Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 6 June 2018 00:00 - - {{hitsCtrl.values.hits}}

KPMG released its fourth annual Global CEO outlook 2018 in early May. This landmark survey reached 1,300 CEOs of the world’s largest companies in 11 countries covering 11 key industries. Global CEOs were asked challenging questions not only about the corporations they run but global perspective of the future economy, opportunities and trends.

KPMG released its fourth annual Global CEO outlook 2018 in early May. This landmark survey reached 1,300 CEOs of the world’s largest companies in 11 countries covering 11 key industries. Global CEOs were asked challenging questions not only about the corporations they run but global perspective of the future economy, opportunities and trends.

Today’s CEOs face more daunting challenges than their predecessors. They see a world that is changing rapidly where dynamic changes are happening to business drivers, risks and disruptions. To be a CEO today means facing profound business challenges, transformations, opportunities, professional and personal tests.

This survey by KPMG had to deal with the sheer volume and depth of national, global business issues CEOs face in their day-to-day jobs.

Key findings

Ninety per cent of the CEOs are confident in their company’s growth prospects and 67% are confident in the growth prospect for the global economy, 55% said that they predict a pragmatic cautious growth of less than 2% and finally 52% of the CEOs says that they need to achieve growth targets before hiring new skills.

However, CEOs’ optimism is tempered by greater anxiety about existential threats. They are having to manage their exposure to three primary headwinds: geopolitical volatility, cyber security risk and demographic shifts.

After many years of widespread international consensus on globalisation, the potential withdrawal from trade agreements by some developed countries and the UK’s decision to exit the EU show that nationalism is now on the rise. For CEOs, a more nationalistic approach to trade is worrying: a ‘return to territorialism’ is their number one threat to growth.

Regionally the outlook of risks and threats are different. Interestingly, there are some notable differences at a country level on the risk landscape. In the US, where organisations are charging ahead with their digital agendas, cyber is the number one ranked growth risk. And, as China undergoes sweeping changes to tackle pollution issues, Chinese CEOs are making environmental/climate change risk their top concern.

How prepared are the global corporations for a cyberattack?

According to Dani Michaux, Head of KPMG Asia Pacific’s Cyber Security practice, “Cyber security has become a mandatory boardroom topic, particularly as governments and regulatory bodies increase their scrutiny,” and continues by saying, “No matter what industry you’re in, data is the lifeblood of modern business.”

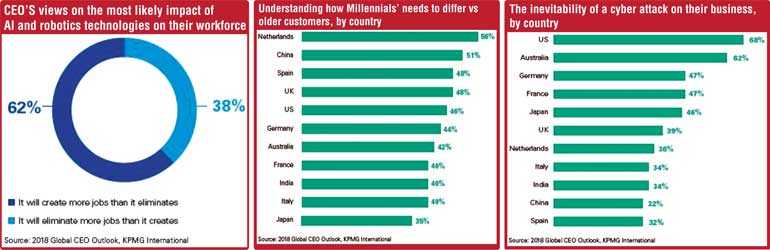

At the same time, greater connectivity brings increasing cyber vulnerability, and about half of all CEOs (49%) say that a cyberattack is now a case of ‘when’, instead of ‘if’.

“The challenge is to constantly be ahead of the cyber criminals — a task which is very difficult to achieve,” says Ali Ahmed Al-Kuwari, CEO of Qatar-based QNB Group, the largest bank in the Middle East and North Africa region.

While cyber security used to be considered an issue primarily for the IT department, these days it is a permanent agenda item for the entire Board, where all are responsible for. CEOs are concerned about the robustness of their defences. Only about half of CEOs (51%) believe they are well-prepared for a cyber-attack.

KPMG’s Michaux agrees that cyber vigilance has moved up the agenda. “No matter what industry you’re in, data is the lifeblood of modern business,” she says. “Smart leaders are making cyber preparedness a board priority, stress-testing the resilience of their systems and people to withstand an attack. Businesses are also looking for a competitive edge from this investment and the increased insight they get on their systems and data.”

