Friday Feb 27, 2026

Friday Feb 27, 2026

Tuesday, 23 March 2021 00:00 - - {{hitsCtrl.values.hits}}

By Theja Dedu S. Pathberiya

People are enticed to commit financial crimes because of the large monetary benefits they gain from such activities. Criminals make various attempts to conceal the origins of illegally earned money and this is known as the process of laundering money. Hence, money laundering is the process of concealing the illicit origins while attempting to attribute a legitimate appearance. This concept of money laundering is similar to laundering clothes.

People are enticed to commit financial crimes because of the large monetary benefits they gain from such activities. Criminals make various attempts to conceal the origins of illegally earned money and this is known as the process of laundering money. Hence, money laundering is the process of concealing the illicit origins while attempting to attribute a legitimate appearance. This concept of money laundering is similar to laundering clothes.

For example, a person earning money by illegal means such as drug dealing may launder that money by investing in a legal asset such as real estate. If there is no legislative requirement to question the source of funds at the time of the investment, the money launderer will be able to easily sell the real estate property later and deploy that money in illegal activities such as furthering crimes or engage in terrorism. This process encourages criminals to engage in illegal activities to raise funds and deploy them in illegal activities, which are both harmful activities to the society.

Financing of terrorism is also another harmful act that may be related or independent from money laundering activities. By avoiding money laundering and terrorist financing, it would contribute towards the well-being of the society. Hence, every country requires a comprehensive anti-money laundering and anti-terrorist financing regime with a proper institutional framework to combat these illegal activities.

Financial information plays an important role in ceasing the flow of funds to both crimes and terrorism. Accordingly, financial information coupled with intelligence derived using that information are vital in identifying, addressing and mitigating money laundering and terrorist financing risks. Financial intelligence plays a vital role in this era as globalisation and advancement in technology have triggered money launderers and terrorist financiers to operate across borders. In this context, combating of money laundering and financing of terrorism are key concerns that needs special attention of each country as it is clear that both money laundering and terrorist financing threaten the integrity of a country’s financial system. Hence, the weight a country should give to collect and receive financial information or intelligence is significant.

Therefore, availability of proper institutional arrangement to collect or receive financial information related to activities of various institutions is a fundamental requirement. Further, supervision of financial institutions and other relevant institutions for their compliance to mitigate money laundering and terrorist financing activities and cooperation among domestic law enforcement authorities, reporting institutions, international agencies and governments to mitigate cross-border money laundering and analysis of terrorist financing risks are extremely important for a country. Hence, there should be a central institution to oversee such activities and it is a fundamental component of every national anti-money laundering and countering of terrorism financing framework.

What is a financial intelligence unit?

As discussed above, financial information and intelligence should be readily available or accessible to trace fraudulent or doubtful transactions. In this scenario, information related to financial transactions such as depositing or transferring money between bank accounts, investments in shares or properties such as lands, vehicles or precious metals and gems etc. should be collected by a central authority. Once collected, they should be analysed in order to verify any suspicious transactions.

On the other hand, when there is a money laundering or terrorist financing suspicion behind specific transactions, there should be a mechanism and an authority to inform such doubtful transactions. Also, collecting or receiving such financial information and analysing them must be carried out by an authority or an entity which is vested with powers by laws of the country. An entity which a country requires to establish to carry out these critical functions and focus of other key roles relating to prevention of money laundering and combating of terrorism financing is known as a Financial Intelligence Unit (FIU).

Global recommendation on establishing of an FIU

Establishing of a central authority; an FIU for a country or jurisdiction is a global requirement. To facilitate this requirement, it is important to understand the global standards against money laundering and terrorist financing. The requirements of fighting against money laundering and terrorist financing have become a global concern as it is believed that illegally earned funds move across borders freely threatening the global financial system.

To successfully face and fight against this growing global concern an entity named Financial Action Task Force (FATF) was formed by G-7 Summit in 1989. Since then, the FATF works as the global policy setter against money laundering and terrorist financing. The FATF plays a prominent role in encouraging countries to say “no” to money laundering and terrorist financing. The FATF has issued 40 Recommendations as a plan of actions that needs to be addressed in order to fight against money laundering, terrorist financing and financing of proliferation. In implementing its 40 Recommendations, the FATF collaboratively works with FATF-style regional bodies.

For example, “the Asia Pacific Group on Money Laundering (APG)” is the FATF-style regional body for the countries belonging to Asia and Pacific region. Hence, every country in the world is not a direct member of FATF, however, they belong to their FATF-style regional body and work to combat money laundering, terrorist and proliferation financing together with the rest of the world by ensuring the compliance with FATF Recommendations.

