Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Monday, 17 August 2020 00:25 - - {{hitsCtrl.values.hits}}

They have been on a blame game charging their political rivals for indebting the nation to foreigners, whereas they themselves have been responsible for committing that crime when they were in power – Pic by Shehan Gunasekara

Two popular fallacies about foreign debt

It appears that all Sri Lankan governments in the past and the one in power today have taken the country’s foreign debt crisis lightly. They have been on a blame game charging their political rivals for indebting the nation to foreigners, whereas they themselves have been responsible for committing that crime when they were in power.

There are two indicators which they use to frighten people and in return earn their sympathy. One is the amount of debt falling on each citizen – called per capita debt – arrived at by dividing the total debt stock by mid-year population. The other is the increase in the rupee value of the debt stock due to depreciation of currency. Both numbers are rising year after year giving each political party a chance to blame its rivals. However, both these arguments are fallacious.

Per capita debt is a fallacious indicator

Per capita debt will become a real burden if and only if the entirety of foreign debt is to be repaid in one year. In that case, each citizen has to make a sacrifice immediately at the cost of his personal consumption or investment today. But Sri Lanka’s debt maturity profile is long term and the actual burden falling on each citizen is only the share of debt servicing – that is, commitment to repay the principal and pay interest on the debt – and not the total debt stock. In Sri Lanka’s case, that is about 10% of the total debt stock.

Government is a net beneficiary of currency depreciation

As for the depreciation of currency, the government is a net beneficiary of falling exchange rates. Though it is true that the rupee value of the annual debt servicing increases after the currency is depreciated, the additional amount it has to pay in rupee terms is much less than its gain due to the valuation of imports and government’s foreign borrowings at a higher exchange rate. For instance, in 2019, if the rupee depreciates against the US dollar by Rs. 1, the rupee value of the debt servicing would go up by Rs. 4 billion. But the government’s additional rupee income by way of import duties and loan proceeds had amounted to Rs. 6 billion, making the government a net beneficiary of the depreciation of the rupee.

Need for taking a realistic view of the burden

These numbers are not presented to make a case of currency depreciation. Rather, they are presented to show that the argument of the critics is fallacious.

As long as political leaders cling on to these fallacious arguments, they are not in a position to correctly diagnose the ailment and introduce the necessary remedial measures. Longer a country postpones introducing necessary remedial measures, much deeper it would get itself in the crisis in hand making it difficult for the country to escape the hard realities of being indebted to other nations.

Foreign debt involves a resource inflow and outflow whereas domestic debt doesn’t

This is because in the case of foreign debt, a country gets a benefit when it receives the proceeds of a loan. People in the rest of the world have sacrificed their current consumption, saved money and enabled the borrowing country to have a higher consumption or investment in the current period. But when the debt is to be repaid or interest on it has to be paid, the borrowing country has to make a similar sacrifice. If this sacrifice is too much, then it becomes a burden. In the case of domestic debt, a country does not face a similar situation. At the time of borrowing, savers give their savings to the government which in turn gives it back to people by way of government expenditure. Hence, there is no change in the country’s total consumption levels. At the time of repayment or payment of interest, people pay taxes to government that causes a reduction in their consumption. But when the government spends that money, they get it back as the whole society. Hence, domestic debt is normally categorised as ‘We owe it to ourselves’ meaning there are no outside creditors holding their guns at our throat to get their money back.

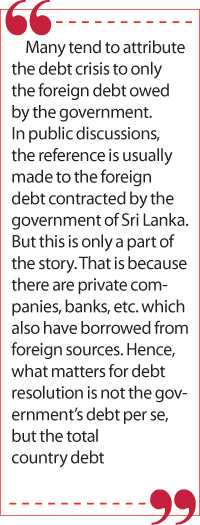

It is the total country debt that matters

Many tend to attribute the debt crisis to only the foreign debt owed by the government. In public discussions, the reference is usually made to the foreign debt contracted by the government of Sri Lanka. But this is only a part of the story. That is because there are private companies, banks, etc. which also have borrowed from foreign sources. Hence, what matters for debt resolution is not the government’s debt per se, but the total country debt.

