Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 15 January 2019 00:08 - - {{hitsCtrl.values.hits}}

(5) Approach to FTAs of other countries

(a) Lessons from India-EU FTA negotiations

It is good for Sri Lankan negotiators to learn from their counter parts in India and EU. This is an exemplary occasion where negotiators from both India and EU showed their commitment to the cause of each country at the negotiating table and how EU-India trade negations ended up abruptly.

According to Times of India – a well-respected newspaper in India – negotiations on India’s FTA with the EU had started in 2007, and since then 16 rounds of discussions have been held at the chief negotiator level. However, since 2014, when the 16th round was held, the negotiations have been suspended, as the negotiators were not able to arrive at a compromise solution to address the EU’s key demands. As of today, neither party has shown any interest to resume negotiations.

What are the reasons for the standoff on negotiations? According to informed sources says it happened due to the EU’s demands for India to eliminate duties on dairy, automobiles, wines and spirits while India’s main demands included those on data security status, which are key for India’s information technology sector. India had also sought easier temporary movement of professionals in the services sector. India was of the view that the EU was being rigid in giving access to services, while new data security and transparency laws would affect many Indian companies.

For many scholars and experts, the India-EU FTA is on the verge of death. It is widely believed that the formal announcement on closure of business on trade negotiation is expected in the near future. This is an excellent example that if negotiators feel that FTA negotiations cannot bring the expected benefits to their respective countries, they should not be afraid or hesitate to pull out of trade negotiations.

(b) Lessons from USA

In this context, we draw the example from US process adopted at NAFTA negotiations. The US Government with a view to expediting negotiations under NAFTA (North American Free Trade Agreement) used the fast track approach but only after getting the approval from congress!

What is fast track authority? In the USA, if the President negotiates a trade agreement that requires changes in US tariffs or in other domestic laws, that trade agreement’s implementing legislation must be submitted to Congress – or the President must have Congress’ advance approval of such changes.

Fast-track authority is given by congress to the president with a view to expedite the negotiation and finalise the tradeagreement.it requires Congress to approve or disapprove the trade agreement without reopening any of its provisions or changing negotiating points!

Ultimately, fast track gives the President credibility to negotiate tough trade deals, while ensuring Congress a central role before, during and after negotiations. The authority puts America in a strong position to negotiate major trade agreements and maintains a partnership between the President and Congress that has worked for more than 20 years.

However, even after introducing this fast track model, still the trade negotiations for NAFTA passed through the times of three Presidents – Ronald Reagan, George H.W. Bush and Bill Clinton.

(c) Sri Lankan experience

It is evident that the practice adopted in Sri Lanka clearly deviates from the standard practice and accepted norms of trade negotiations. Though such practices can vary from country to country, certain minimum standard practices should be maintained.

During the SLSFTA (Sri Lanka-Singapore FTA) negotiations, the Government introduced a similar model of “fast track” to finalise FTA. However, in the case of Sri Lanka’s fast track model for FTA negotiations, has there been an accepted mechanism on the part of the Government to grant such approval?

In the first place, as per the Presidential Committee of Experts to evaluate the SLSFTA it should be remembered that negotiations on SLSFTA were begun even without a proper Cabinet approved mandate!

FCCISL learns that in the case of Sri Lanka’s FTA negotiations with Singapore, the GOSL exerted pressure on the negotiating committee to work according to a tough set of dates to conclude negotiations.

This unusual practice of setting a tight-time schedule for completion of negotiation without giving breathing space for any preparatory process or to formulate a rational strategy for negotiating such an FTA may have certainly put Sri Lanka at a disadvantage.

According to informed sources, Sri Lanka seems to have agreed to a cut-off date to conclude negotiations. To divulge or disclose the end date for negotiations is not an accepted principle when a country is negotiating for a FTA with another country.

Because of this unwanted disclosure, Sri Lanka’s chances of negotiations and bargaining power were considerably reduced the since other party (Singapore) was sure that agreement would follow by the due date for signing of agreement in whatever form! We have reasons to believe that there would have been more unresolved issues than solved issues in the FTA though it was signed on the due date.

According to informed sources the “Negotiating” Committee had to merely engage in a time-bound exercise and was not guided by the implications of binding commitment which should have been thoroughly understood perhaps with the backing of sectoral studies. These require in-depth understanding of implications and hence hard negotiation to gain tangible benefits and promote trade and economic interest of the country. It is no doubt these deviations from the standard practice and accepted norms of trade negotiations had been more advantageous to Singapore.

Today SLSFTA stands as a controversial FTA with more questions than answers to trade and with less credibility. Finally it’s now seen by majority of the business community as a FTA hostile to Sri Lankan business interest.

(d) The level of transparency and practice in the UK

The UK Government ensures publishing scoping assessments before entering into negotiations with partner countries and publishes an impact assessment later in the process, at an appropriate time. (Source: An information pack for the consultation relating to a bilateral Free Trade Agreement between the United Kingdom and the United States by the Department for International Trade in the UK).

Sri Lankan case: Even though the chief negotiator of the FTA with Singapore had several rounds of discussions with trade chambers, the business community was not informed of the impact assessment on tariff liberalisation.

The next section of this article is focused on unrealistic benefits expected through FTAs without the backing of analytical studies. We deal with two such justifications used by policymakers to promote FTAs.

(6) Are there prospects for Sri Lanka to enter into Global Value Chains (GVC) through FTAs?

