Monday Feb 23, 2026

Monday Feb 23, 2026

Saturday, 5 May 2018 00:03 - - {{hitsCtrl.values.hits}}

I remember having seen Prof. Ajith de Alwis been described as Project Director of Coordinating Secretariat for Science, Technology and Innovation and whenever I see an article by him in the papers, I expect to read about some specific plans he or COSTI under him have developed to take Sri Lanka to the next level of industrial development.

I have seen Prof. Rohan Samarajeewa’s earlier response to Prof. Alwis’s latest article on rubber and erasers but still wanted to write this for the simple reason that I have been involved in these sectors/industries very intimately and thought that I should vindicate all those professionals who wanted to see a Sri Lanka making good use of the land devoted to tea, rubber and coconuts in this country.

Rubber sector developments

We wanted to export rubber products rather than raw rubber since early 1960s. Of course, in 1953 when a former Minister of Trade, late R.G. Senanayake, went to China and signed the Rubber-Rice Pact and brought rice to meet local demand, we were happy that we had raw rubber to export.

I was a Development Officer at State Rubber Manufacturing Corporation (SRMC) in 1976 and SRMC was established to add value to our raw rubber exports. Initially it started (a) Block Rubber Factories to convert waste rubber (Ottapalu) which was exported as is into Technically Specified Block Rubber and (b) Crepe Rubber Factories to convert small holder rubber latex into crepe rubber and get a higher export price. At that time, it was value addition. While J.G. Anandarajah who retired as CEO of Dipped Products was Development Officer assisting Production Manager M.T. Weerabangsa, in running of Mawanella Block Rubber Factory and Crepe Rubber Factories, I was helping PM in respect of new developments.

After studying statistics and reports available from International Trade Center in respect of rubber, we concluded that rubber latex is the area we should start with, because we were exporting 30% dry rubber and 70% water when we were exporting rubber latex for importers to centrifuge the same and make latex based products.

So SRMC wanted to collect small holder latex again, around Eheliyagoda and convert into centrifuged latex using a centrifuge to be installed at Sunderland Estate and make rubber bands in a joint venture with Richard Peiris & Co. We had done feasibility studies on these when I left in 1978 and then plans changed, and Centrifuge was installed again at Mawanella Block Rubber Factory itself.

It was found that gloves for different applications ranging from domestic, surgical to industrial would be a better option and Hayleys moved in with Richard Peiris to form Dipped Products to make gloves. Ansell, Lalan and Richard Peiris and many others have entered this field of latex rubber-based industries and there may be others like ATG Gloves, etc. who would be making gloves using not only natural rubber latex.

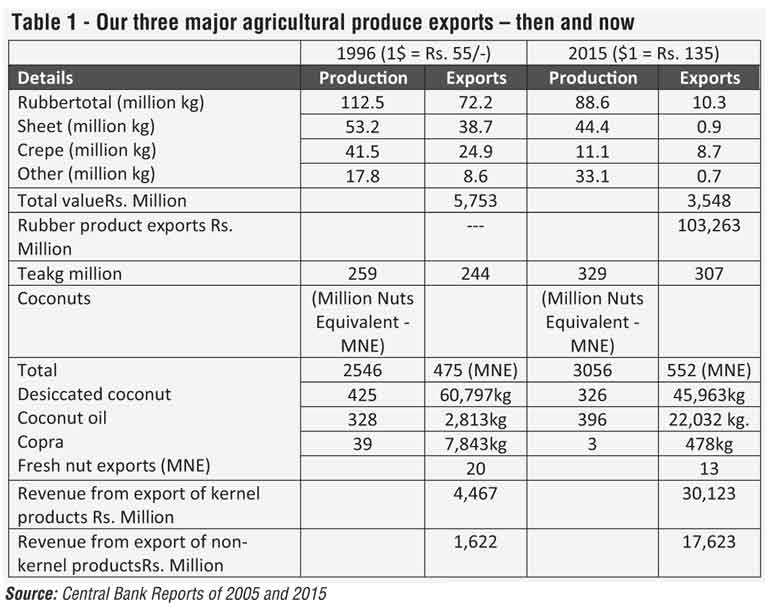

On the solid rubber side also there had been many developments towards value addition with Loadstar, Arpico, DSI, Ceat, Elastomeric and many others who would have joined recently. If we go by the Central Bank data, it shows that in 2015, we exported rubber based industrial products to the value of Rs. 103.2 billion, while raw rubber exports was only Rs. 3.5 billion. In 1996, our raw rubber exports was only Rs. 5.7 billion and there was no category called rubber-based products. A table with this data is given here.

Sri Lanka researchers not only did all this value addition, but they also started using rubber seed oil as accelerator in vulcanisation process. Rubber wood gets treated and furniture is made and remnants from this industry are collected and used to make plywood. When I left Haycarb in 1991, we had just concluded our research on activating rubber seed shell to be used as a catalyst for Merox Process in Ceylon Petroleum Corporation refinery. So, Sri Lankans had identified products to be made from everything belonging to the rubber tree except leaves which is allowed to fall on ground and become manure for the plantation itself.

