Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 28 August 2019 00:00 - - {{hitsCtrl.values.hits}}

This article is the first of a series about the current state of the Sri Lankan economy. I expect to cover key areas of the economy including the real, external, fiscal, monetary and financial sectors. The  discussions will focus on key aspects within each sector and try to highlight possible challenges and layout future directions. This series is intended to provide an overview of the economy to the general audience. I welcome your comments, suggestions and ideas.

discussions will focus on key aspects within each sector and try to highlight possible challenges and layout future directions. This series is intended to provide an overview of the economy to the general audience. I welcome your comments, suggestions and ideas.

The starting point of the series is the real economy that deals with the production of goods and services. Economic growth and employment are two important areas of the real economy. The focus of this article is economic growth.

Higher growth is absolutely necessary to tackle economic issues

Sri Lanka’s recent economic performance has been mixed. The country is trapped in a growth conundrum. While the economy has continued to expand, growth has been low and decelerating in recent years. The country needs structural and other reforms necessary and critical to unlocking impediments to growth.

Sri Lanka needs higher growth to contain the budget deficit. The level of public debt is high and unsustainable under the prevailing growth environment. Further deterioration of fiscal balance could lead to more borrowing by the government and build-up of more debt. Improving the trade balance and thereby the balance of payments deficit also require higher growth.

Sri Lanka has now reached the level of an upper middle-income economy. Achieving the high-income status will require higher and sustained growth. With reasonable assumptions regarding key variables influencing growth, a 5% annual growth will take Sri Lanka about 20 years and a 6% growth about 15 years to become a high-income economy.

Overall economic growth

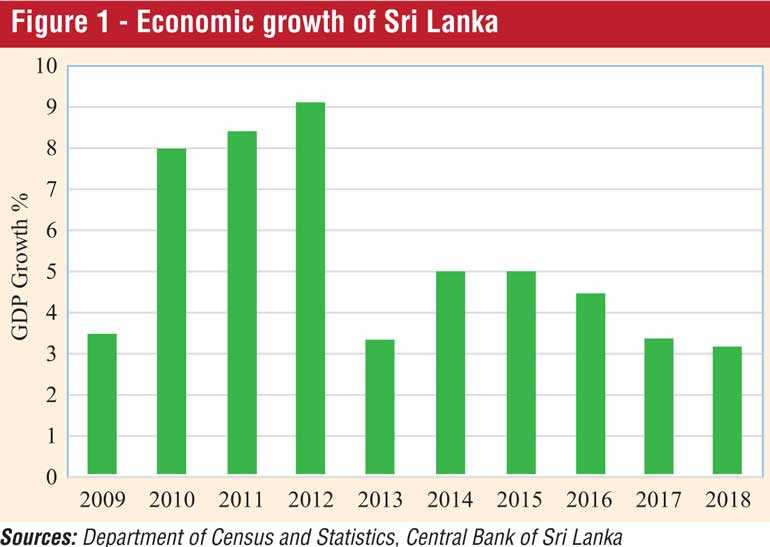

In terms of the overall economic growth, over the past 10 years (2009-2018), Sri Lanka recorded an average annual growth of 5.4% in real terms (Figure 1).

This period consisted of two different growth episodes: In the five-year period from 2009-2013, which was the period immediately after the end of the 26-year civil war in May 2009, the economy grew at an annual average rate of 6.5%. The higher growth was particularly impressive in the three years after the end of the war where the growth was 8.0% in 2010, 8.4% in 2011, and 9.1% in 2012, showing continued high growth momentum.

However, this momentum broke with growth declining substantially to 3.4% in 2013, and in the last five-year period of 2014-2018 the average annual growth declined to 4.2% which is more than a 2 percentage point drop relative to the previous five-year period. Moreover, growth has shown continuous declines since 2015, and the growth in 2018 of 3.2% was the lowest in 16 years.

Sectoral growth performance: agriculture, industry and services

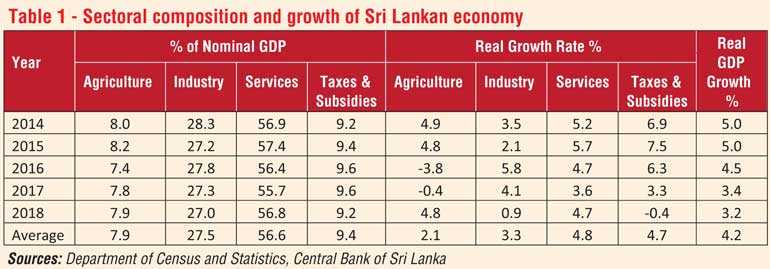

In terms of the sectoral composition of the economy (Table 1), the services sector is the largest sector of the economy contributing to 57% of the real gross domestic product in 2018 followed by the industry sector (27%) and agriculture (8%). It is clear that during the past five years, the sectoral structure of the economy has barely changed.

