Saturday Feb 21, 2026

Saturday Feb 21, 2026

Saturday, 23 June 2018 00:15 - - {{hitsCtrl.values.hits}}

China overtook the United States to become the largest trading nation in the world in 2014. China is the second largest economy in the world behind the United States and the largest exporter in the world. It is referred to as the factory of the world, with its economy integrated so strongly with the world economy, especially with the US and European Union economies. Any effect on the Chinese economy will have repercussions all over the world.

China overtook the United States to become the largest trading nation in the world in 2014. China is the second largest economy in the world behind the United States and the largest exporter in the world. It is referred to as the factory of the world, with its economy integrated so strongly with the world economy, especially with the US and European Union economies. Any effect on the Chinese economy will have repercussions all over the world.

The inflow of Foreign Direct Investment (FDI) has contributed greatly to China in terms of promoting employment creation, technology transfer, capital formation and integration with the global economy. The flow of FDI into China has a large effect on China’s economy, which has an effect on the global economy, due to it being integrated so well.

In this context, a look at the implications of inward FDI on China is very important. We will look at evidence, from 1979, when the Chinese government opened the economy to the world to the present day. In 1997, 71% of foreign direct investment going into developing countries went to just nine countries and from that China took over 30%. By the end of 2009, cumulatively, China had attracted a total inward FDI of $ 940 billion, which made it the largest receiver of FDI for a developing country.

Why do MNCs invest in China?

Why do MNCs invest in China?

John Dunning’s Eclectic Paradigm theory can be applied in China. According to the theory, location specific advantages are used to increase the growth of companies and maximise profits, as labour and natural resources are two of the main reasons why firms use location specific advantages.

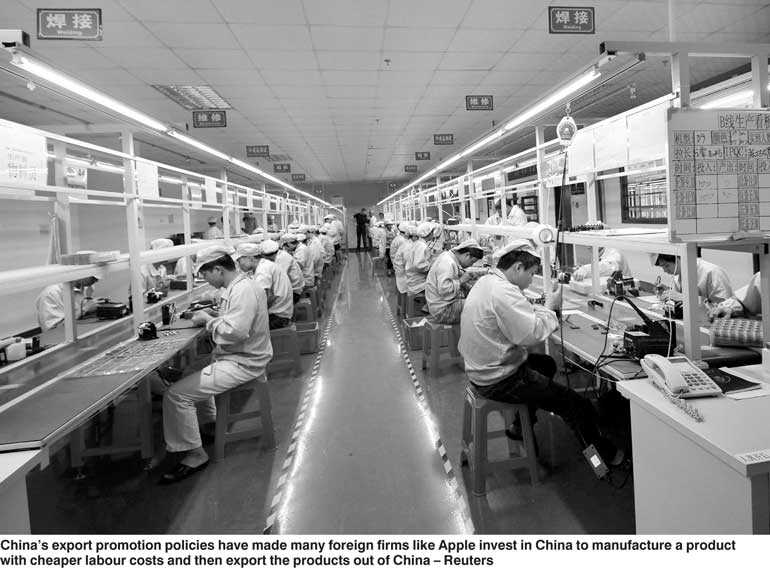

In China’s case, the evidence clearly shows MNCs use Greenfield investments to benefit from the cheap labour available in China. The MNCs see this as a good reason for investing in China.

The entry of China into the WTO in 2001 has made it more open to trade. Trade openness is crucial in order to obtain FDI’s growth effects. If one firm goes from exporting to FDI, its competitors will follow not wanting to have a competitive disadvantage, while foreign firms, with a mere threat of trade restriction, may lead to anticipatory investment in the host country. The argument is true in China’s case as MNCs know that China’s market of 1.4 billion people is too much to be left out of.

FDI and economic growth

FDI’s total contribution to China’s economic growth in the 1990s is estimated to be near 3% annually, which is almost one-third the total growth of China’s economy at that time. This is significant as a positive correlation can be found between foreign direct investment and domestic investment in China. This finding is supported by the fact that Chinese partners were eager to join foreign invested enterprises with foreign firms, considering Chinese investment policies were friendlier to foreign invested businesses than domestic firms. It has also been observed that Chinese regions and provinces exhibit faster economic growth with a higher FDI intake.

FDI’s effect on China’s balance of payments

China’s balance of payment has seen surplus for so long. This is due to the rise of exports, which can be attributed to the effects of FDI. First, FDI’s growth enhancing effects are stronger in countries pursuing a policy of export promotion rather than import substitution.

Second, in countries with export promoting policies, FDI has a stronger impact on growth than domestic investment. This is the case in China. FDI, especially in the Chinese manufacturing sector, has led to China becoming a net exporter. China had a trade surplus with the US of $ 270 billion in 2010. This has led China to invest nearly $ 1.5 trillion in US treasury bonds, giving China enormous leverage over the US, as China could dump the dollar anytime, which can cause the US economy to collapse.

China’s export promotion policies have made many foreign firms invest in China to manufacture a product with cheaper labour costs and then export the products out of China. Apple does this to make its products in China and then exports them back into the US through Foxconn.

FDI and employment

33% of the entire manufacturing workforce of China were employed as a direct or indirect result of FDI. While it is argued that the number of workers when including unregistered workers and workers who work for village and township enterprises will number more than 100 million, saying the actual figures of manufacturing workers in China is an underestimation. The emergence of SEZ (Special Economic Zones) in Guangdong and Shenzhen as a result of FDI has resulted in millions of job creation and have emerged as two large and wealthy cities.

Technology Transfer and Innovation through FDI

Technology Transfer and Innovation through FDI

The technology and production innovation brought by foreign firms has an effect on China. Transfer of technology to the host country increased the stock of knowledge through skill acquisition, labour training, new management practices and organisational arrangements, contributing to economic growth.

The rate of technical progress from advanced technology, management practises, etc. in the host country has increased because of FDI through a contagion effect. It can be pointed out that FDI through technology transfer has contributed in larger measure to growth than domestic investment. Technology and knowledge of large MNCs with large budgets for R&D may be brought to the host country, which are not readily available there. But many MNCs are not very willing to give away technological knowledge to the local population as technological leaders are encouraged to adopt direct entry as protecting technology is of great concern in high tech industries.

Negative aspects of FDI

But FDI does have its negative effect. MNCs investing in China promote Westernisation, more youth move away from Chinese culture. Environmental protests have become more common as cities are polluted and become unhealthy to live in. Workers in China being abused and made to work in inhumane conditions is another factor, which became more prominent with the news about workers at Foxconn, (which manufactures Apple’s products) being treated so badly, they commit suicide.

Even, the job creation due to FDI could be over as many MNCs find China becoming more expensive and find cheaper labour elsewhere in countries like Vietnam. Even with such downturns, Chinese people do love the companies that invest in China as Apple is the most loved brand in China.

Conclusion

When reviewing the theories regarding FDI’s effects on China’s economic growth, balance of payments, employment, technology transfer and environment, the effects are profound but they can be positive as well as negative. Though poor working conditions and environmental and cultural damage as a result of FDI can be seen, the job creation, economic growth, trade surpluses and technology and knowledge transfer are more positive.