Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 10 October 2019 01:09 - - {{hitsCtrl.values.hits}}

Sri Lanka is at a transition point – progression is reflected in the rising per capita income, number of high-rise buildings, bevy of cars on the road, etc. The desire to spend and celebrate life – by treating your family to dinner, vacation or buying an expensive jewellery increases with income.

Sparkwinn Research intended to understand the credit card usage patterns with the rising consumption levels. In fact, do consumers facing a cash or card dilemma when it’s time to grab the wallets to pay for their consumptions?

The key results of the study have been outlined below:

Low credit card penetration

Sri Lanka’s credit card industry is becoming increasingly dynamic, as the number of new cards issued declines yet the purchase volume and transaction value have steeply increased. Only 1.7 million cards were in use during the year 2018, indicating the definite scope to grow the category.

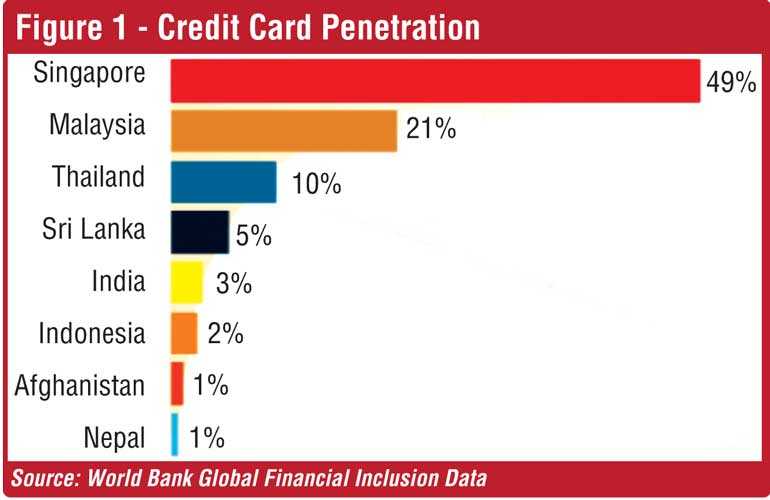

Sri Lanka’s credit card penetration is only 5%, even though 74% of the population own a bank account according to World Bank Global Financial Inclusion Data. Even though Sri Lanka’s credit card penetration is considered to be fairly sufficient, it is comparatively low to its Southeast Asian counterparts. Differentiation is key when banks appeal to various consumer segments in order to expand in this highly competitive market. Credit cards need to offer an experience that truly stands out, amidst the overcrowding of choices and disruption in the market place.

Search for alternate payments is picking steam

Cash is still king in Sri Lanka, yet the search for alternate payments is picking steam. More than three-fourths of credit card users surveyed prefer to use cashless payment methods. Interestingly, around 41% of the participants selected credit cards as the most ideal payment choice.

Source: World Bank Global Financial Inclusion Data 2018

Males emerge as star consumers

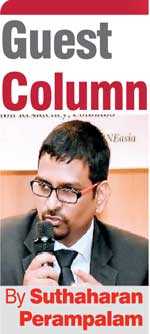

Men and women certainly sport a different relationship with their credit card, as motivations to use varied based on gender – 55% of the males and only 37% of females reported that the spending on their credit card has increased when compared to last year.

Males have increased their credit card spending, whereas females on a contrasting note have curbed their credit spending. Women had a conservative attitude while men remained less cautious with their credit card usage. 19% of the females reported that the primary reason to use a credit card was to track their purchases while only 2% of the males that participated in the study stated the same reason.

Rethink and redesign offers/promotions

Offers, discounts, etc. were the primary motivation for shoppers to swipe their credit cards. Interestingly, around 38% of the males and only 17% of females had more than one credit card in order to benefit from the various promotions.

Times have changed, with rise in working women and job-sharing at home which have resulted in males hitting the stores to shop for their household needs. Males are indeed making more purchasing choices than ever before. Credit cards owned by the males, were used to purchase household’s routine grocery, healthcare and life style needs, while women’s cards were relatively less actively used. Males pointed out the need to improve credit card offers/promotions – tailoring it to suit their needs by making it unique. It must be noted that cards are customised in other countries, adapting to suit the differing needs of the customer. For example, female friendly cards with curated lifestyle benefits, unlimited spa access and grooming benefits etc. are popular in some parts of the world. However, such customisation is yet to be seen in Sri Lanka.

Men and women use their credit cards clearly for different purposes, and it would be effective if customer-centric promotions/ offers were planned keeping this in mind. It is essential to shift from product-centric to customer-centric mindset to unlock the hidden opportunities.

