Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 24 April 2018 00:00 - - {{hitsCtrl.values.hits}}

The present regime came to power three-and-a-half-years back. People voted in the hope of realising the progress that was promised, namely minimising corruption, better economic development, establishing law and order, better media freedom, upholding democracy. The most influential single word they used during their election campaign was Yahapalanaya (Good Governance). The majority of the country wanted a Yahapalanaya and as a result they came to power.

Did the present Government manage to fulfil the aspirations of the people who voted for them? Freedom of information and freedom of expression, law and order situation in the country has improved to some extent. However in all other areas there is no improvement or below the previous level. In general people call this is bad to worse. As the citizens of this country, what is the way forward for our future? Let’s analyse the situation from the end of the previous regime to date and see where we are doing wrong.

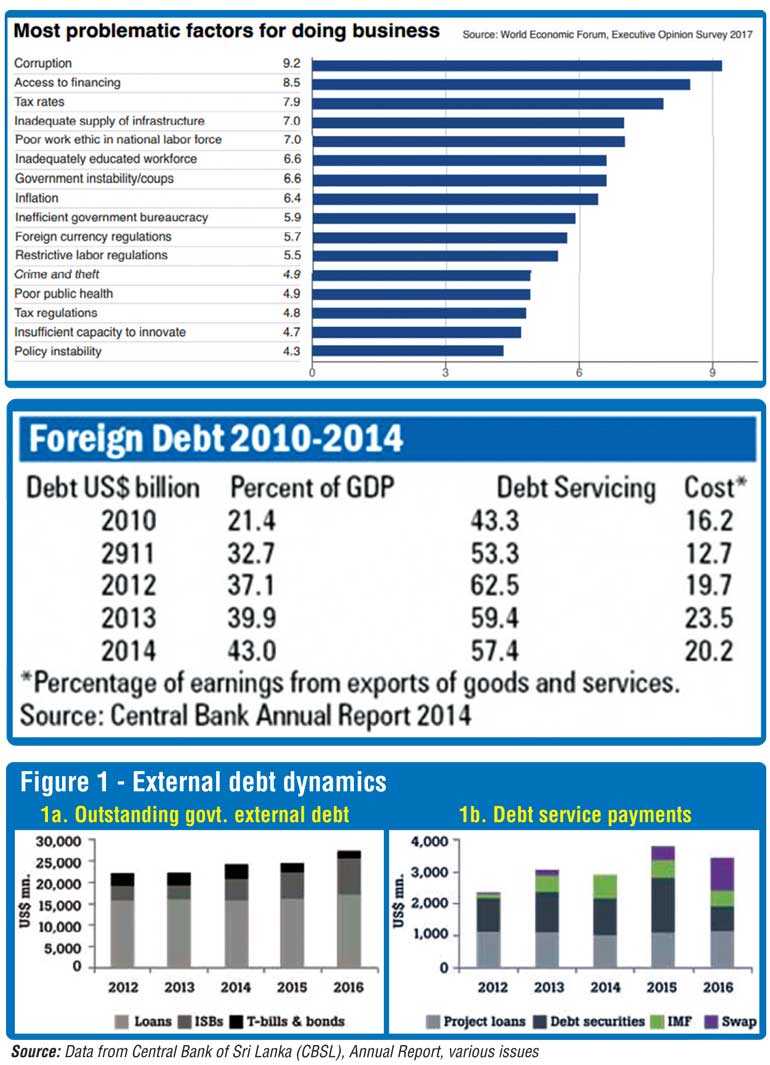

Start of the foreign debt

At the end of March 2015, the overall volume of foreign debt reached $70 billion or nearly five times of Government revenue while debt repayment is almost equal to the revenue. The country came almost to the debt crisis. If Sri Lanka actually faces a debt crisis this will be very disappointing for a country that is known to be self-sustained during the time of the kings.

The complaint for the previous regime was that they have taken too much foreign loans for various projects which have no priority need or benefits to Sri Lanka, mismanagement of borrowed funds and corruption. The people of Sri Lanka were waiting for this regime to do the right thing by following Yahapalanaya which they have promised to the people. However the people’s expectations were never realised. The present regime too has various allegations starting from the Central Bank bond scam to corruption and misuse of funds of State-Owned Enterprises.