Robust cyber defences are also critical to building trust. Over half of CEOs (55%) said that a strong cyber strategy is critical to secure key stakeholders’ trust. This indicates that cybersecurity is a major concern for CEOs. Many leading organisations realise that their businesses are far from secure from attacks. In the future all these global corporations will have to have a futuristic strategy, trained staff and funds to be ahead of the cyber criminals.

Changing trends and Millennials – Who are Millennials?

To drive long-term growth, organisations often need to appeal to consumer markets of the future. Millennials represent significant spending power, but they are engaging with organisations and brands in new ways and businesses need to make sure they are in sync.

Anyone born between 1981 and 1996 will be considered a Millennial. They range in the age group of 22-37 in 2018. This powerful group is also called the Y generation.

Millennials grew up in an electronics-filled and increasingly online and socially-networked world. They are the generation that has received the most marketing attention. As the most ethnically diverse generation, Millennials tend to be tolerant of difference. Having been raised under the mantra “follow your dreams” and being told they were special, they tend to be confident. They are often seen as slightly more optimistic about the future than other generations.

The survey finds that many CEOs are concerned that their businesses are not keeping up. Asked about the key challenges of meeting Millennials’ needs, 45% of CEOs say their organisation struggles to understand how the needs of this generation differ from those of older customers. Over a third believe they need to reposition their brand. Dutch companies are the most likely to be focused on the challenge, while Japanese companies see this as less of a challenge.

Carmen Bekker, Partner with KPMG Customer Brand Marketing Practice, is of the view that “organisations that listen to Millennials will see that they respond well”. She also believes that the “Millennials want to feel that what’s important to them is also important to the organisation they are dealing with. Tomorrow’s successful organisations will listen, think about what their corporate and brand values are, and ask if they are aligned with the values of Millennials and future cohorts.”

Understanding new generations is also about empathy with the values they consider important, such as sustainability. “Millennials have often a clear philosophy on this,” says Feike Sijbesma, CEO of global science-based company Royal DSM. “They really want to do something meaningful with their lives. They want to make an impact, and they see sustainability as a key element of this. You will only continue to be successful if you adapt and make your company future-proof. Today Millennials are now the fastest-growing category of US car buyers.”

Realistic growth

Many of the world’s major economies are experiencing positive growth momentum and CEOs are optimistic about the next three years at the global and national level, while we see broad confidence across most of the world’s largest economies, there has been a drop off in confidence for some of the European powerhouses notably the UK, Germany, Spain and Italy all experiencing political turmoil during the past 12-18 months.

The majority of CEOs (55%) expect conservative topline growth of less than 2%.

Lately trade protectionism has raised its ugly head. In the past Western nations espoused free trade and encouraged globalisation, however, such proponents seems to have taken a back seat and it is the developing and emerging markets that are striving for free trade and open for further liberalisation in trade.

CEOs’ concerns about the headwinds they face, particularly the return to territorialism that tops their growth risks. It could also reflect the difficulties of driving growth from new digital business models and revenue streams. As traditional products and services become obsolete, and CEOs work to make their portfolios relevant to the digital age, it will take time to replace historical revenue streams.

“The CEOs we’re advising have realised that topline revenue growth is no longer the most important measure of success in the digital era,” says Mark A. Goodburn, KPMG’s Global Head of Advisory. “They are focused on how they can achieve better profitability: investing in technology and their people and looking at different business models. These CEOs recognise that success is achieved with a stronger products and services portfolio profitability.”

Over 52% say they will not hire new skills until growth targets are met.