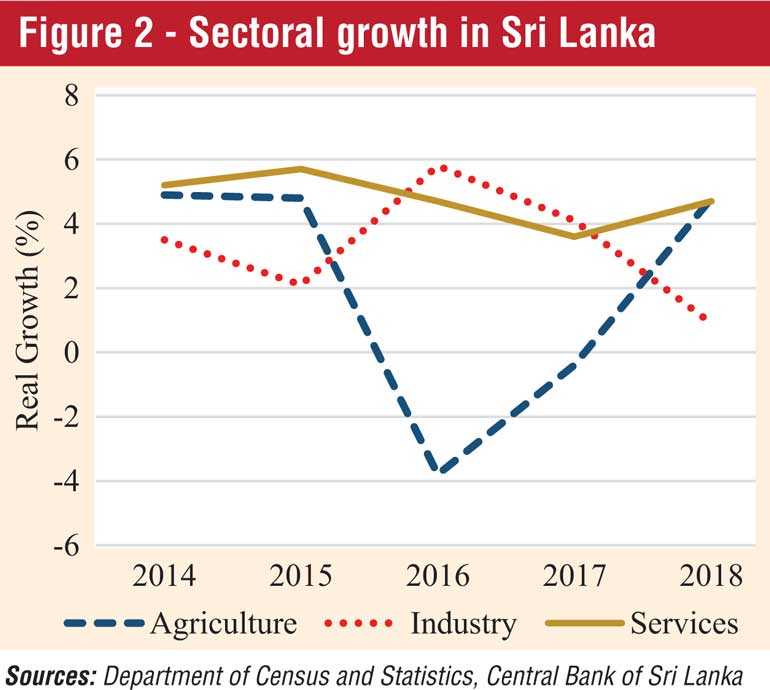

In terms of sectoral growth (Figure 2), the agriculture sector has grown at an average rate of 2.1% over the past five years. With the exclusion of the negative growth in 2016 and 2017, this sector has shown a growth of about 5% at most. The industry sector recorded an average growth of 3.3% with large variability from 0.9% in 2018 to 5.8% in 2016. The services sector has shown steady growth averaging about 5%.

The decline of GDP growth reflects volatility in agriculture and industry growth. Clearly, the sectoral growth rates have been low and have not been able to maintain a sustainable upward trend.

Consumption, investment and net exports

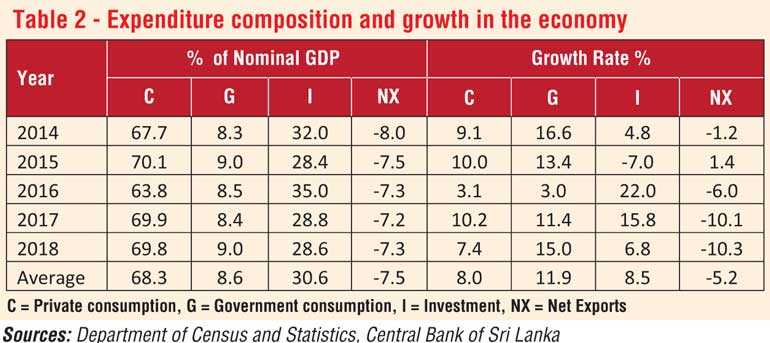

The composition of the economy in terms of the expenditure on GDP, the data show (Table 2) that private consumption expenditure (C) constituted 70% of the Sri Lankan economy in 2018, making it the largest share of the economy. The second largest expenditure component is investment expenditure with a share of 29% in 2018. Government expenditure is 9% of the economy. Net exports, which is exports minus imports, have been a negative contributor because imports exceed exports. Their share in the economy was about -7% in 2018. It is quite evident that the structure of the economy in terms of the expenditures has not changed much in the past five years either.

