Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 30 June 2020 00:15 - - {{hitsCtrl.values.hits}}

In keeping with such international policy measures, the Central Bank of Sri Lanka (CBSL) also introduced extraordinary regulatory measures to provide relief to pandemic-affected individuals and businesses

Addressing the Seventh Asian Monetary Policy Forum, Chief Economist of the International Monetary Fund (IMF) Gita Gopinath stated that the world economic growth trajectory was on a shrinking trend. It will very likely be worse than what we had projected, she said.

While most of the economies are focusing on re-opening, there have been reports regarding a possible second wave of the COVID-19 pandemic as well. The adverse impacts this can have on economic resilience does not require elaboration. The novel corona epidemic generated exceptional challenges which required exceptional solutions. Financial regulators have come up with very flexible macroprudential support to address acute market stress during the pandemic.

In keeping with such international policy measures, the Central Bank of Sri Lanka (CBSL) also introduced extraordinary regulatory measures to provide relief to pandemic-affected individuals and businesses. Accordingly, Domestic Systemically Important Banks (D-SIBs) and non-D-SIBs were allowed to draw-down their Capital Conservation Buffers by 100 bps and 50 bps, respectively, to facilitate uninterrupted credit flows to the economy.

The CBSL also withdrew the requirement to classify all credit facilities extended to a single borrower as non-performing when the aggregate amount of all outstanding non-performing loans granted to such borrower exceed 30% of total credit facilities.

Sri Lanka’s business sector has been facing extreme challenges as the pre-Covid-19 economy also carried dark spots which have now been compounded. The tourism and travel industries were severely affected by the Easter Sunday bombing which occurred, in April 2019, and all businesses, in general, were affected by the pre-election political uncertainty which emerged towards the latter part of 2019.

The banking sector was required to assist such businesses by providing debt moratoria and other relief packages introduced by the authorities during 2019 and in the beginning of 2020. The COVID-19 pandemic added new challenges for the country’s business sectors which were already vulnerable. In response, new debt repayment deferral policies were introduced to alleviate cash flow pressures on businesses and households.

All such persistent fragilities in the economy and uncertainty about an end date of the health crisis have put severe strains on the financial system. The CBSL, as the prime regulator of the financial system, has a crucial task to ensure banks keep credit flowing to the real economy while preserving the safety and soundness of individual institutions and the entire system. However, the regulator alone cannot prepare the financial system and the economy to withstand the unfolding of a crisis of unprecedented scale.

The purpose of this article is to invite the attention of all the stakeholder authorities to focus on the need for policy measures to be formulated to strike a delicate balance between the positive countercyclical role of financial intermediation during a time of an unprecedented crisis and the need to preserve the resilience of the financial system.

Financial intermediation: The lifeblood of the economy

Scope Insights Managing Director Sam Theodore says: “The most rewarding outcome for a bank in the age of the pandemic should not be closing a juicy commission-rich deal but saving a business from virus-triggered bankruptcy and its employees from being laid off.”

The banking and financial sector has a vital role to play as systemic stabilisers in a crisis of this nature. If the pandemic-affected businesses are assisted during this difficult time, the financial sector can thrive when the economy turns around. It is, therefore, important to follow responsible banking principles to be supportive to communities and enable economic activities that create shared prosperity for current and future generations. Providing timely and appropriate advice, enhancing accessibility to service, identifying most vulnerable segments and upgrading consumer protection frameworks will lead to strengthen banker-customer relationship. Banks need to take proactive measures to be partners of a solution for the crisis.

However, one needs to appreciate that the capacity of banks to play this role will depend on country specific circumstances as well. In most of the jurisdictions, banks have been encouraged to partner with government authorities and Central Banks in assisting affected businesses. Government support has included both aggressive monetary policy loosening and regulatory relaxation by Central Banks and comprehensive fiscal stimulus packages. In the absence of a substantial backing from the fiscal side, banking sector being constrained by credit risk is an inevitable outcome.

While carrying out the financial intermediation function efficiently and effectively which has now become a national priority, banks need to impose self-governance mechanisms to ensure improved transparency of balance sheets, maximum possible compliance with prudential standards, enhanced internal controls and a close dialogue with regulatory authorities through efficient disclosures. It is uncertain exactly when we will be able to have a clearer view of the impact of the pandemic.