Becoming a foreign debt crisis

The Sri Lankan economy appears to be trapped in a growing debt overhang. The figures released in the Central Bank Annual Report 2016 indicate that total general Government external debt has grown by 10% in 2016 to $27.2 billion. Even averaging out for 2015-2016, annual debt growth was 6.2% compared to 4.5% in the preceding two years.

As it is the total amounts paid from 2014 – $ 1,442 million, 2015 – $ 2,031 million, 2016 – $ 1,828 million, 2017 – $ 2,417 million and the total amount should be paid (estimated) in 2018 – $ 2,564 million, 2019 – $ 3,992 million, 2020 – $ 3,463 million. According to the actual figures and estimated figures 2019 -2020 going to be really hard for Sri Lanka.

Multilateral lender cautioned Sri Lanka

The Asian Development Bank at the release of the Asian Development Outlook for 2018, the Asia focused multilateral lender cautioned Sri Lanka on the risks emanating from potentially unexpected large rise in global interest rates and the volatile capital markets, which could sharply limit the planned borrowings and increase their cost.

The warning from the development lender comes at a time when the country has a $ 22 billion foreign debt repayment during 2018-2024 and $ 4.2 billion due in 2019 is a mounting task from a $ 82 billion economy.

Survival strategy

What is the way out from this debt crisis? The theoretical way out is to improve the export earnings, improve the local production which can substitute imports, reduction of imports and attract foreign investments.

Export potential/imports

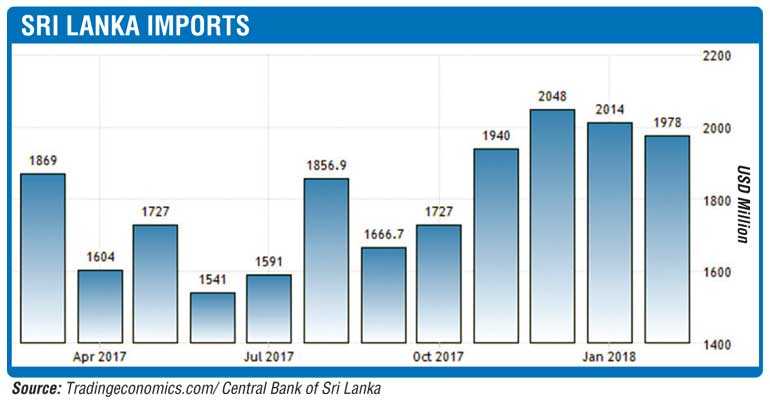

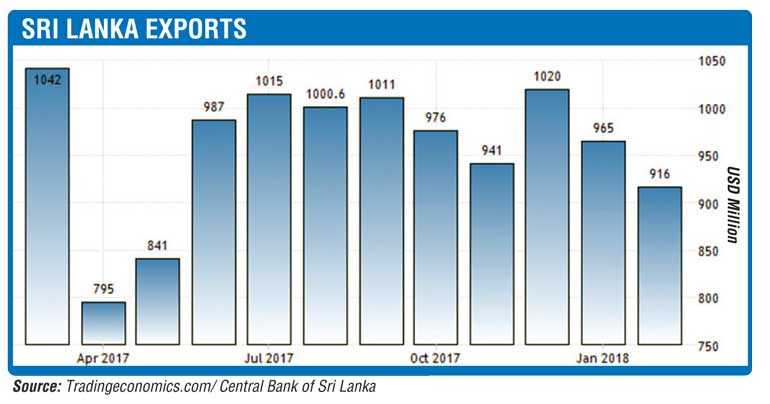

We are somewhat lucky in this area due to the improvement of garments and some of the other value added product exports to the global market. From last year there is an improvement of exports compared to the last few years. Gaining the GSP plus and managing to remove the fisheries ban has lot of potential to improve the garments and fisheries products exports to the global market. We are not using the best potential of fish product exports having the sea all around our island. If there is a clear strategy and an action plan the growth can be tremendous.

Imports has gone up a little and there is a tendency that we have to pay more in the future for fuel and some of the other manufactured products which we are importing to Sri Lanka. When we compare the import export situation the excess income we earn from exports will have to spend for the items we are importing to Sri Lanka.

