Friday Feb 27, 2026

Friday Feb 27, 2026

Monday, 22 February 2021 00:30 - - {{hitsCtrl.values.hits}}

President Gotabaya Rajapaksa

Prime Minister Mahinda Rajapaksa

Dr. P.B. Jayasundera

State Minister Nivard Cabraal

Central Bank Governor Prof. W.D. Lakshman

In a recent press conference, Central Bank Governor Deshamanya Professor W.D. Lakshman has said that the present Government is adopting an alternate economic strategy to solve the country’s chronic as well as acute economic problems. Critics have branded that alternate policy as following what is known as Modern Monetary Theory or MMT. The main characteristic of MMT is the use of Central Bank-printed money for financing the Government budgets. Since it leads to inflation if it is done without restraint, such a measure has been identified as equivalent to imposing an inflation tax to have resources transferred from the private sector to the government sector. Hence, it is useful to look at how inflation tax is imposed and what repercussions it would bring to a country.

In a recent press conference, Central Bank Governor Deshamanya Professor W.D. Lakshman has said that the present Government is adopting an alternate economic strategy to solve the country’s chronic as well as acute economic problems. Critics have branded that alternate policy as following what is known as Modern Monetary Theory or MMT. The main characteristic of MMT is the use of Central Bank-printed money for financing the Government budgets. Since it leads to inflation if it is done without restraint, such a measure has been identified as equivalent to imposing an inflation tax to have resources transferred from the private sector to the government sector. Hence, it is useful to look at how inflation tax is imposed and what repercussions it would bring to a country.

Risk of working with a demon

Perhaps the starting point is a popular folk story about a villager making a chance meeting with a demon in the forest and using his artfulness to get the demon to work for him. Understandably, the demon being an untiring person proves to be a marvellous worker. His contribution to the villager far exceeds that of even a thousand workers. According to the story, everything is well and good so long as the villager is able to keep the demon under his control. But, on the day the villager loses his grip over the demon, it would set upon the villager and devour him. So, though the villager would have a jolly-good life in the short run, he runs the risk of losing everything, including his life, in the long run.

Use of inflation is like getting a demon to work for you

Governments’ use of inflation as a tax to force-mobilise resources for funding Government projects, has been equated to the fate of the villager in that folk story. In the short run, a government could forget about all its fiscal problems and enjoy the temporary solace provided by it. But in the long run, when inflation becomes uncontrollable, it will have to sacrifice all its temporary gains. When an initially mild inflation degenerates into an uncontrollable hyper-inflation later, it has been termed as a mass killer. It would destroy the financial infrastructure and, through it, the entire social and economic infrastructure. Rebuilding a nation after this massive destruction would be a very painful and tedious challenge for everyone.

What is meant by inflation tax?

Modern governments have been given monopoly power by their respective societies to produce and supply currency with a single objective: maintaining its value to facilitate its use for transactions, keep wealth, settle debt, and record transactions on a uniform basis. Governments are required to attain this objective by responsibly regulating its supply. Governments, when performing this task and as a cost-effective measure, have resorted to the habit of issuing paper currency notes and debased metallic coins thereby gaining a unique advantage. That advantage is the ability to produce it at a cost which is simply a fraction of its face value. For instance, a currency note may have a face value of 1,000 units of money, but a government does not spend 1,000 units of money to produce that note. The total printing cost of that note may be just a fraction, say, 5 units of money. So, in this case, by issuing a note to a value of 1,000, the government makes a profit of 995 units of money. Such profits accrued to the government are known as ‘seigniorage’.

Fooling of smart people by governments

Now suppose that the government uses this 1,000-note to pay salaries to a teacher. The teacher is required to sacrifice eight hours of her time a day to get that 1,000-note as her salary. Her sacrifice is a real sacrifice, because she could have enjoyed that time for her own pleasure. In contrast, the government’s real sacrifice is just 5 units of money, the value of real resources it spent on producing the note. So, the government enriches itself at the expense of the teacher who now has been given a note with real sacrifice of 5 units for getting eight hours of real services. This type of an unfair transaction is known in economics as an unequal exchange.

Danger of working on false promises

Why should the teacher agree to this unequal exchange? That is because she is promised that she could acquire a real basket of goods and services worth of 1,000 units of money with that paper. For instance, if a kilogram of rice is 1,000 units, she is promised one kilo of rice in exchange for eight hours of her time. If this promise is kept, then, there is no problem. But, if such currency is excessively produced, too much money would chase after too little rice and the price of rice would go up in the market. As a result, when the teacher goes to the market, if the price of rice has risen to 2,000 units of money, she could now buy only a half of a kilogram of rice. In other words, she has been forced to give up eight hours of her time for half a kilo of rice.