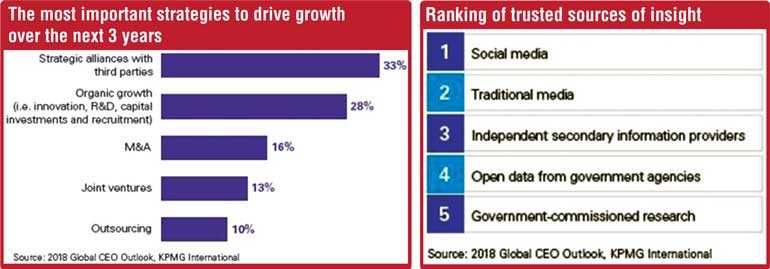

The rate at which technology is evolving adds complexity to decisions around hiring strategy: CEOs need to achieve the right balance of reskilling the existing workforce and adding fresh talent — even as the implications of new technologies remain uncertain. In terms of where growth will come from, CEOs are looking to inorganic methods. Only 28% say that organic growth, through tactics such as R&D and recruitment, is their primary strategy; the other 72% are choosing other strategies. While only 16% cite mergers and acquisitions (M&A) as their most important growth strategy, more than a quarter (27%) of CEOs indicate a high M&A appetite over the next three years.

And when asked about the geographic markets they will prioritise for expansion, 70% of CEOs cite emerging markets — and Central and South America are targeted by a third of these CEOs. “Central and South America are becoming more attractive as it’s a significant market that is getting wealthier,” says KPMG’s Reader. “Let’s not forget about Africa either, a continent rich in natural resources and with an age demographic that presents some great growth opportunities.”

Miles Roberts, Group Chief Executive of UK-based international packaging business D.S. Smith Plc, agrees that “ it’s important to strive for growth, but growth has to come in the right way. “We have to be a better company, not just a bigger company, and it’s better through the eyes of the receiver, how they feel we are a more responsible company and earning the right to be a larger company. That’s what we’re working on. Those hurdles are only going to increase for all of us.”

Digital gets personal

To win the digital race, CEOs are taking close personal ownership of driving digital transformation. They recognise the power of data to personalise the customer experience, though only 23% claim to exceed customer expectations today. CEOs are planning how to prepare their people for the age of the smart machine. According to KPMG’s Goldburn, “More and more of the CEOs I speak with are telling me ‘I am personally leading our digital change.’”

Samuel Tsien, Group CEO of Singapore headquartered OCBC Bank has a similar view of how CEOs should approach transformation. “The word ‘disruption,’ often used in association with digital technologies, has an antagonistic feel that I’ve never liked,” he says. “Instead, we need to look at it as a transformation that is brought about by the change in our market environment.”

Contd on page 25

(Sun Lai Yung is a Consultant for KPMG and heads the China Investment desk.)

Susan Story, President and CEO at American Water, the largest publicly traded water and wastewater utility company based in the US, CEOs’ focus on transformation reflects the fact that business and technology are now intertwined.

“In the old days, you had business and then you laid technology on top of it,” she explains. “Today, business is technology and everything we do has technology threaded through it. How you most effectively and efficiently do that is what distinguishes companies that are digitally transformed from those companies that aren’t.”

Will technology cost jobs?

In 1815, the global population was less than a billion. Classical economist from Ricardo to Malthus forewarned that with the growing population will create shortages of land and food which will affect wages. Today the global population has crossed six billion and the world has been able to feed herself better by applying technology.

Until the 1970s people believed that robots would rob them of their jobs. Today we see that technology has helped create wealth, higher productivity with lesser inputs. “I think the history of the world has proven that technology doesn’t cost jobs at the end of the day,” says DHL Express’ Allen. “Uber is creating jobs. Airbnb is creating jobs.”

“Humans will continue to do jobs in high-touch segments such as the arts, social enterprises and entertainment, selling and marketing, where humans pull on people’s heartstrings,” says Masayoshi Son, Chairman and CEO of Japanese conglomerate SoftBank Group Corp. “But I believe that almost all blue-collar workers will be replaced by ‘metal-collar’ workers. By that, I mean robots equipped with intelligence and super-intelligence. They are no longer robots without brains, as they were in the past — they have become smart-robots.”

Tarek Sultan, CEO and Vice Chairman of integrated logistics provider Agility, believes that AI and automation will make roles more interesting and will drive significant efficiency improvements.

“New technologies are going to allow our people to do a lot more with less,” he says. “They will be able to focus on the important parts of our business, which are serving the customer, analysing the data and making good decisions. Much of the mundane work will be taken care of by automation, AI and the use of data and digitisation. That should play a big role in making our jobs a lot more interesting.”