Similar to the advice given to the general public to learn to live with the coronavirus, financial institutions also have a responsibility to guard against their soundness being fundamentally undermined. The financial system staying healthy and safe is critical for the road towards sustained recovery. The CBSL had taken regulatory measures to ensure banks build regulatory buffers to cushion risks stemming from crisis scenarios. However, the preparedness of the banking sector to face rapidly unfolding new challenges due to prolonged economic downturns needs constant review. This becomes even more important given the challenges for banks to build up buffers in the context of dwindling assets quality.

Possible spike in non-performing assets in 2020

Analyses conducted on Sri Lanka’s financial sector report that banks and financial institutions are likely to experience a hike in non-performing loans (NPLs) and credit cost due to the persistent slowdown in the economy. Declines in remittances, fallout in the tourism sector and outflows of foreign investments may exacerbate the challenges faced by Sri Lanka’s financial sector.

Fitch Ratings announced that a reversal in the currently loosened NPL classification requirements as the economy recovers could see the banks’ NPL ratios rise significantly. According to PwC Sri Lanka, due to difficult operating conditions, the performance of the banks and particularly NBFIs will be challenging and there will be impacts on the asset quality and profitability recovery of the said sectors. They further state that non-performing loans, in 2020, will increase due to the six-month debt moratorium given to COVID-19 affected sectors. Debtors with more chronic problems are going to be in vulnerable zones once the payment holidays expire.

Trimming down investments in bank equity

A gloomy picture of economic growth, narrowing net-interest margins, declining non-interest income and high possibility of loans going sour due to declining economic activity could make investors uncertain about being in the bank equity market.

Operating business continuity plans for an extended period and providing infrastructure required during the lockdown may have caused increased operational costs for banks. Although banks have got an opportunity to grow their loan books, borrowers are in very vulnerable situations. These circumstances will pose significant challenges to banks in strengthening their capital holdings.

According to Fitch Ratings, the resulting impact of these challenges on Sri Lankan banks’ profitability could offset the benefits from the reduction in taxes announced in 2019. It is also said that generating internal capital via profits could be reduced due to weaker margins and higher loan impairment charges amid the heightened operating environment risks.

Emerging solvency challenges

According to the Harvard University, there is a realistic probability of a ‘pandemic’ of bankruptcy filings in the near future. An Euler Hermes study reports that global insolvencies are likely to rise by 20% in 2020. The preparedness of Sri Lanka’s court system for a surge of corporate bankruptcies and the availability of required legal expertise has not been evaluated.

In the absence of a special bankruptcy code, addressing emerging solvency challenges will be problematic. Towards the end of payment deferral programs, banks will be able to see the viability of their borrowers. It would be important for banks, therefore, to be ready with documents to deal with insolvent borrowers once the eventuality occurs.

The regulator’s dilemma

Financial regulators all over the world are facing the unprecedented challenge of striking a delicate balance between efficient flows of credit to businesses and preserving the resilience of the financial sector. No economy can afford to let the crisis in the real sector to spill over to the financial sector. It is vital to prevent the health and economic crisis morphing into a financial crisis.

Moreover, the decline of interest rates may discourage depositors and curb supply of loanable funds. It can create ripple effect on the cost of funding for banks. One needs to examine whether increased liquidity through reduced statutory ratios and capital buffer releases would bridge the gap between the supply and demand for loanable funds.

In addition, the financial regulator will have to face blame from special groups, such as senior citizens, in this scenario of reduced interest rates. Off-setting fragilities emerging from loan losses and the constraints in making money through deposits and lending by banks is a painful task for the regulator.

How long can the regulatory forbearance prevail?

The CBSL will have to balance a challenging task of getting banks to support the economy while restoring internationally agreed regulatory standards. Regulatory tolerances cannot be continued for an extended period. Deviating from international best practice for a prolonged period could sow the seeds of future risks that potentially undermine the medium-term soundness and health of the banking system (IMF).

Pre-existing financial vulnerabilities in Sri Lanka’s economy, including challenging debt dynamics and lack of fiscal discipline, may impede creating a conducive and competitive environment for businesses. It also constrains the CBSL’s capacity to manoeuvre less stringent regulations for the financial industry. No one knows when the next crisis will hit the economy and the nature of it.