A more relevant aspect that needs the attention of COSTI and people like Prof. Alwis is ensuring continuing availability of rubber latex for all these exports in a scenario where entities might resort to maximising more immediate returns from rubber tree wood and facilitate increased production of polyurethane foam mattresses elsewhere. Such denial of rubber sap oozing out from trees for manufacture of carbon neutral or carbon negative rubber products like foam mattresses could be a blow to mankind planning desperately to overcome climate change.

Value addition in the coconut industry

Value addition in the coconut industry

If one looks at coconut industry again, value addition that had taken place is significant. Our export of the kernel itself is as desiccated coconut as Prof. Alwis has rightly mentioned. Then the shell is charcoaled and activated to be exported as activated coconut shell carbon or for use in locally manufactured purification units.

Then the fibre from the husk had been extracted in fibre mills for decades and exported for use in different cushioning applications. Some fibre get more value added and exported for a large number of applications some of which are even covered by patents.

Till 1989, the only product from the coconut which was not been exported was coir dust which was getting accumulated, for decades at the fibre mills. The mill owners were even prepared to get their areas occupied by the coir dust cleared by paying money. Both state sector entities, CEB and IDB, the private sector corporates Ceylon Tobacco and Haycarb were interested in converting this coir dust to briquettes to be burnt as fuel instead of firewood which was then about Rs. 1.50 per kilogram. Of course, HC wanted to convert it into a pelleted activated carbon after charcoaling.

None of them succeeded in drying coir dust from 90% moisture content to the required 20% level in a fashion which would make it profitable to use at Rs. 1.50 per kg. Then we at Haycarb managed to dry it with solar energy using an innovative method and export it to Australia, USA, etc. at Rs. 21 per kg (price of sugar at that time). It was probably the first time a Blue Ocean Strategy or Market Innovation was used to enhance the market potential of a Sri Lankan product.

And with that everything associated with the coconut has been made use of with significant value addition and you would not see any coir dust heaps at fibre mills today. Last year also it would have brought at least Rs. 2 billion as foreign exchange into Sri Lanka. Overall export values of coconut products are also given in the table.

A certain amount of coconut cream is also produced for both local consumption and export.

Value addition in the tea sector

Tea is the other major export commodity we need to consider. Here again significant value addition has been brought in. Today tea is exported as tea bags and there are tea preparations in tablet form. We also need to remember that some of our customers would like to do the bagging in their own countries. If there is anything where value addition is possible, it is to waste tea, sweepings, etc. Even this is made use of in manufacturing instant tea which basically consists of extracting the main ingredient in the tea into a liquid form and spray drying these to get different types of instant tea. In around 1997 or so, we provided ISO 9001 Quality Management Consultancy Services to this company.

We know of at least two attempts to repeat this in Sri Lanka. In the first attempt the factory met with a water related disaster and the project was abandoned. Subsequently another entity started a similar project and was either commissioned or about to be commissioned when a fire took place. This was a company which is well known for their safety requirements and regulations.

Sometimes I tend to wonder why both these attempts failed in bringing positive results. I could only think of two reasons – one related to a demand side threat anticipated by a global player. This is unlikely because one of these attempts was by an entity with such linkages. The second is a supply side threat and this could arise from entities who do not want this waste tea being linked to a new value addition route. I am sure that there are more knowledgeable personnel in the sector who could help in this value addition.

1977 Revolution and its spillover to industrial development

1977 was a year when we shifted to a market economy from being a semi-centrally planned economy and as a result some manufacturing companies went out of business. But the country started on a new growth trajectory and in came energy projects linked to the Mahaweli Scheme, Greater Colombo Economic Commission Project at Katunayake which opened up many medium scale projects. Foreign direct investments came in and the demand for cement also increased.

Ceylon Cement Corporation wanted to start a new project to make 3,200 tons of cement per day. Their existing capacity at both Kankasenthurai and Puttalam was only about 2,600 tons per day. It was planned to be put up at Puttalam and even the ground-work had been carried out and limestone availability studies were concluded. But in an environment where a lot of development activities was being done in the South – Mahaweli, GCEC, etc., the Government didn’t want to have the people in the North feel left out and so the Minister of Industries and Corporation officials decided to shift the factory to Kankasenthurai.

Kankasenthurai also had enough limestone of very high quality of about 98% CaCO3. It was planned from the very beginning to enhance local participation to the maximum extent possible. For previous cement plants, the kilns, liner plates, grinding media were imported and waste gas fans, precipitator fans were all imported; but the corporation management under guidance of the Minister and Chairman decided to get the designs for these items from KHD Humboldt Wedag of Germany and fabricate them locally.

I, as the Deputy Works Manager at Puttalam, handled the projects to establish (i) Plate Bending Machine to make the Kiln at KKS and (ii) Arc Furnace to make liner plates and grinding media at Puttalam. We wanted to do sub-contracting in respect of Kilns and these items for other cement plants to be put up in the region. The management also wanted to promote workshops in the peninsula to fabricate the fans of different sizes to match the needs of the plants – the two existing plants with a total capacity of 1,200 tons per day capacity and the new plant of 3,200 tons per day capacity.

