Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 14 May 2018 00:10 - - {{hitsCtrl.values.hits}}

A regulatory sandbox

The Central Bank of Sri Lanka has recently announced its intention to create a sandbox for financial institutions to experiment with new financial technologies, without running the risk of getting caught for violating regulations pertaining to the sector (available at: https://www.cbsl.gov.lk/sites/default/files/cbslweb_documents/press/notices/notice_20180502_sri_lankan_fintech_regulatory_sandbox_e.pdf).

This proposal is still at a nascent stage, and a lot more has to be done by the Bank to realise its full fruits. Yet, it will pave way for Sri Lanka to join the exclusive club of countries that have attempted to bring about a healthy marriage between regulators and innovators. Sri Lanka has joined the fray at a time when many countries in the world are racing to gain membership of this club.

That is because financial innovations are considered a must for cutting costs, giving better services to customers and remaining included in a world of advancing global financial technologies.

A lot more to be done by Central Bank

A lot more to be done by Central Bank

According to the Bank’s press notice, it has so far not determined the scope of the proposed regulatory sandbox. This is understandable, because there is no generally accepted model of regulatory sandboxes by its proponents, nor can such a general model exist due to the diversities in the financial systems in different countries in the world. Hence, at present, fintech regulatory sandboxes are custom-made and restricted to individual countries, implying that there is no scope for ‘cut and paste’ work. Hence, each country has to find its best model, though they can seek general guidance from those countries which have already implemented them.

Now UK proposes to go for a global regulatory sandbox

However, there will be a generally accepted single model of a fintech regulatory sandbox when the world settles on a global fintech regulatory sandbox system one day. The pioneer of the local fintech regulatory sandbox, UK’s Financial Conduct Authority or FCA, has proposed a global model following the success of its local model introduced in 2016 (available at: https://www.fca.org.uk/firms/regulatory-sandbox/global-sandbox). But, it is still at the blueprint stage and therefore, the new entrants have to be content with local fintech regulatory sandbox frameworks.

Hence, in this initial exercise, the Bank proposes to consult those who are to introduce fintech innovations, so as to assure that the sandbox system is beneficial to them, and identify the requirements of the market. Such a participatory approach will help the Bank to eliminate shortcomings of the new system as and when it is implemented on the ground. The present exercise is thus limited to collecting expressions of interest by would-be fintech innovators, by means of a very short and simple questionnaire.

Sandbox comes from children’s learning game

The term ‘sandbox’ has been borrowed from the children’s ‘learning game’ involving a box or a pit filled with sand.

Children are allowed to sit around the pit and use the sand for coming up with new creations. Some build castles, some statues and some simple roadways. They are watched from a distance by elders, but there is no interference or guidance by them in close range. Thus, the normal disciplinary code which is applied to children’s other work is taken out, and they have full freedom to do what they like to do within a given time space.

The objective of this learning game is to help children think creatively and do it in competition with others in the group. Sometimes, children who belong to a given pit could compete with children in other pits. They, therefore, learn not only creativity but also the value of competing with others. If this competitive spirit is continued to their adult life, they would be able to create things beneficial to others.

Only free minds can make inventions

The message given by the learning game exercise with children is that people will become creative, innovative and enterprising when they are free from regulations, rules and restrictive behavioural guidelines.

Creativity comes from the ability of persons to see beyond the frame set for them by society or its members. If one has the courage to break the barrier, one could bring about changes that are beneficial to others. If, in the opposite, one chooses not to challenge the barrier, there is complete conformity and loyalty and society will continue as it is. They would not shine in the environment.

The Buddha advised the Bhikkus in the Avasa Sobhana Sutta that if they wish to shine within the monasteries they live in, one of the prime qualities they have to cultivate in themselves is the ability to see beyond the numerous Dhammas they learn.

UK is the pioneer in sandbox approach to innovation

The sandbox-type regulatory approach to promote financial technology and innovation was first proposed by the UK’s FCA in 2015, which also coined the term ‘sandbox’ to describe the methodology (available at: https://www.fca.org.uk/publication/research/regulatory-sandbox.pdf).

Since then, many countries around the globe have emulated the UK exercise. The leading users who have gone live in the project have been Holland, Canada, Singapore, Abu Dhabi, Australia, Malaysia and Hong Kong. In addition, a number of countries – as high as 40 – have proposed to setup a sandbox-type regulatory concession to new financial innovators. Sri Lanka, with its recent proposal, belongs to this latter category.

Popular demand for exempting from regulations to test innovations

According to the above report by FCA, the reason to go for a regulatory sandbox was the request made by many participants in its earlier innovative exercise, code-named robo-advice.

Those who had participated in this exercise had requested that they be given an opportunity to test their products – involving complex algorithms – in a regulation-free environment. It was thus felt by FCA that a regulatory sandbox was the best to meet this requirement due to four reasons: cutting time and cost to implement an innovative idea in the market; easy access to financing; ability to test more products; and opportunity to address consumer protection issues.