Preparation for uncertain times needs to be a “business as usual” element for banks, particularly as Sri Lanka is one of the most vulnerable countries to the effects of climate change which are increasing in frequency and intensity. Therefore, regulatory authorities will find it difficult to extend flexible regulatory approach for a long period. Prudent action would require banks to get back to the track of building buffers for financial soundness.

The need of a right policy mix

The CBSL, as the apex monetary authority of the country, has been adopting an accommodative monetary policy since the beginning of the year 2020. However, the right mix of monetary and fiscal policy to buffer the impacts of the health crisis has not been there as budgetary and non-budgetary fiscal tools were not adequate. In tandem with the monetary policy responses to the economic crisis emanating from the health crisis governments introduced various fiscal stimulus packages.

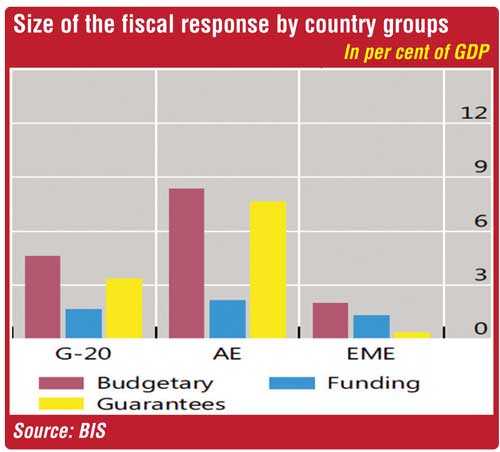

These included budgetary measures, such as spending on health care, transfers to firms and households, wage and unemployment subsidies and tax cuts or deferrals. According to the Bank of International Settlement (BIS), non-budgetary measures consisted of funding and credit guarantees. Loans by government and other financial agencies and financial support including equity injections to strategic firms, come under funding category.

The size of the fiscal stimulus packages has been varied depending on the fiscal space of each country. Advanced economies have introduced fiscal support which reached 15-20% of GDP whereas the magnitude of the packages of emerging market economies registered 5-10% of GDP. However, Sri Lanka has been able to provide only a very marginal support of 0.2-0.3 % of GDP. The absence of adequate fiscal room has been the reason for Sri Lanka’s relatively weak fiscal stimulus assistance.

According to BIS, financing costs and hampered access to external financing constrain the fiscal response of emerging economies. The lack of broader social safety nets has also been instrumental in enhancing the pain of the crisis for Sri Lanka’s households and businesses. Well-coordinated, coherent economic policies need to be put in place to overcome aforesaid challenges.

Improving the country’s credit profile

A sound credit profile of the country is a strong determinant in addressing difficulties in building external financing. As former Governor of the CBSL, Dr. Indrajit Coomaraswamy, emphasised Sri Lanka has handed over significant economic sovereignty to international markets and credit rating agencies. Sri Lanka will have to, therefore, rely on international financial institutions and markets in meeting the extremely challenging external sector financing issues.

A country’s GDP growth and GDP per capita; export revenue; and external financing and internal reserves are key quantitative indicators used by rating agencies. Furthermore, political stability and policy predictability, investment climate, financial system stability, rule of law, corruption control, voice of people, regulatory quality, government’s effectiveness and crime and violence level are some other qualitative variables taken into consideration in this exercise. Institutionalising policies and preserving the independence of regulatory agencies also bear a significant weight in sovereign rating methodology.

Upgrading the country’s credit profile should, therefore, be a collective task of the government, the opposition, law enforcement and other government agencies. The CBSL alone cannot be expected to play this role. Financing conditions of Sri Lanka will have to be improved to expand fiscal measures for supporting businesses during the recovery phase and future crises.

Exploring the possibility of establishing a Credit Guarantee Corporation

Most of the governments have introduced guarantee programs to facilitate lending to affected businesses. These guarantee schemes help mitigating possible credit rationing due to risk averse decisions of banks. It is argued that the Impact on fiscal balances will be triggered only in the event the borrower defaulting and therefore, the short-term fiscal impact of the guarantees is limited. These public guarantees help incentivise bank lending. However, due to restricted fiscal capacity, Sri Lanka has not been able to implement such credit guarantee schemes and the CBSL has been compelled to bridge the gap.

Given the crucial role played by the Micro, Small and Medium Enterprises (MSMEs) in the economy in terms of generating economic activities and providing employment opportunities, it is of essence to ensure continuous credit flow to this sector. However, lack of adequate collateral, information asymmetry, inadequate capital, high administrative costs and increased risks associates with MSMEs have caused constraints for banks in granting financial assistance to this sector. This has been a prolonged problem and not limited to the current crisis.