Total debt in 2019

For instance, at end-2019, the government had borrowed a sum of $ 35 billion from foreign sources. As at the same date, the private sector had borrowed $ 21 billion, making the total country foreign debt a staggering US$ 56 billion which amounted to 66% of the country’s GDP. Sri Lanka has to repay all these loans as and when they mature and pay interest on them annually. For this, it needs foreign exchange. Since there is a deficit in the current account of the balance of payments of the country, foreign exchange for debt repayment should be found by making further foreign borrowings or using the country’s existing foreign reserves. In the next twelve-month period, the total debt repayment commitment of Sri Lanka will be $ 5.6 billion. Since the available liquid foreign reserves amount only to $ 6.6 billion, the only option available for Sri Lanka to meet its debt repayment obligations is resorting to further borrowing. But it would worsen the country’s woes and will snare it in an inescapable debt trap.

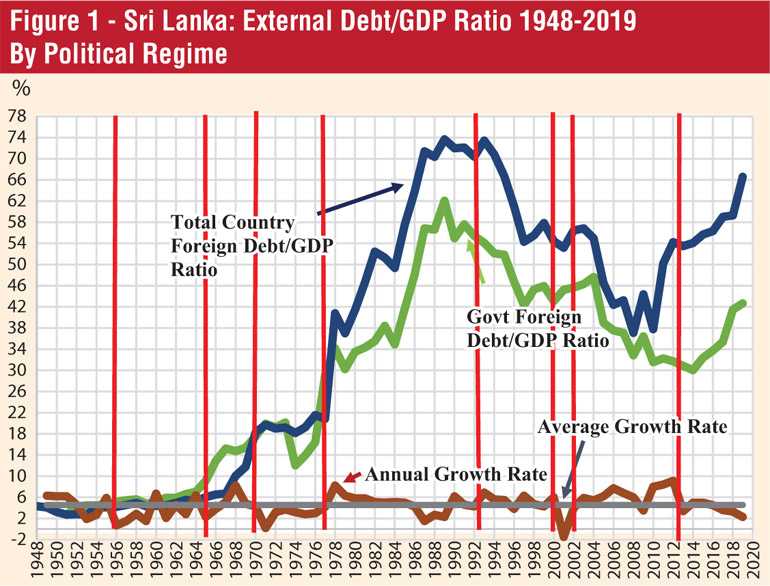

At independence, foreign debt was insignificant

All Sri Lankan governments since independence have contributed to the build-up of foreign debt by the country. In 1948 when it gained independence, Sri Lanka’s foreign debt was negligible at 4% of GDP. This was not a problem at all because the British had inherited Sri Lanka when they left the country a massive amount of foreign assets sufficient for paying for 17 months of imports in the following year. But over the years as shown in Figure 1, foreign debt has increased both in amount and as a share of GDP, while the foreign assets have fallen sharply making the country vulnerable to unexpected external payments.

In some years like early 1970s, 1989 and 2007-8, foreign asset adequacy was as low as less than two months of future imports. Today, Sri Lanka’s average foreign asset level is about four months of future imports but it has basically been built by borrowing from abroad rather than earning via the export of goods and services. Furthermore, of the total amount of foreign assets of about $ 7 billion, the liquid cash available for making a ready payment is about $ 6.6 billion. This has to be viewed against the total foreign debt repayment obligations of about $ 5.6 billion in the next 12-month period. If foreign assets are used to meet these obligations, the country will not have enough foreign exchange to buy oil, medicines and raw materials for industries. This is the nature of the crisis which the country is facing today.