Every country is responsible to pursue the FATF 40 Recommendations and countries are subject to periodical assessments on the progress of implementing FATF 40 Recommendations, technically as well as effectively, by its peer countries. The FATF’s Recommendation 29 requires countries to establish an FIU to serve as a national centre for the receipt and analysis of mainly two types of information. The first is the suspicious transactions reports which are filed by the reporting entities such as financial institutions and designated non-financial institutions of that country. The second is the other relevant information on money laundering, its underlying offences and terrorist financing. Also, the results of analysis are to be disseminated among the relevant law enforcement and competent authorities.

As per the FATF Recommendations, the core functions of an FIU are receipts of disclosures filed by reporting entities, analysis of those information, and dissemination of results of analysis among relevant competent authorities. Further, the FATF’s Recommendations require that FIU should have powers to access any other information relating to money laundering, its predicate offences and terrorist financing. More importantly, FIUs should have policies and procedures for handling information securely and confidentially. The other highlighted fact is the operational independence and autonomy of an FIU. Every FIU should be free from undue influence or interferences in obtaining and deploying the resources it requires to carry out its core functions. Operational independence and autonomy are fundamental elements of an FIU.

Further, the FATF Recommendations require each FIU to apply for the membership of the network of worldwide FIUs named as Egmont Group. This is mainly for the purpose of developing a mechanism between FIUs in exchanging information among them on money laundering and terrorist financing.

The FIUs are also required to have mechanisms for financial institutions and designated non-financial institutions to report all domestic as well as foreign transactions above an identified amount. Hence, an FIU should facilitate a way for its reporting entities to report their cash and other financial transactions including electronic fund transfers.

Core and other functions of an FIU

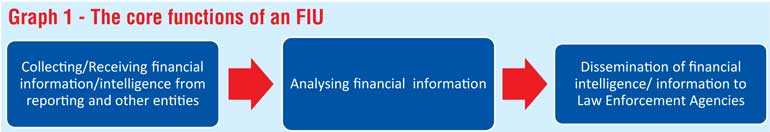

The core function of an FIU is receiving financial information or intelligence from reporting entities and general public, analysing them with the purpose of identifying any relationship to criminal activities on money laundering, terrorist financing and proliferation financing and sharing relevant financial intelligence with relevant law enforcement authorities to facilitate further investigations and prosecutions. The following graph shows the process of core functions of an FIU.

In practice, while FIUs are mainly involved in attending to their key functions, they also attend to various other functions and duties related to combating illicit financing activities. Developing national level strategies for more effective anti-money laundering and anti- terrorist financing regime, issuing or amending rules and regulations to strengthen the anti-money laundering and anti-terrorist financing framework, examining the compliance of relevant reporting entities, coordinating with domestic as well as foreign entities on related matters and making public awareness on anti-money laundering and countering the financing of terrorism measures, entering into memorandum of understandings to share information with other institutions and countries and freezing and holding of funds which may relate to money laundering, terrorist financing and proliferation financing are some of the other functions carried out by FIUs.

Different types of FIUs

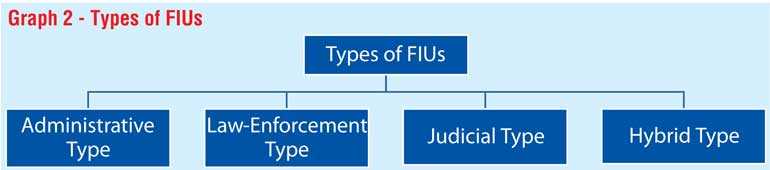

The ways that the FIUs administer and handle their core and other activities differ significantly from one country to another. Hence, the operation and administrative structures of worldwide FIUs are different. Accordingly, FIUs are categorised mainly under four different types: (1). Administrative type, (2). Law-enforcement type, (3). Judicial type, (4). Hybrid type.

When an FIU is a part of or under the supervision of another agency other than law enforcement or judicial authority, it is called an administrative type FIU. An FIU which is established under a Ministry is an example for administrative type. This type of an arrangement for establishing an FIU makes a buffer between the reporting entities and the law-enforcement authorities of that country. When reporting entities do not have capacities to decide whether a transaction is connected or not to a criminal activity, the administrative type FIU works to fill up that gap and analyse the information disclosed by the reporting entities and disseminate the results to law-enforcement authorities, if a significant suspicion is formed. However, in this case, the FIU does not have investigative or prosecutorial powers. Some administrative type FIUs have supervisory authority over reporting entities, where such FIUs conduct compliance examinations of reporting entities.