Exploring the pros and cons of establishing a Credit Guarantee Institution (CGI) would, therefore, be important in obtaining the maximum benefits from MSMEs for the inclusive economic growth agenda. Such an institution will help MSMEs in overcoming challenges related to access to finance during crisis situations, as well as normal times, by providing credit guarantee services. Operational deficiencies related to credit guarantee schemes can also be addressed through a dedicated institution.

The SME Credit Guarantees Fund established by the Taiwan Government is considered a success story from which to draw experience for Sri Lanka (De Alwis and Basnayake 2009). Credit Guarantee Institutions in India, Malaysia, Nigeria, Chile, Indonesia, Canada, France, Germany, Thailand, Brazil, Korea and Japan are also some other examples. Of these, some CGIs are entirely public institutions and there are public-private models as well.

CGIs in Germany and Italy are owned by private bodies. It would be worthwhile proposing a CGI under the forthcoming budget proposals given the urgent need to attach priority to a continuous funding flow to the MSME sector. Institutional architecture and funding can be designed drawing on international experience.

Borrowers should not live beyond their means

Beneficiaries of payment deferral programs should have very stringent financial discipline to use the loan proceeds in a productive manner. Mismanaged debt will cause them to end up with far lower living and business standards. It is important to understand that banks should also be sustainable like other businesses in the economy. Prioritising activities should, therefore, be a must for households and as well as businesses. Attaching priority to reduce expenses and borrow as a last resort would be a prudent strategy.

Without tinting a rosy picture in reports to banks, borrowers need to be realistic and trustworthy. Instead of continuing with the same business plans that prevailed prior to Covid-19 pandemic, businesses need to revisit them to improve productivity.

Business models should be restructured by bringing in more viable options. Sustainability in the context of the “new normal” needs to be planned carefully by switching resources from less productive sectors to more vibrant fields.

Firms with poor credit history need to stop living beyond their means. There are dozens of Government institutions in Sri Lanka entrusted with mandates to promote SME sector. Efficient collaboration of such institutions and business chambers is needed to provide technical assistance, marketing avenues and facilities to ensure sustainability of affected industries. These credible plans will help ensuring the flow of credit to needy sectors efficiently.

It is important to mention the possibility of loan proceeds being diverted for personal use by businesses and households which do not have urgent funding requirements. The credit appraisal process, therefore, needs to take place in accordance with applicable regulations. Financial entities need to guard against such downside risks associated with pressure for expeditious loan programs.

Path ahead

During this high uncertainty environment regulators are confronted with the difficult challenge of balancing facilitation of credit flows to support the recovery of the economy with maintaining the stability of financial institutions. Continued downward forecasts of economic growth bring challenges for credit decisions of financial entities.

While supporting the recovery of businesses and households as much as they can, banks need to take account of their fiduciary responsibility to depositors and shareholders by exercising due care regarding the prospect of deteriorating asset quality, profitability destruction and capital impairment over time. In this connection, targeting affected borrowers and sectors instead of mass loan programs is likely to be more effective in both boosting recovery and mitigating moral hazard. Increasing strain on the financial sector due to deteriorating credit quality can be eased to a certain extent through a risk sharing mechanism. Establishing a Credit Guarantee Institution could be a solution for longstanding sustainability issues in the MSME sector. In addition, fiscal policy needs to play its role in redirecting funds to the priority sectors of the economy and fiscal capacity needs to be strengthened for this purpose. A conducive economic environment is vital to enable banks to build buffers amidst the persistent fragilities of the economy as otherwise they will not be well placed to absorb macro and micro-economic shocks of a future crisis.

Comprehensive and coordinated efforts by fiscal and monetary authorities, private sector organisations as well as individuals and households are vital in bringing the economic recovery within a better framework. Priority also needs to be attached to addressing structural issues in the economy, which are beyond the regulator’s remit. Every stakeholder’s equal commitment will lead the country’s economy to a better footing to rise after COVID-19 pandemic.

“It’s only when the tide goes out that you learn who has been swimming naked” – Warren Buffett.

(The writer is Deputy Director, CBSL, Attorney-at-Law, and can be reached via [email protected]. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)