Borrowings are needed when savings are paltry

Sometimes, the question is posed why Sri Lanka should borrow abroad to finance its domestic development works. Why can’t Sri Lanka do without it? If for example King Parakramabahu I could build giant reservoirs and other irrigation schemes without borrowing from abroad, why Sri Lanka could not do the same today? Surely, Sri Lanka can finance its domestic development works without borrowing from abroad if it makes enough savings locally. The problem with Sri Lankans is that they are notorious spenders and poor savers. For instance, on average, a Sri Lankan spends about Rs. 80 out of an income of Rs. 100 on consumption and saves only Rs. 20. This Rs. 20 is insufficient for it to meet the high investments that would generate prosperity to Sri Lankans. The problem is further worsened because the government is a dissaver. When it receives Rs. 100 as income, it normally spends Rs. 102. Hence, it has to necessarily use the savings made by foreigners to meet the gap between the required investments and available local savings.

King Parakramabahu I and his surplus budget strategy

As for King Parakramabahu I, there was no need for borrowing abroad to finance the local development works for two reasons. First, the budgetary policy adopted by all Sri Lankan kings was that of surplus budgeting. Kings were advised to build treasuries full of resources because that was a symbol of his power. To build such treasuries, they should spend less than what they have got as revenue, gifts or expropriations. The resultant surplus enabled them to undertake massive development projects or meritorious works.

Inclusive tax policy of ancient Sri Lankan kings

The second reason was the high and inclusive taxation policy adopted by all ancient kings. People had to pay income tax not by using money which was in short supply at that time but by providing free labour services to the king under a system called Raajakaariya or compulsory royal service. This is similar to the polls taxes which some governments impose on their citizens today. Under the polls tax, all able-bodied persons have to pay a tax to the government simply because they have a body. Similarly, under the Raajakaariya system, all able-bodied people had to provide free labour to the King for three months and it was similar to an income tax of 25% levied on people. In addition to this, taxes paid by farmers were even higher than 25% of their annual crop values. Overall, people were paying taxes of more than 50% of their income to the king and therefore, kings did not have to borrow abroad to finance domestic development works.

Therefore, in today’s context, there is nothing wrong in borrowing abroad to finance local development works if the available domestic savings are inadequate. However, a crucial requirement in doing so is the adoption of prudential measures to use such borrowings and ensure their repayments.

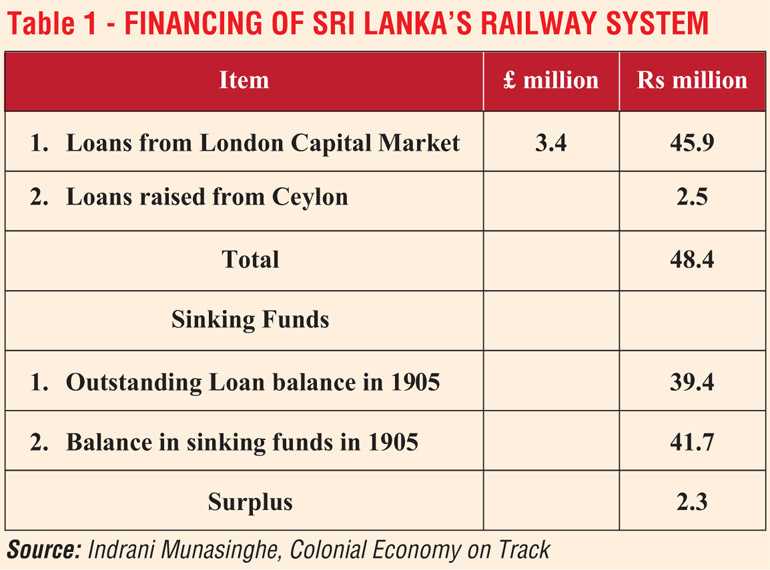

Financing Sri Lanka’s railway system by borrowing

A good example is the financing of Sri Lanka’s railway system by the colonial masters. Many in Sri Lanka who use the railway services today are unaware that almost entirety of the capital cost of the development of the system was financed out of borrowings from the London capital market by issuing Sterling debentures at interest rates ranging from 3% to 6% by tapping the savings of British savers. In addition, to meet the local expenses, a small sum was borrowed from local sources too. Altogether £ 3.4 million from London and Rs. 2.5 million locally were raised by railway authorities to finance this project.