Business leaders need to arm the workforce for a new machine age of “artificial intelligence (AI) and increasing automation. We have to face up to the fact that AI and automation will have a significant impact on the way we work — so let’s redevelop our workforces,” says Fujitsu’s Tait.

Instinct over data

With customer demands changing continually, and the technology landscape in a constant state of flux, CEOs now see agility as the dominant currency of business. CEOs are also bringing their own intelligence to bear, combining their experience and intuition with data-driven, predictive intelligence to spot new growth opportunities.

In a digital economy, where new technologies are constantly reshaping industries and business models, the ability to innovate quickly is a strategic imperative. In the survey, 59% of CEOs say that acting with agility is the new currency of business and that if they are too slow they will go bankrupt. Acting with agility is not just the new currency of business; it’s the most valuable currency today,” says KPMG’s Goodburn. “If you succeed, you succeed faster, and if you fail, you fail quicker — both of which add to the health of a business.”

Data and analytics have changed how CEOs and the rest of the C-suite make business decisions. And they continue to get more sophisticated: AI that draws on deep learning techniques, for example, will transform predictive analytics. CEOs have not lost sight of the importance of their own intuition, experience and judgment.

In our survey, in the past three years, 67% say they have overlooked the insights provided by data and analytics models or computer-driven models because they contradicted their own experience or intuition.

CEOs in the US are particularly likely to draw on their domain expertise and unique insights when making critical strategic decisions, with three-quarters saying they have overlooked computer driven models in the past and followed their intuition instead.

CEOs also show some scepticism about data. Over half (51%) say they are less confident about the accuracy of predictive analytics than historic data. They want to understand where the data that informs predictive models has come from and whether it can be trusted. “Understanding where the data comes from is crucial for us,” says Cintra’s Díaz-Rato. You can be driven to wrong conclusions if you just follow the data blindly.”

Perhaps surprisingly, CEOs place a high degree of trust in data and information from social media sources. We asked CEOs which data sources they trusted to make strategic decisions, and social media emerged as easily the most trusted source. For example, 42% of CEOs say they have very strong trust in social media, but only 12% say the same for open data from government agencies.

KPMG’s Gusher is not surprised that social is the most trusted source. “Social media is direct from the customer,” she says. “A CEO might find the opinions of a business reporter interesting and useful, but they may not trust it as much as they would the direct word-of-mouth of one of their customers.”

According to Patricia Kampling, CEO of Alliant Energy, “There is more data today without a doubt, but it is important to focus on the data that helps decision-making or reveals trends, and not get overwhelmed with the quantity. It’s also very important to go beyond the data and realise that nothing is more valuable than having constant communications with employees, customers and technology partners. My decision-making is a combination of data-driven information, input from many and decades of experience.”

The 2018, Global CEO Outlook finds Chief Executives optimistic about the economy and excited about the growth opportunities offered by disruption. At the same time, CEOs are managing their exposure to a range of headwinds. Driving growth will require CEOs to combine equal amounts of resourcefulness and realism.

Today’s CEOs are faced with unprecedented challenges unlike the CEOs of the past. It’s not just producing a good product and marketing it. It is facing an environment that is in continuous flux with opportunities and threats. Those who are agile will survive.

The data published in this report is based on a survey of 1,300 Chief Executive Officers (CEOs) in 11 of the world’s largest economies: Australia, China, France, Germany, India, Italy, Japan, the Netherlands, Spain, the UK and the US. The survey was conducted between 22 January and 27 February 2018.

The CEOs operate in 11 key industries: asset management, automotive, banking, consumer and retail, energy, infrastructure, insurance, life sciences, manufacturing, technology and telecom.

Of the 1,300 CEOs, 314 came from companies with revenues between $ 500 million and $ 999 million; 546 from companies with revenues between $ 1 billion and $ 9.9 billion; and 440 from companies with revenues of $ 10 billion or more.

(Sun Lai Yung is a Consultant for KPMG and heads the China Investment desk.)