Improvement of the local GDP

The economic growth of the year 2017 was only 3.1%. The future perditions will depend on the political climate and election approach subject to have a good weather condition expected growth will be around 6%. This shows there is no proper attention to the local industries or the local agriculture which can control the imports to some extent and bring benefits to the economy and improve the Gross Domestic Product. The growth of 3.1% is very unsatisfactory given the fact there are large scale constructions still in progress in a big way. If that part removed from the growth rate % the real growth is very minimal.

Foreign Direct Investments (FDIs)

In the area of Foreign Direct Investments, it is vital to have a short, medium and a long term clear policy which can attract the foreign investments. It is evident the foreign investors will come to a small country like Sri Lanka to produce and sell the products in the global market. The large global companies will not have any interest to produce for a small economy of 22 million people in Sri Lanka.

The Government in power as well as the successive Governments also should continue the commitments made by the country. This is the only way we can gain the confidence of the foreign investors. There should be a clear predictability of the medium and long term for the investor to recover their investment. (Return on investment- ROI)

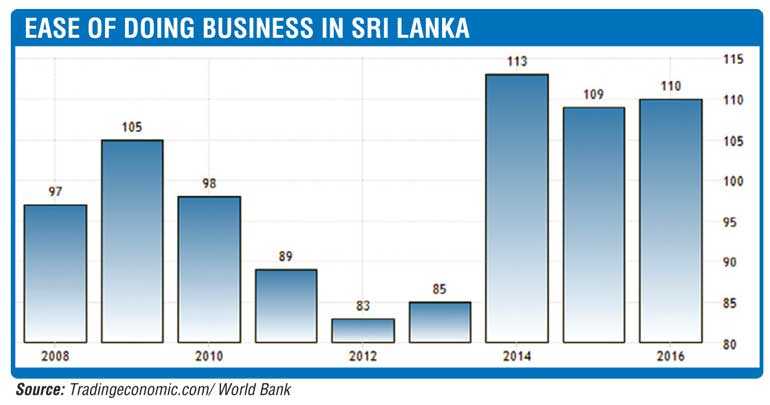

Ease of Doing Business

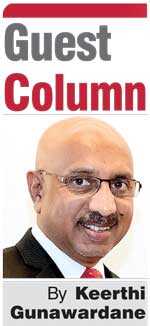

In addition all the investors will look at the ease of doing business statistics of a country before they invest. The following chart will give you the Sri Lanka’s rating which will be not lucrative to the investors. From a ranking of 83 in 2012, Sri Lanka has slipped to the 111th position in the 2018 Ease of Doing Business ranking by World Bank.

Promoting Foreign Direct Investments to Sri Lanka is very challenging. Ease of doing business we have not improved at all and some of the areas we have gone down. Approvals, time consumption for the approvals and processing time has never improved.

(The writer is an Economics Hons Graduate from the Sri Jayawardenepura University, Immediate Past President of the International Chamber of Commerce and the Vice President of the Federation of Chamber of Commerce and Industries Sri Lanka.)

There are examples of global brands decided to start business in Sri Lanka but due to the long process for approvals, corrupt officers and politicians they decided to move the businesses to other countries. Once we lose such opportunities it is very hard to create a good name and bring them back. Most of the countries in Asia improved their ratings over the years however Sri Lanka still seriously lagging behind. The following statistics are evident we are not doing well.

WTO Trade Facilitation Agreement

After Sri Lanka signing the WTO Trade Facilitation Agreement we are committed to improve our status to make a business friendly country. Sri Lanka has a firm commitment to the World Trade Organisation after ratifying the agreement 31 May 2016.

The charts show the most problematic factors for doing business 2017 by the World Economic Forum and Ease of Doing Business rank in Sri Lanka from 2008-2016 out of 190 countries in the world.