Inflation as a tax

The reduction in the basket of real goods she is now getting because of inflation is like a tax she has paid to the government. In this case, the tax is equivalent to four hours of her time. It is not different from a rule requiring the teacher to work four hours a day for the government for nothing! That rule obviously reduces her welfare. She undergoes this reduction of her welfare not on her own accord, but involuntarily. Such involuntary reduction of welfare in favour of the government has been caused by inflation and, therefore, known as inflation tax.

How is the inflation tax imposed?

Governments have appointed either central banks or currency boards as their agents for producing and supplying currency. Unlike currency boards which must maintain a hundred percent reserve of valuable assets (gold and hard foreign currencies such as Dollars, Euros or Sterling Pounds) for issuing currency, central banks are peculiar animals. They do not have to have a reserve of an equivalent amount and can issue currency simply by making book entries. In other words, they can acquire any asset by assuming a liability on account of the currency they have issued. For instance, if a central bank has to acquire a building, all it has to do is to open its vault and issue the required amount of currency to the seller of the building. After the transaction, the central bank has a building on the asset side of its balance sheet. But, at the same time, on the liability side, there is an equivalent amount representing the currency issue of the bank.

Exchange of a paper security for money printed by a central bank

Exchange of a paper security for money printed by a central bank

Governments impose inflation tax on society by borrowing from the banking system made up of the central bank and commercial banks. Both these types of institutions lend the government by creating new money just by keeping a small amount as reserves to back them. When such borrowings are made, the government would give the central bank and commercial banks a government security such as a treasury bill. The central bank or commercial banks, in return, permit the government to pay its bills by using that money. So, on the asset side of the balance sheet, the central bank or commercial banks have a treasury bill. On the liability side, this asset is matched by a new liability, the currency issue in the case of the central bank and government deposits in the case of commercial banks.

Production of seed money

While any borrowing from the banking system is inflationary, borrowing from the central bank is highly inflationary. That happens when the commercial banks make use of this currency issued by the central banks as seed money to produce more bank money in the form of deposits. When governments spend the currency borrowed from central banks, such currency finally gets back to commercial banks as deposits of the public. Commercial banks, in turn, use such deposits to create more deposits and credit. They create deposits and credit in multiple terms restricted only by the public’s preference for currency as against deposits and banks’ own need for keeping a safe cash reserve to meet public’s demand for cash.

In Sri Lanka, commercial banks could create bank money nearly ten times higher than the initial amount of currency issued by the central bank. Because of this ability to self-produce in multiple terms, (in Sri Lanka, that multiplier is about 10), the seed or reserve money produced by central banks is also called ‘high powered money’.

Creation of money in multiple terms

Thus, the total money in an economy would be much more than what a central bank would issue to the economy as reserve money. For instance, as at end-2020, the reserve money base of the central bank was Rs. 964 billion. But the total money which people could use for buying goods and services amounted to Rs. 9,406 billion. When that money which is known as money chases after the limited availability of goods and services, the general price level would elevate to a higher level. If it happens continuously, inflation sets in an economy imposing an inflation tax on people.

Why is there a preference for inflation tax?

There is a general preference for inflation tax for several reasons.

First, it is easy, quick, and convenient to borrow from the central bank and commercial banks, compared to imposing taxes. Such conventional taxes need to be backed by legislation, take time to generate the tax revenue and must be enforced by an elaborate tax administration. It also runs the risk of failing to generate the required revenue due to tax evasion and avoidance. But borrowing from banks is just a single transaction and the Treasury could use it immediately for making payments.

Second, because of the limitations of the tax bases in developing countries, there is resource paucity for governments to undertake much needed infrastructure projects. Hence, it has been argued that the governments in developing countries could initiate the development efforts by mobilising resources through inflation. The initial inflation so created would get reversed once the new economic development increases market supply by increased production. So, inflation would become a self-destroying process and, therefore, it is argued that there is no danger of using inflation for economic development.

Third, taxes are mandatory payments and therefore, but taxpayers make that payment unwillingly. Because of the pressure coming from the lobbying groups, political authorities too sometimes are unwilling to raise the tax rates to generate higher tax revenue. However, the resistance of the citizens to inflation tax is virtually non-existent. This is because no one realises that they are paying a tax to the government when prices move up. Any resistance by them is not against the inflation tax per se, but against the inflation. That again takes place after some time when they have been very badly hit by inflation.

Fourth, inflation is said to be bringing about some salutary effects to an economy from the point of view of its long-term growth. It re-distributes income in favour of the rich people who normally save a greater proportion of their income than the poor people. So, a country would get the much-needed savings through this inflation-induced re-distribution. It makes available funds for investment and through investment, ensures long term sustainable growth.

Due to the above reasons, inflation tax has been liberally used by many governments throughout the world. All post-independence governments in Sri Lanka too have used it liberally. With a reduced revenue base, the present Government is on to it in a big way.

The evils of the use of inflation tax

Though inflation tax has been preferred by many, it has been criticised on many grounds.