In some countries, the FIUs are a part of the law-enforcement mechanism with law enforcement powers with the prime objective of functioning as the law enforcement arm in tracking and investigating money laundering and terrorist financing offences. It functions as a division of the Police. Then the FIU itself has powers to freeze and seize transactions. The staff in such FIUs are officers of the law enforcement mechanism with experience in financial investigations. This type of an FIU is called the law enforcement type FIU.

In some countries, FIUs are established within the court system (judicial branch) of the country and they are called judicial-type FIUs. The FIU exercises the judiciary powers such as freezing accounts, seizing funds, detaining suspects, and conducting searches.

Also, there are FIUs which are combinations of at least two types of above described arrangements and they are known as hybrid FIUs. These FIUs have one or more features of administrative type FIUs as well as law-enforcement type FIUs. Sometimes, the powers of customs office and the police are combined with these FIUs.

Each type of an FIU has its own advantages as well as disadvantages. Therefore, in selecting the type of an FIU which suits to a country should be carefully done with a good analysis of country specific factors such as administrative, legal and economic strengths and weaknesses as well as the regional specific factors.

THE CASE OF SRI LANKA

Establishment of the Financial Intelligence Unit of Sri Lanka (FIU-SL)

Sri Lanka is one of the founding members of the FATF-style regional body, the APG. Sri Lanka has enacted the required laws and regulations which are essential to combat money laundering and terrorist financing and established the core institutional set up which is required to have an effective anti-money laundering and countering the financing of terrorism regime for the country.

The key institution among those is the FIU Sri Lanka (FIU-SL) which has been established in March 2006 in terms of the provisions of the Financial Transactions Reporting Act, No. 06 of 2006 (FTRA). The FIU-SL functions as an independent institution within the administrative structure of the Central Bank of Sri Lanka since February 2007, in terms of the order made by the President under the Act. Accordingly, the FIU-SL is presently working as Sri Lanka’s national centre for collection, analysis and dissemination of financial information/intelligence.

The FIU-SL is empowered to collect or receive financial information or intelligence from its reporting Institutions. Financial institutions such as banks and non-bank finance companies, insurance companies, stock brokers, foreign exchange dealers and money value transfer service providers as well as non-financial institutions and professions such as casinos, real estate businesses, gem and jewellery dealers, accountants, lawyers, notaries and company service providers have been defined as its reporting Institutions under the FTRA.

Other than its core functions, the FIU-SL engages in many other activities under its mandate. When analysing its core functions, the FIU-SL is more similar to an administrative type FIU as it does not have any law enforcement powers. However, FIU-SL has powers to freeze transactions and accounts based on a suspicion.

a. Powers and functions of the FIU-SL

The FIU-SL is mainly vested with powers to collect or receive reports or information which may relate to money laundering, terrorist financing as well as financing of proliferation from designated domestic entities, government agencies, law enforcement agencies or governments or institutions of other countries. Also, the FIU-SL analyses information provided, and reports filed by its reporting entities and have powers to refer them to law enforcement agencies if required on the basis of its analysis.

FIU-SL is authorised to carry out examinations of its reporting institutions. Under this, the FIU-SL or any person authorised by it on that behalf will examine the records of the reporting institutions for the purpose of ensuring the anti-money laundering, countering the financing of terrorism and proliferation compliance. The FIU-SL not only has powers to examine its reporting institutions, more importantly it is empowered by law to impose penalties to enforce compliance with these legal requirements of the country. Collection of such penalties imposed by the FIU-SL is also a responsibility of the FIU-SL and these monies should be credited to the government Consolidated Fund. Once the penalties are imposed, names of such institutions are shared with the public by way of naming and shaming.

The FIU-SL is also empowered to issue or make arrangements for the supervisory authority of an institution to issue rules and guidelines relating to identifying customers/beneficial owners, retention of records and reporting obligations. For example, the FIU-SL works closely with Insurance Regulatory Commission (IRC), Securities Exchange Commission (SEC) and Sri Lanka National Gem and Jewellery Authority (SLNGJA) in supervising particular industries on applying anti-money laundering and countering the financing of terrorism measures relevant to those sectors.

Also, the FIU-SL conducts training programmes for its reporting institutions and the other supervisory authorities on FIU related subject matters.

Further, the FIU-SL conducts research into trends and developments in the areas of money laundering and terrorist financing in different industries, educate the public and reporting institutions and create awareness on related matters.

In addition, the FIU-SL is empowered to enter into agreements or arrangements with any domestic government agency, institutions. Further, it could also enter into such agreements with an agency of a foreign state, international organisations or a foreign law enforcement agency regarding the exchange of information with the approval of the Minister of Finance.