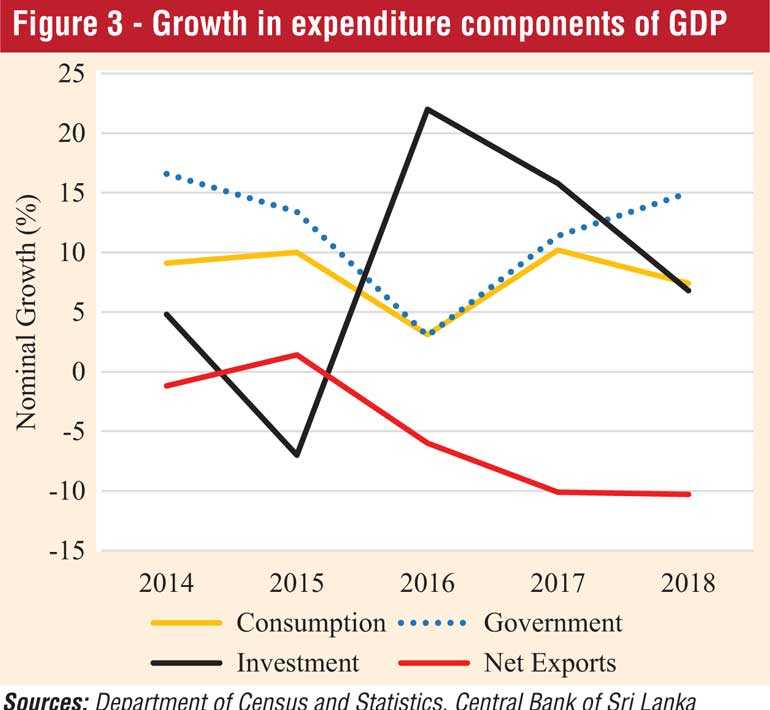

As for nominal growth in expenditure components (Figure 3), consumption and government expenditures have grown at an average rate of 8% and 11.9% respectively during 2014-2018. They have been somewhat volatile, particularly due to very low growth in 2016. Investment growth has been the most volatile over time ranging from -7% in 2015 to 22% in 2017. Except for 2015, the growth in net exports has been negative, and the magnitude of negative growth has continued to increase, reflecting weak trade performance. On average, net exports have recorded a growth of -5.2%.

Recent growth experience in Asian economies

The greatest challenge for Sri Lanka is to stem the deteriorating growth the country experienced in the recent years and to reignite the economy with a concerted effort to reach higher single growth in the next decade. This requires a closer analysis of growth dynamics of the Sri Lankan economy, taking into account experiences in other lower-middle income (LMI) and upper-middle income (UMI) economies.

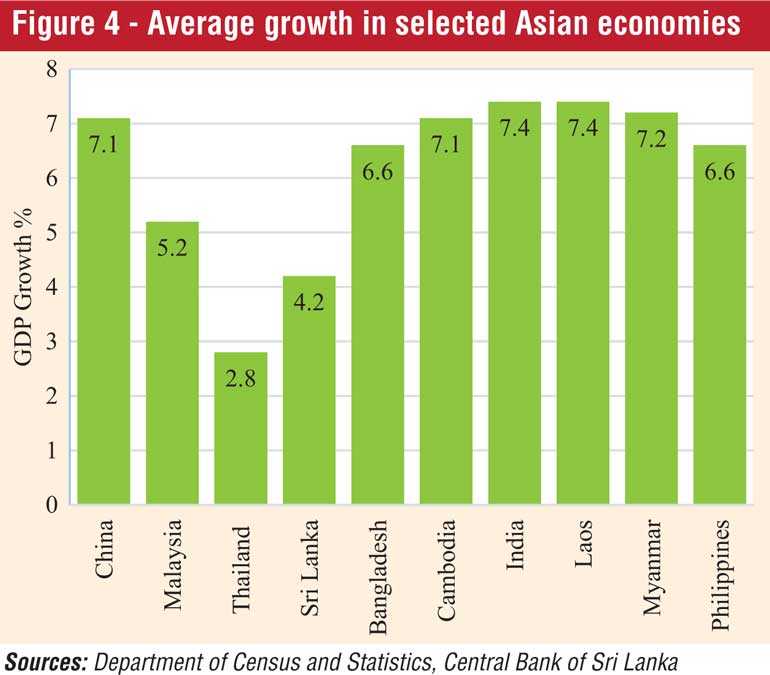

As Figure 4 shows, while Sri Lanka averaged a growth of 4.2% in the 2013-2017 five-year period, every other country in the South Asian region recorded higher average growth than Sri Lanka. The notable stars were India with an average growth of 7.4%, Bangladesh with 6.6% and Maldives with 6.3%. The average growth in East Asia was 6.5% with growth exceeding 7% in China, Cambodia, Laos and Myanmar.

The country needs a medium-term economic plan with a long-term vision

Although it may not be possible to perfectly replicate the growth paths of these high growth Asian economies, their growth experiences clearly contain lessons and plans Sri Lanka can learn from. Economic reforms are absolutely essential for Sri Lanka to unleash its growth potential.

Low economic growth makes it difficult to contain budget deficit, public debt and worsening of the current account deficit. Policy measures to address the twin deficits – budget and current account - are vital since countries with persistent twin deficits tend to have weak growth and their currencies tend to depreciate more. Debt sustainability critically depends on higher growth as well.

Export-oriented industrial development financed by private capital, particularly foreign direct investments, is key to higher economic growth. In this context, Sri Lanka needs to have a robust exports growth strategy and a regionally competitive incentive framework for attracting foreign direct investments on a larger scale.

Significant reforms are needed to modernise and diversify the agricultural sector in order to increase productivity and its contribution to growth. Private capital needs to be leveraged for infrastructure development as a growth driver. The country’s high-level of human development and highly educated workforce could be harnessed to expand existing service industries and create new ones which have greater potential to contribute to growth.

Overall, achieving high single-digit economic growth on a sustained basis is necessary to overcome fundamental economic imbalances and problems facing the country. This requires a medium-term five-year social economic development plan crafted within a long-term planning and policy framework and political commitment to its implementation. In addition to economic plans, ensuring political stability and policy certainty are vital to spur investments and growth.

Lalith Samarakoon is a Professor of Finance and Financial Economist. He serves as the Secretary-General and Chief Economist of the National Economic Council of Sri Lanka. Follow Perspective at www.lalithsamarakoon.com and Twitter @LSamarakoon. Email feedback and comments at [email protected].