The first criticism is levelled on the ground that, when governments learn of this easy way of funding budgets, they would tend to ignore the more solid and sustainable forms of raising revenue, namely, through taxation. This type of behaviour is known in economics as ‘moral hazard’ behaviour. The danger of that behaviour is that it deprives the society of the opportunity to carry out public expenditure programs based on a solid resource base. It would reduce the government to the same unfortunate position of a student who has passed all his examinations by cheating. Then, one day when he could no longer do so to pass an examination, he would painfully learn that he has no in-built capability to face it on his own strength.

Inflation tax is also anti-poor. That is because the rich could avoid it by transferring their financial assets into real assets of which the price will increase along with inflation. These are called inflation hedging measures and the poor are unable to use them due to ignorance and lack of such financial assets. Hence, inflation tax squarely falls on the poor and causes a redistribution of income from the poor to the rich.

The second criticism has been advanced on the ground of the evils of inflation. They could be summarised as follows:

Inflation causes the market system to fail in its resource allocation function. This is because, inflation raises all the prices together and, for resource allocation, what is needed is the changes in the relative prices, i.e., the price of one commodity rises, but the price of another should fall to compensate the same.

Inflation discourages exports by functioning as a tax on exports. At the same time, it encourages imports by providing a subsidy. The result is a continuous shortage of foreign exchange and pressure for exchange rate to fall in value.

Inflation also taxes savers and subsidises borrowers. This happens when interest rates are not adjusted to ensure a positive real rate of interest rate in the market. Hence, savers would find that the real value of their savings falling and borrowers the opposite, along with inflation.

Inflation also causes an undesirable change in assets structure by favouring unproductive assets like real estate, gems and jewellery and discouraging the much-needed financial assets. This happens when interest rates are negative in real terms due to the non-adjustment of the rates to reflect inflation. So, people would shift from value-falling financial assets to value-appreciating real assets.

Inflation disadvantages the vulnerable groups with low bargaining power such as pensioners, housewives, students etc. It generates social disharmony and social tensions.

Inflation also raises the costs of local enterprises by raising the prices of inputs and wages. This would adversely affect a country’s comparative advantage.

Similarly, inflation also puts further pressure on the government budget by raising current expenditure due to increases in the prices of inputs and the salaries of employees. It also causes the revenue to fall behind the increases in the national income.

Therefore, the use of inflation as a measure for funding government budgets is not an advisable strategy for any government.

Wisdom of Singaporean leaders

This was very cogently expressed by Dr. Goh Keng Swee, economic pundit behind Singapore’s economic miracle, in his reminiscences of why Singapore chose to retain the currency board system, as follows:

“Financing budget deficits through Central Bank credit creation appeared to us as an invitation to disaster. There was no effective way of exchange control in an open trading economy like ours to deal with inevitable balance of payments troubles.

……The way to better life was through hard work, first in schools, then in universities or polytechnics and then on the job in the workplace. Diligence, education and skills will create wealth, not Central Bank credit.”

The demon’s revenge over Zimbabwe

There is no better explanation of the evils of inflation tax than the above statement of wisdom. Countries which did not have this wisdom fell through the line and were gripped by uncontrollable hyper-inflation in their economies. In early 2000s when Zimbabwe’s hyperinflation, according to private analysts, was more than 1 million percent, its Central Bank Governor, Gideon Gono, lamented by equating his country’s hyperinflation to an economic HIV, an epidemic that would kill people on a mass scale. But today one may also equate inflation tax to infecting the whole population with COVID-19.

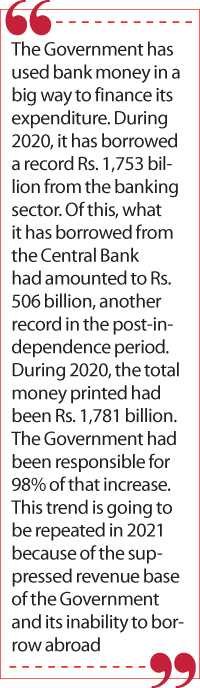

The demon at work in Sri Lanka

Present Sri Lanka Government has used bank money in a big way to finance its expenditure. During 2020, it has borrowed a record Rs. 1,753 billion from the banking sector. Of this, what it has borrowed from the Central Bank had amounted to Rs. 506 billion, another record in the post-independence period. During 2020, the total money printed had been Rs. 1,781 billion. The Government had been responsible for 98% of that increase. This trend is going to be repeated in 2021 because of the suppressed revenue base of the Government and its inability to borrow abroad.

But prices have not increased officially because of the price controls. But nowhere in the market goods are available at those controlled prices. When inflation sets in defying the Government’s price controls, it will certainly feel that it has badly handled the demon. It behooves on Governor Lakshman and the Monetary Board of the Central Bank to warn themselves of this possibility before it becomes too late.

(The writer, a former Deputy Governor of the Central Bank of Sri Lanka, can be reached at [email protected].)