirus pandemic offers an opportunity for our Government to replace many of the obsolete laws that have been dragging down our economy for decades. Continued failure to take action on legislative issues like revising the labour laws, which was an urgent national need even 20 years ago, will have catastrophic economic consequences.

For private companies who have not yet fully embraced a digital way of doing business, including those slumbering colonial relics that have become complacent because of their past success, the time has come to make an existential choice. For our national universities and institutions of higher education, it is time to stop being museums of education and genuinely switch to online, hi-tech and distance learning systems, even after the lockdown is over. Sri Lankans have always shown a remarkable ability to rapidly adapt and to adopt new technologies. The Government, our medical professionals, security forces and providers of essential services have done an amazing job controlling the spread of the virus, minimising deaths and maintaining the chain of essential supplies. However, every day we extend the lockdown, the human cost in lost employment, lost income and socio-cultural costs that include increased domestic violence and a higher future divorce rate, will be at an unprecedented magnitude.

The other troubling reality we must accept is that this will not be the last pandemic we face in our lifetimes; similar events with similar reactions by governments can be expected every few years. How well we fare after this and future lockdowns is up to us; a historic opportunity is on offer. Sri Lanka can transform into a truly digital economy, even though we are two decades late to the party.

[The writer has served as the CEO of 3CS (https://www.3cs.lk) for the past 21 years. He received his business degree from Franklin & Marshall College in Pennsylvania. 3CS is one of Sri Lanka’s leading web design and digital marketing companies and is the winner of the Best Web Developer award at the national bestweb.lk competition for 10 years from 2010-2019.]