Opportunities in Sri Lanka

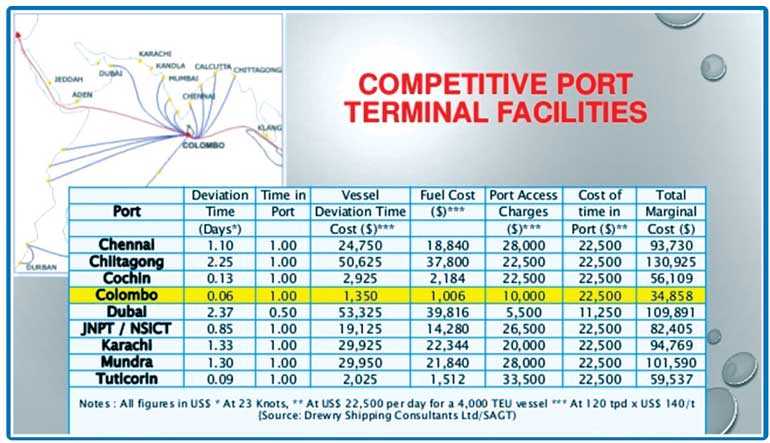

After a study of all the strengths and weaknesses of our economy, the Global Alliance for Trade facilitation found port handling charges in Sri Lanka were very competitive in this region. This create a good opportunity for Sri Lanka to establish a multi-country consolidation hub.

They as a team agreed to talk to other Global Alliance Partners, some of the global businesses, investors about the opportunities of this project and convince them to invest. However from the Sri Lanka Government side still the progress is very slow. Hope this will not be a lost opportunity for Sri Lanka among many of them.

Benefits of the proposed project

nBoosting SMEs exports by providing huge additional transportation capacity and improved connectivity at a competitive price;

nUnlocking significant Foreign Direct Investment by international private sector companies in the form of logistics facilities;

nIncreasing Sri Lankan ports’ ability to bring in more foreign exchange by assisting the country to further develop Colombo port from being mainly a transhipment port towards becoming a centre for value-added logistics services;

nGenerating employment for an industry that is labour intensive.

In addition to the above benefits the a multi-country consolidation hub would respond directly to a broad range of TFA commitments, including expedited shipments (Article 7.8), temporary admission of goods (Article 10.9), as well as freedom of transit (Article 11) and Authorised Operator (Art. 7.7).

Opportunities for FDI

Global investors have a variety of choices among the countries inviting them to their respective countries, especially the lucrative Asian countries, newly-developing African countries and Middle Eastern counties. If we miss the opportunity once, it will never come to us again. Because of this reason as a country all the citizens should be patriotic and work for the development of the country rather than supporting short term political agendas presently taking the priority.

At a recent forum on good governance in public enterprises, Speaker of Parliament Karu Jayasuriya mentioned the lack of good governance killing public enterprises. He further stated the economy continues to fall victim to nepotism, which taxes the nation in terms of income and productivity. He said there continues to be a lack in professional management of public enterprises. There have been many political appointments at top level and he said the chairmen and those sitting on the boards should be dynamic people, who are well-versed on the enterprises.

If the lack of good governance is killing the public enterprises and already there are bad/inefficient people sitting on the boards due to political appointments, why we are not taking immediate corrective steps? Who should do this? Again, it is the politicians. We as the citizens of this country request major political parties in action not to kill public property anymore, please stop this – especially at the most dangerous time when we have to pay off so much debt.

At this same event Auditor General Gamini Wijesinghe highlighted the need to establish a holding company to address complex administrative governance issues of public enterprises in Sri Lanka. He addressed the issue of Sri Lanka suffering heavy financial losses due to mismanagement at SriLankan Airlines and coal power generation projects commissioned in Sri Lanka over the years.

It is evident from the above statements by the Speaker of the Parliament and the Auditor General that even the present regime has not done what they have promised and there is no Yahapalanaya in action. As the Auditor General mentioned, it is not only SriLankan Airlines and coal power generation projects; all of us know the list is very long. Can we afford such huge losses to the public?

All the heavy taxes paid by the citizens of Sri Lanka direct and indirect are wasted to maintain corruption and corrupt officers in public enterprises. There should be an end to this soon for us to move forward as an honourable nation.

(The writer is an Economics Hons Graduate from the Sri Jayawardenepura University, Immediate Past President of the International Chamber of Commerce and the Vice President of the Federation of Chamber of Commerce and Industries Sri Lanka.)