The corporation got a 55 MW Power Plant based on Gas Turbines and 60 room hotel approved for establishment in the Peninsula, and Kankasenthurai harbour to be modernised so that we could ship clinker from the new factory to the cement grinding plants at Ruhunu Cement Works in Galle. Then there were Precalciner Projects at both Puttalam and Kankasenthurai and these were the first two projects then new National Development Bank funded. Existing kilns were to be converted to coal firing from oil firing and electrostatic precipitators to be modernised to give better performance with conditioning towers to humidify the gases coming from the kilns.

If all these projects were allowed to be implemented, Jaffna peninsula would have been different and Sri Lanka would have been different. So was that decision to shift 3,200 tpd modern cement plant from Puttalam to Kankasenthurai to demonstrate our eagerness to develop Jaffna Peninsula wrong and if it had not been moved we would be having that plant even today.

Mahaweli Projects succeeded and yielded results, Colombo Port projects succeeded and yielded results, GCEC project succeeded and yielded results and there was no reason why that 3,200 tpd cement project, if implemented at Puttalam would not have yielded desired results. At least it would have saved the Project Manager of Lanka Cement, W.D. Jayamanne and C. Gajanayake Manager-Finance for Sri Lanka to benefit from. It was these two gentlemen who got killed and burnt in Kankasenthurai.

While Sri Lankans were the losers as a result, somebody else manufacturing either cement or only clinker elsewhere were the winners as it is this cement or clinker which is brought in and marketed in Sri Lanka.

The only blunder

I personally believe we have played our cards to the best of our abilities, excepting one blunder which unfortunately involved the biggest-ever process engineering plant planned and executed successfully in Sri Lanka. It is the Fertiliser Manufacturing Corporation’s Urea Project, the biggest project ever implemented in Sri Lanka. The project was a $ 140 million project then to make 940 tons per day of urea from Naptha. We were producing some naptha in our refinery and the plan was to subject it to steam reforming (using water to make steam) and capture nitrogen from the local atmosphere to get (NH2)-CO-(NH2). One could see that as long as we use local naptha, we don’t need to import any other raw material.

This project was not attractive to the new UNP Government. Funding agencies offered very attractive grace periods, but still we wanted to sell it for a nominal amount. SFMC Executives used to blame the Finance Minister for selling this factory to Pakistan – that blame may be mainly due to his daughter been married to a Pakistani gentleman. Again, the suppliers of urea to Sri Lanka may have had a say in all this.

So, during that period we lost this urea factory which would have supplied urea for our agriculture, existing cement factory in KKS doing 1,200 tons per day, constructed and due to be commissioned 3200 tpd cement plant and 55 MW power plant. And, of course we brought in so many apparel factories, tourists. I am not adequately qualified in macroeconomics to carry out a complete cost-benefit analysis; but may I only comment that whatever we intend to indulge in to-day should be something which do not have existing competitors nor interested parties near us.

Although there had been no visible industrial development in way of chemical factories put up, etc., there had been enough of them in the newspapers. My mind goes back to late 1970s when a front page news item was about the plans of Freeport-Mcmoran, formulated to explore our Eppawala phosphate reserves, put up a large Triple Phosphate Plant at Trincomalee and export it. It died a reasonably early death. Then there was a news item about a patent obtained by SLINTEC to add value to the phosphate from Eppawala and that patent had been purchased by a fertiliser manufacturer in India. Yet another news item was about a patent on the manufacture of Titanium Dioxide from our own mineral resources in Sri Lanka and we are yet to see any results from these.

Only possible industries

So, all this implies that we should start industries which do not involve too many current participants. And we are fortunate that right now there are such industries arising from mankind’s interest to avert disasters arising from climate change. Mankind is promoting green industries and even the UNEP promotes the establishment of a green economy where energy and transportation sectors would involve nearly $ 1 trillion per year of investment in new green products. So, we need action before somebody in the region starts disrupting our plans, this is the way to go and we can straight away think about Battery Electric Vehicles to eliminate our dependence on imported oil.

There aren’t enough manufacturers world-wide and we should be able to establish some assembly plants, do research on lithium batteries and establish an incubator for green industries in Sri Lanka, etc. To generate the necessary electricity for these vehicles, Highway Solarisation will be the obvious choice and we may be able to export this technology and it, of course, depends on how we present it. What we need to remember is that we are looking at the two sectors – energy and automobiles – which are right at the top of the Fortune 500 Global List and we are talking about two new products which are still in the infancy and hence the possibility of a current player upsetting our plans is reasonably remote. The balance is action, action and action before somebody in the region starts disrupting our plans.

In spite of writing all this about what has happened in the past, the more important thing is to plan and implement what could be done for the future generations. The future provides enormous opportunities. As I always say do not worry about whether climate change is real or not; do what you can do to mitigate and adapt to it. If it comes you could be happy that we have done something and benefit from it. If it does not still, we would have had our normal revenue and benefitted.

(The writer is Managing Director, Somaratna Consultants Ltd.)