Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 6 July 2020 00:28 - - {{hitsCtrl.values.hits}}

From upper middle-income to lower middle-income

The World Bank in its latest country classification by incomes, released last week, has downgraded Sri Lanka from upper middle income to lower middle income (available at: https://datahelpdesk.worldbank.org/knowledgebase/articles/906519-world-bank-country-and-lending-groups). This was just one year after Sri Lanka had been elevated to the status of an upper middle-income country in July 2019.

The first elevation was based on the per capita Gross National Income or GNI per capita, calculated according to World Bank’s Atlas Method, for 2018. The downgrading was done on the basis of GNI per capita for 2019. According to the World Bank Atlas Method calculations, Sri Lanka’s GNI per capita for 2018 stood at $ 4,060. Due to the non-growth of the economy in US dollar terms in 2019, GNI per capita in that year has fallen marginally to $ 4,020. This level was again marginally below the threshold of $ 4,046 fixed for an upper middle-income country valid for the period from July 2020 to June 2021. Hence the downgrading of Sri Lanka from upper middle-income to lower middle-income in the current year.

Man-made shocks causing GNI to fall

There had been two main negative shocks that had caused Sri Lanka’s GNI to be stagnant in US dollar terms in 2019. One was the uncertainty created in the economic system in the first half of 2019 emanating from the constitutional crisis of October-December 2018. During this period, there was no government in Sri Lanka and hence, there was no proper budget approved by Parliament for 2019. The second was the Easter bomb attack on major hotels and Christian churches in April 2019 and the ensuing religious clashes in selected areas in the country. This shock had reduced the growth momentum of the country in the second half of 2019.

The final result was, according to the Department of Census and Statistics, the slowing-down of growth in GNI in 2019 to 2.2% in Rupee terms from previous year’s growth of 3.2%. However, in US dollar terms, GNI fell by nearly 6% in that year. Both these negative shocks were man-made and could have been avoided or contained.

The elusive upper middle-income status

According to the World Bank data, Sri Lanka got promoted from low income to lower middle income in 1997. The annual economic growth at around 5% on average since then had helped Sri Lanka to pass the first barrier and be in the upper middle-income category in 2019, but that was after the lapse of some 22 years. Based on this performance, Sri Lanka had expected to cross the second barrier within the next 15 years and join the high-income country club by 2034. But the projected negative economic growth in 2020 and the very slow economic recovery in the next 4-5year period would make this goalpost move further away from Sri Lanka thereby lengthening the time period needed to become a high-income country.

GNI is a better indicator of wellbeing than GDP

Since these classifications are an indicator of the welfare levels of people living in respective countries, the World Bank uses GNI to do so rather than using the more popular Gross Domestic Product or GDP. GNI records all the incomes earned by citizens of a country irrespective of whether they live within the country or outside. GDP, in the opposite, records incomes earned by all who had been living within the territory of the country including foreigners. GNI, therefore, excludes the incomes earned by foreigners within Sri Lanka but adds the incomes earned by its citizens living outside.

GNI is marginally lower than GDP and the gap is widening

Since Sri Lanka is paying a massive amount of interest to foreigners on its foreign loans, its GNI is a little lower – by about 3% – than GDP. What this means is that the some of the incomes earned within Sri Lanka’s territory are leaked out to the rest of the world thereby reducing the resources available to citizens for their use. With increased interest payments to foreigners in each successive year, this gap is now widening. For instance, GNI was lower than GDP by 2% in 2000. It has widened to 3% by 2019. This is one of the adverse consequences of high external debt accumulation by Sri Lanka over the years.

The Atlas Method: An approximation of the actual exchange rate

The Atlas Method: An approximation of the actual exchange rate

The country exchange rates are often manipulated, over or under-valued and demonstrative of spikes and depths. Hence, it is misleading to use them to convert GNI calculated in respective local currencies to US dollar, the common measure used for country comparison purposes. To overcome this defect, the World Bank calculates its own exchange rate for countries for use in its Economic Atlas. Hence that exchange rate is known as the Atlas Method.

The Atlas Method is an approximation of the equilibrium exchange rate applicable to a country. It is based on the average of the exchange rate during the three-year period up to the year under consideration adjusted for the domestic inflation of the country concerned as against the international inflation. The domestic inflation used for this purpose is the average change in the prices of goods and services for converting money GNI to real GNI.