The FIU-SL also has powers to direct its reporting institutions to not to proceed transactions if there is a reasonable ground to suspect that it is related to any unlawful activity or connected with offences under Prevention of Money Laundering Act, No.05 of 2006 or the Convention of Suppression of Terrorist Financing Act, No. 25 of 2005.

Further, the FIU-SL is empowered to transmit any information from its examination to the appropriate domestic or foreign law enforcement authorities on the reasonable grounds to suspect that the information is suspicious.

b. The FIU-SL as an operationally independent FIU

As explained above, the FIU-SL functions under the administration structure of the CBSL. However, the core operation of the FIU-SL is conducted independently as required by the international recommendations to stand as an entity with no influences for effective anti-money laundering and countering the financing of terrorism operations in the country. By doing so, the FIU-SL facilitates and supports investigations and prosecutions against persons suspected for money laundering or terrorist financing without any undue influence. Therefore, the information provided by reporting institutions are handled confidentially within the legal provisions provided by the FTRA.

c. Operational structure of the FIU-SL

The FIU-SL administratively functions under the CBSL and is overseen directly by the Governor of the CBSL. However, for the administration related activities it follows the normal reporting and authorisation procedures as other departments of the CBSL.

The FIU-SL has its management structure with a director who oversees the overall functions (Core and other functions) of the FIU-SL. The functions carried out by the FIU-SL are assigned to different divisions for their smooth functioning and there are controls between divisions to protect confidentiality of the financial intelligence/information it received/collected. The FIU-SL has strengthened its pool of human resources with diverse backgrounds such as legal, accounting, economics, examinations/inspections and financial analysis.

Further, to smoothen the functions of the anti-money laundering and countering the financing of terrorism regime in Sri Lanka, there is an Anti-Money Laundering and Countering the Financing of Terrorism National Coordinating Committee (NCC) to provide directions on policy matters and other related strategic issues. The Chairperson of the NCC is the Governor of the CBSL and there are 23 key officials representing relevant ministries and government institutions for anti-money laundering and countering the financing of terrorism regime matters of the country. The FIU-SL closely works with such ministries and institutions in relation to matters handled by it in achieving its goals in this regard.

d. Recent developments of FIU-SL and the way forward

the FIU-SL serves as the national centre for the receipt and analysis of suspicious transactions and other financial information relevant to suspicious transactions of money laundering and terrorist financing and dissemination of the outcome of such analysis to the law enforcement agencies and regulatory bodies of Sri Lanka. In this process, FIU-SL aims to improve the quality of its financial analysis and referrals. The FIU-SL has already taken different strategies in this regard.

Mainly, clear guidance has been provided for its reporting institutions in reporting suspicious transactions with high quality. Moreover, the FIU-SL provides educational and awareness programmes periodically on reporting high quality suspicious transactions. Further, training facilities are provided to its staff with the use of analytical software to increase the efficiency of its analysis. Regulatory actions are being used if there are weaknesses found in compliance programmes of the reporting institutions. This is to improve the quality of reporting suspicious transactions. In order to report a quality suspicious transaction, the reporting institutions should have proper risk-based programmes and customer due diligence procedures. Hence, the FIU-SL recently started a naming and shaming procedure for its reporting institutions who fail to comply with requirements under the provisions of Financial Transactions Reporting Act, No. 06 of 2006.

At the same time, the FIU-SL coordinates with all the relevant national institutions to have an effective national AML/CFT regime for the country. In this matter, the lessons learnt from the FATF listing in Oct 2017 are always be in focus. Accordingly, the FIU-SL takes the leadership to promote international standards of AML/CFT within Sri Lanka with the cooperation of other relevant institutions. Under the FATF listing, which is known as the Grey Listing an action plan was given for Sri Lanka to implement within a given timeframe.

The country was under close monitoring of the FATF and APG during that period. Sri Lanka was then delisted in 2019 due to the progress made during the given timeframe. The FIU- SL with its other relevant counter parties such as ministries, government entities and private sector institutions worked hard to fulfil the requirements under the given action plan to delist Sri Lanka from the Grey List considering the cost of being listed as a country. Accordingly, the FIU-SL always works for improving the effectiveness of following measures initiated during the listed period by Sri Lanka and to strengthen the AML/CFT regime of Sri Lanka.

Furthermore, the FIU- SL continuously works to strengthen the AML/CFT framework of the country through various measures such as signing of memorandum of understandings with different government entities and international agencies and working closely with relevant ministries and other governments as well as private sector institutions to make country’s AML/CFT regime more robust.

(The writer is a Senior Assistant Director – Financial Intelligence Unit of the Central Bank of Sri Lanka. The views express in this article are those of the writer’s and do not necessarily reflect the CBSL.)