FCA also had to resolve three key issues when it pursued the establishment of a regulatory sandbox: the selection of barriers to be lifted; deciding on the safeguards for consumers and the financial system during testing; and, since the UK was within EU at that time, how the regulatory relaxation in the sandbox approach would compromise EU rules.

Stringent rules for selection potential innovators

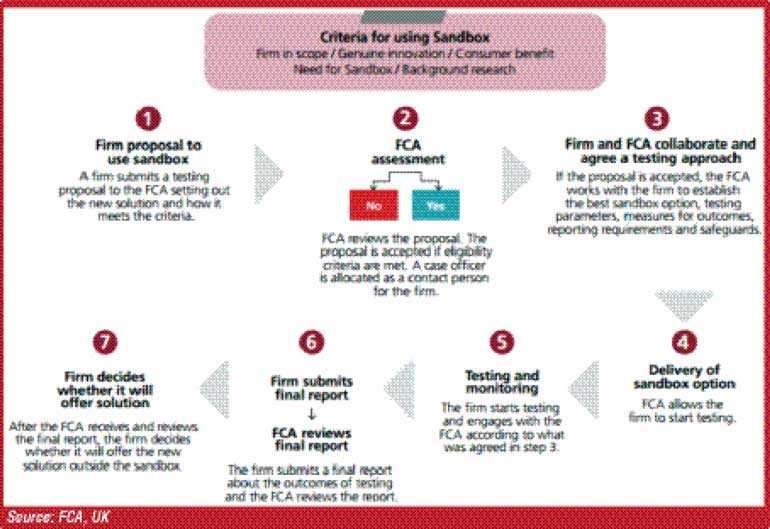

The UK sandbox went live in February, 2016. Not every firm that made requests was accepted to the sandbox project. According to the report, the following five criteria had to be satisfied by every such firm for acceptance:

A quantum leap to beat competitors

These strict selection criteria eliminated amateurish firms and accommodated only those with genuine intention to support the industry and consumers. The objective of the FCA had been to take the UK financial market to the next world stage, through genuine and value-adding innovations.

The concern of FCA was that London, which remained the number one global financial market for centuries, was being threatened by new entrants like Singapore, Hong Kong and Abu Dhabi.

If it is to retain its position and remain as number one, it has to make what economists call a ‘quantum leap’ or a jump so high that its competitors would not be able to capture it. That quantum leap would be powered by innovations supported by competition, which would also ensure the best of everything, from excellence to market practices to product delivery to consumer satisfaction.

Thus, FCA had no choice but to promote fintech innovation on a grand scale. But its solace has been short-lived, since its competitors too have now followed it. As it is, the regulatory sandbox is a public good which can be copied and adopted by anyone in the globe. This is why the UK is now planning to propose a global sandbox, so that financial innovations in any part of the world would be made available to mankind in general, and not to people in a given national state.

Safeguards for customer protection

If the regulatory sandbox goes wrong, there are complications for the entire financial industry. It is like testing a new drug on human beings. If a new drug is discovered, it is first tested in vitro in a laboratory environment, and then on selected animals. It is tested on human beings only after the first two tests have shown conclusively positive results.

Even then, when it is tested on human beings, necessary safeguards have to be introduced to minimise - if not eliminate - the adverse side effects. The testing of financial innovation on live customers also involves similar risks. Given this background, the regulatory authority concerned has to take extraordinary measures to protect the rights of consumers who have now become live guinea-pigs.

Fourfold safeguard approaches in UK

UK’s FCA has suggested four different approaches to safeguard the consumers in the case of simple financial technologies as follows:

Caveat venditor: Let the seller beware

In the case of testing complex technologies like the blockchain – the ledger system in which many customers would participate on line to effect transactions – the sandbox firms should not only get the consent of the customers, but also do so only with sophisticated ones.

This requirement arises from the legal principle ‘caveat venditor’ or let the seller beware. It effectively passes the responsibility on the seller to educate the buyer on the complexities involved in the product he is going to buy.

This is specifically relevant to derivative products and high tech consumer products. In the case of financial markets, new innovations are sophisticated ones and therefore, not all customers could be expected to be knowledgeable of the potential risks involved. That is the reason for insisting that complex innovations should only be tested on customers who are aware of the market risks involved in sophisticated financial products.

Next move of Central Bank

The Central Bank should now come up with a detailed paper on how it is going to implement its regulatory sandbox proposal.

It should contain, among others: the selection criteria; how the innovating firms should be given a regulatory umbrella by the Bank; the legal implications in exempting them from regulations and how it should be sorted; and finally, how the firms should go to the market after they have successfully tested their innovation. This involves continuous education of market participants and customers. But this is not rocket science, and it can always follow the best practices adopted by other successful countries which have now gone live on the system. It is only a matter of customising what other countries have done to Sri Lanka’s specific case.

This will take time but the initial action taken by the Central Bank is commendable. Thus, the market is patiently waiting for Central Bank’s next move.

(W A Wijewardena, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected] )