Those prices are known as GDP deflators and in the case of Sri Lanka, they are compiled by the Department of Census and Statistics. The international inflation used by the World Bank is the average change in the value of the Special Drawing Rights or SDRs, an artificial currency created by IMF to record its transactions with member countries. SDR is a more stable currency than any individual currency since its value contains the values of the five major currencies in the world, namely, those of China, Japan, the UK, USA and the Euro Area. The changes in the value of SDR are presented by another deflator called the SDR deflator.

Larger changes in GDP deflator than those of SDR deflator cause the currency to depreciate.

In terms of the Atlas Method Formula, if the change in the domestic GDP Deflator is higher than that of the SDR deflator, the local exchange rate is further depreciated. However, that exchange rate being the average of the exchange rates for three years, is basically free from manipulations and unusual spikes or depths in the movement of the rate.

In the case of Sri Lanka, GNI deflators for 2017 amounted to 7.3% and 2018, 4.3%. The comparable numbers for SDR deflators were negative 1.4% in 2017 and 2.7% in 2018. Clearly, for the conversion of GNI into US dollars, the Atlas Method exchange rate had been a depreciated rate over the simple average of the exchange rate for 2017, 2018 and 2019. This is because the Sri Lanka rupee has not depreciated enough to match the higher local inflation over the international inflation.

The current country classification thresholds

The GNI levels used for country classification are based on the current value of the US dollar compared to its value in 1987. Since the dollar values change, the threshold values of the four main categories are revised by the World Bank every year and announced in July each year. Once announced, they are valid for July in the current year to June in the next year. Accordingly, the limits applicable to 2020-21 are as follows: Low income countries, $ 1,035 or below, lower middle-income countries, $ 1,036-4,045, upper middle-income countries, $ 4,046-12,535 and high-income countries, more than $ 12,535. Sri Lanka was downgraded to lower middle-income category because its GNI per capita amounting to $ 4,020 was below this threshold.

Disparities in income distribution and provincial shares of GDP

Sri Lanka was jubilant when it was elevated to upper middle-income country status in July 2019. But as I have argued in a previous article in this series (available at: http://www.ft.lk/columns/Sri-Lanka-s-elevation-to-upper-middle-income-status-Attainment-is-welcome-but-challenges-are-more/4-681449), due to two reasons, this was not an occasion for jubilation.

One was the wide disparity in income distribution across citizens. The other was the disparity in the incomes earned by provinces. In the case of the income disparity among citizens, the top 20% of the population normally bags a little over 50% of the total income of the country. In the opposite, the lowest 20% gets only 5% of the total income.

With regard to the income disparity among provinces, the lion’s share of 37% was earned in the Western Province whereas the rest of the country had earned only the balance 63%. Accordingly, eight out of the nine provinces were below the minimum income threshold for an upper middle-income country. As such, from the welfare point of people, a large segment of Sri Lanka’s population was not enjoying living standards attributable to those living in an upper middle-income country. For all practical purposes, I, therefore, argued that Sri Lanka was not an upper middle-income country but a lower middle-income country.

Still eight provinces are below the threshold level

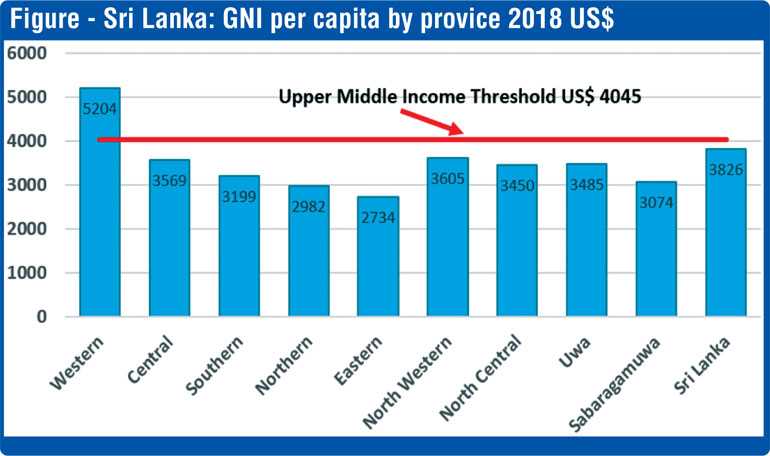

The situation in Sri Lanka in 2020 remains the same. We now have the income distribution data for 2016 and those data too show the same pattern of income distribution. The Central Bank has now updated the provincial GDP numbers for 2018. According to these numbers, the Western Province has increased its share a little to 38% making the other eight provinces earn only the balance 62%. I have converted these numbers to per capita GNI by using the fixed share of GNI at 97% in GDP. The results are shown in Figure I.