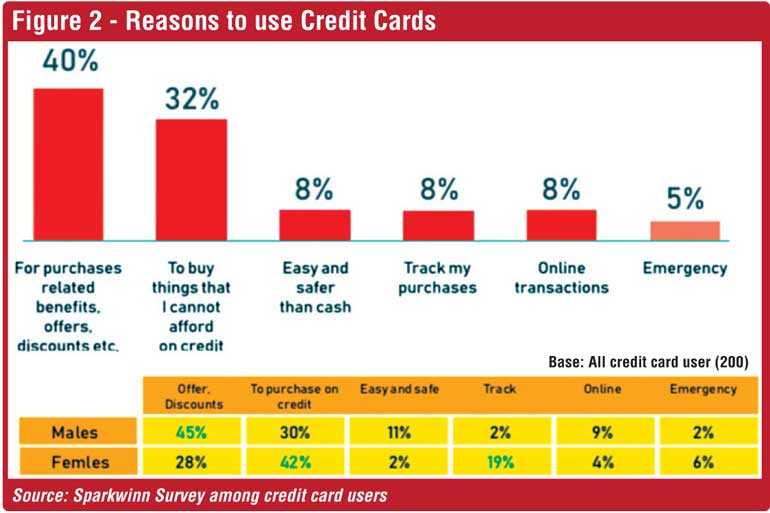

Larger pie on grocery spends

The survey shows that a substantial share of credit card spends is on daily essentials, in addition to other discretionary expenses. Credit cards were mostly used at supermarkets followed by clothing stores, restaurants, fuel stations, etc. Even though the plastic-swipe experience is mainly promoted for life’s celebrations, precious moments, etc. but in reality, majority of the consumers used the cards to purchase daily essentials

“I visit the supermarket during the weekends with my six-year-old daughter and a long grocery list prepared by my wife. Our shopping cart will be filled with items ranging from fresh vegetables to yoghurt drink. Sometimes, I see promotions as I pass through the aisles but rarely pay much attention. The last time I went shopping I saw 10% off for milk powder if I paid by credit card. But there will be so many terms and conditions, so I paid with cash as usual” adds Rajesh during a little chat following the survey.

Emergence of spend instead of save culture

Sri Lankans are typically known for their ‘save and not spend’ mantra, but with capitalistic tidal wave hitting the local shores, things have changed. It used to be a norm to put aside money to build a house, towards retirement, for the children, always for the future, not the present. However, there is transformation as the country gradually grows (3.2% GDP growth – 2018) and a newer generation come of age.

Familial ties and values are regarded high in close-knit society like ours, and credit card advertisements reflects this cultural understanding, and focuses on communicating about ‘spending for your loved ones’. Communications mainly focus on buying your son a toy or your wife jewellery, gifts for loved ones.

Social media motivates spending culture

Social media has created a greater need to buy, it’s a cycle which causes a social need to buy products or go to places to stay relevant. This relevancy, always a social factor has now heightened, chiefly among the youth, this is centric globally not only to Sri Lanka.

Younger age groups are more exposed globally and are unlikely to tread the same steps again. Change and diverse advertising strategies is a clue to a new – not so save, more spend, more oneself and impulsive framework.

A shift of ad strategy is noticeable, as banks are purporting that they can give you the best, there is no imagery of family or friends, the focus is you. Personal happiness is the changing theme, but the objects used are normal. Ordinary car, backpack, shoes, etc. are the focal point, no luxury holiday or branded car are to be seen. This is an attempt to showcase an increase of personal desires while being culturally sensitive of the safe spending social expectation and mind frame.

Way forward

Banks are competing within same small basket of users now and offering the fourth or fifth credit card to the same person. But now is the time to focus on acquiring new users and reach the next million credit card users, especially those belonging to the underserved segments.

Females are one such segment, there is a gender gap in credit card ownership. Only 3.8% of women compared to 7.2% of men own credit cards. In addition to that keeping the star consumers who are males is important when expanding the category by offering relevant promotions, etc.

Reaching the affluent customers within second tier cities could be another strategy, as credit card ownership in areas outside the Western Province is significantly lower. It is important to create relevance for cards by reducing entry barriers such as set up costs, higher interest rates, etc. This could help reaching the emerging middle-class segment. More credit card users in the country would benefit the local ecommerce and platform economy by taking it to the next level.

(Suthaharan is a market research expert, specialised in undertaking quantitative surveys and demand side estimations. He heads Sparkwinn, a research firm that specialises in providing data centric insights on consumer and social issues. He can be contacted through [email protected].)