However, the Colonial Secretary had imposed two conditions for these borrowings. One was that the loan proceeds should be used only for the railway project and nothing else. The other was that to ensure repayment of these debentures, the railway authorities should build up a sinking fund out of the annual surpluses in the railway system. Accordingly, as reported by Indrani Munasinghe in her Colonial Economy on Track and presented in Table 1, by 1905, the total value in the sinking funds amounted to about Rs. 41 million. The outstanding loans as at that date were only Rs. 39 million. What this meant was that the burden of repaying loans raised for the railway project was shouldered by the users of the system, mainly British planters who used it to transport their produce to Colombo for exportation and passengers of the railway system who used it.

The abolition of the sinking fund system

During the colonial times, even the government borrowings were supported by the building-up of sinking funds in this manner. After independence, Sri Lanka government continued with this prudential practice till 1984 and its objective was to get the current taxpayers to bear the burden of repaying government’s borrowings. But this required the government to allocate every year a sufficient amount out of its budget to the sinking funds maintained in the Central Bank. However, by mid 1980s, the government had considered it as an additional burden and therefore decided to abolish the sinking fund scheme. As a result, today, the burden of repaying the country’s foreign (as well as local) borrowings are being passed on to the future taxpayers. It amounts to the present generation selfishly passing the burden of their high borrowings today on to their children and grandchildren.

The growing debt crisis

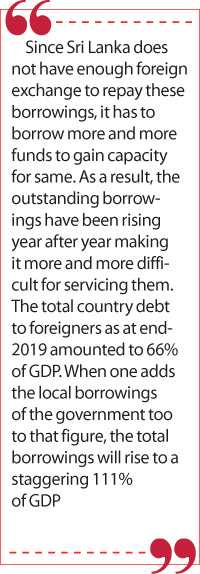

Since Sri Lanka does not have enough foreign exchange to repay these borrowings, it has to borrow more and more funds to gain capacity for same. As a result, the outstanding borrowings have been rising year after year making it more and more difficult for servicing them. The total country debt to foreigners as at end-2019 amounted to 66% of GDP. When one adds the local borrowings of the government too to that figure, the total borrowings will rise to a staggering 111% of GDP.

There are some Sri Lankans who have been arguing that this is not a burden compared to countries like USA and Japan whose borrowings have been more than Sri Lanka’s debt to GDP ratio. This is a fallacious argument because all these countries have borrowed in their own currencies and therefore are in a position to repay those borrowings by printing their own currencies just like Sri Lanka government can print rupees and repay domestic loans if the tax revenue is not sufficient to repay the same.

Repudiation of debt is unwise

Some others also suggest that Sri Lanka should default these loans at this stage. This is also not a prudential strategy. Countries like Vietnam, Cambodia and Laos wrote off their foreign loans in early 1970s but it caused these countries to be isolated from the rest of the world. Only after three decades they have corrected their previous mistake and became respectable members of the global economic community.

Sri Lanka should indicate to the rest of the world that it will be with the rest of the economic community. As an indicator of its good intentions, it should immediately start negotiating with the creditors to have these loan repayments postponed at least for two years as Ecuador has done recently. Then, as a medium to long-term strategy, it should go for improving its foreign earning capacity by promoting the export of goods and services through the introduction of high technology. Sri Lankans are presently sitting on a volcano that might erupt at any time. To evade the inevitable, perishing, they should work hard, create wealth and be ready to make the maximum sacrifice possible. That is the responsibility of Sri Lankans today.

Political leaders should tell this truth to the people instead of playing the more convenient blame game on their political rivals.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)