Accordingly, except the Western Province, all other eight provinces have a GNI per capita level of lower than the threshold for an upper middle-income country. Hence, the lower middle-income country status is what Sri Lanka’s background economic conditions would dictate to it at the present moment of its economic development.

Strategies for the future

But Sri Lanka should not remain here forever. It has the potential to come out of present low growth scenario and move up in the ladder to become a rich country. This requires the country to take a stock of its present state of the economy exacerbated by the economic fallout of COVID-19 pandemic. Using these assessments as the foundation, it has to plan out a credible economic reform program to place the country on a long-term economic growth path.

The perilous economy today

Sri Lanka’s present economic conditions are not promising at all. The fallout of COVID-19 pandemic will worsen it. In 2020, the economy will shrink by about 5-10%. Economic recovery will be slow in the next four-year period mainly due to the restrained economic relationships dictated by health requirements. The government budget is in a precarious condition with a sharp decline in revenue, the undesired outcome of unsound tax reforms introduced in early 2020, and ballooned expenditure programs necessitated by the country’s reconstruction needs. Consequently, the budget deficit will rise to about 10% in 2020 and will remain high in the next four years.

Due to constraints in borrowing, the government has got the Central Bank to finance its expenditure programmes by buying Treasury bills. During the first six months, these Treasury bill holdings have increased by about Rs. 300 billion. But this has not been reflected in printing of new money by the Central Bank due to a fall in its monetary base by about Rs. 68 billion – an unintended outcome of a fast decline in foreign reserves. What this means is that the Central Bank will have to pump new money into the system in the months to come to recoup the shortage of liquidity within the system. All these are not good signs for restraining inflation.

In the meantime, the rising foreign debt servicing, decline in foreign exchange earnings and untamed import bill will lead to deficits in the balance of payments. It will put pressure for the exchange rate to depreciate further.

Way-out: Stra.Tech.Man Approach

The way-out for Sri Lanka is to divert its resources from consumption to investments in physical capital, human capital and technology. They would create new openings for the private sector to actively participate in the country’s development efforts. The development economist Charis Vlados in his 2019 book titled ‘Strategy Technology Management: Theory and Concepts’ has coined Stra.Tech.Man Approach for countries to follow for a quick economic recovery.

What is being presented by him is an extension of what Austrian-American economist Joseph Schumpeter outlined in 1942 as the necessary ingredients for economic advancement and sustainability: Inventions followed by innovations, diffusion and imitation. For growth to sustain, inventions should be made by engineers, scientists and management experts and they should be commercially adopted by entrepreneurs in a process known as innovation. Then, the knowledge about the new innovation should be spread across the economy in a process he named diffusion to facilitate other entrepreneurs to imitate the same.

A good example is the Apple Mackintosh Desktop computer which was invented by engineer Stephen Wozniak and innovated by Steve Jobs. Then, the knowledge about desktop computers spread among other entrepreneurs who later imitated and improved upon it.

Vlados has presented this process as a dynamic evolution similar to what happens in a living organism. When applied to an economy, his approach says that societies should come up with deliberate strategies to foster inventions and innovations boosting a country’s technology base.

This should be appropriately managed by promoting both micro and meso enterprises as the base in any economic system. Micro enterprises are the smallest units in the economy and meso enterprises are in between micro and SME enterprises.

What this means is that meso enterprises are simply a necessary phase in the evolution of business enterprises to SMEs and then to large corporates. This is essential to eliminate both income and provincial disparities.

The previous growth efforts in Sri Lanka have not delivered the desired results because they had disregarded this vital economic-biological process. What the policy authorities should do today is to look after and promote micro and meso enterprises, infuse them with technology and then manage them appropriately so that they would grow into SMEs and later into large corporates. When this happens on a large scale creating a critical pool of entrepreneurs, an economy would naturally move upward sustaining its growth achievements over the years.

This is how Sri Lanka should strategise today to move up from the lower middle-income status to upper middle-income and then to high-income level avoiding income disparities at citizens’ level and production disparities at provincial levels.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)