One of the main justifications for Sri Lanka to enter into FTAs, often quoted by politicians and policymakers, is that Sri Lanka would be able to enter into the global value chain using FTAs.

In this case, FCCSL would like to know whether there has been any prior analytical study, evaluation, or identification to understand where exactly and in which industries Sri Lanka has such opportunities.

FT Link

FCCISL on Government’s road to FTAs: How rational? Part 1 was published in the Daily FT of 14 January and can be seen at http://www.ft.lk/columns/FCCISL-on-Government-s-road-to-FTAs--How-rational--Part-1/4-670765.

Do Sri Lanka’s manufacturing and/or services sectors possess the capacity or a completive advantage or way forward to enter into this much-talked GVC through liberalisation of products, services, and investments? How can Sri Lanka engage in dismantling its regulations across a broad spectrum of products, services, investments, intellectual property, IT, etc. when it has not done a due diligence study or assessment on its preparedness or prospects for GVC linkages in FTAs?

All these questions not only remain as unanswerable to date but also will remain as an index of wisdom of our policymakers who strongly advocate for FTAs and trade liberalisation in the country in a haphazard way.

FCCISL accepts the fact that integrating into regional or global GVCs is undoubtedly a desirable goal of Sri Lanka, yet it seems that this wishful expectation of the pro-FTA camp based on textbook theory is not realising realities such as bottlenecks exist at our own backyard.

In this regard, the Global Value Chain Development Report 2017 by World Bank Group (Measuring and Analysing the Impact of GVCs on Economic Development) offers some valuable insights on the conditions, criteria or economic infrastructure required for successful integration in GVC. Accordingly, there are a host of factors that Sri Lanka should first check on its wishful thinking before its entry into the GVC through a FTA. These factors range from comparative advantage, network, and connectivity and to neighbourhood partnering, etc.

(a) Chinese approach

In this regard it is very useful to learn from the Chinese approach before making a decision on selection of countries to enter into Preferential/Free Trade Agreements. An analysis of China’s Free Trade Agreements reveals that the selection of countries is primarily decided on the basis of a country’s GVC position, particularly its comparative advantage amongst other factors.

Moreover, factors as to the depth of the FTA, whether it is a shallow or deep agreement, what kind of partnering FTA countries the agreement is entered into, all these factors stated above have a strategic role to play in determining whether these so-called GVC linkages will take place.

Generally an approach to FTAs begins in China with its assessment about the country’s GVC position in the market. This is in contrast to the Sri Lankan Government’s position that by signing FTAs it will naturally promote country exports through its value chain.

(b) Productivity improvement for export competitiveness of Sri Lankan products

Going for FTAs without addressing productive capacities and productivity improvement seems like putting the cart before the horse. This is because most of our products have perennial productivity issues coupled with Sri Lanka’s high interest rates and lack of efficiency, directly affecting the competitiveness of Sri Lankan exports and eventually the GDP of the country.

Industrial sectors across the board are faced with acute productivity issues that make our products uncompetitive in the world market. While there are micro-level or firm-level issues of productivity, much of these issues are beyond firms and industry levels.

It is the widespread opinion of the SME community that, without adequate measures to address productivity and competitiveness issues, Sri Lanka’s attempts to enter into Free Trade Agreements with other developed countries such as Singapore, Korea and China that maintain very high productivity level across their industries could make the situation worse.

It is also noteworthy to mention that Sri Lanka has still not been able to reap expected benefits from the FTAs signed so far or unilateral tariff concessions granted by EU under the GSP+, and in reality, many SMEs face extinction. Low-priced, often substandard imports from the Indian sub-continent have flooded the Sri Lankan market, when Sri Lanka’s leading exports such as apparel, tea, rubber and spices to the Indian subcontinent have faced non-tariff barriers and other trade obstacles.

(c) Is there a link between FTAs and FDIs?

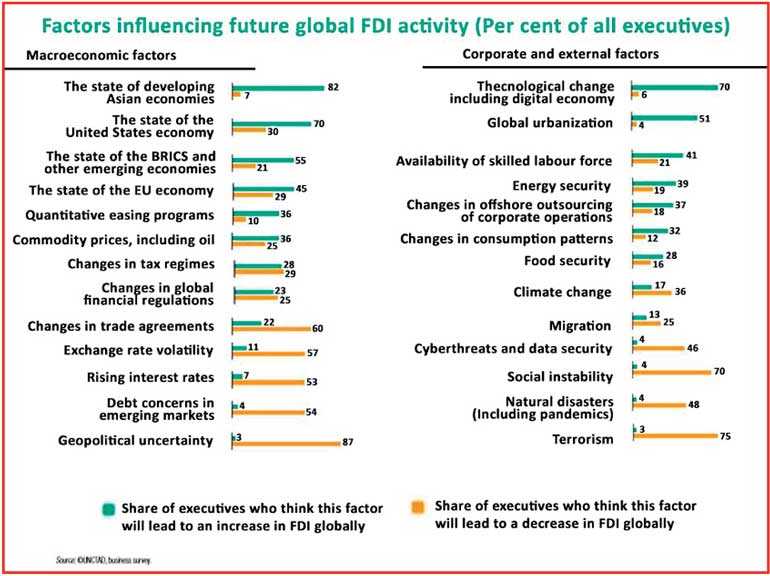

This is yet another justification that FTAs promote FDIs. This justification is also somewhat exaggerated as the flow of FDI into the country is determined by a host of other factors. This is well evident in annual business surveys conducted by UNCTAD. This business survey is done based on factors influencing future Global FDI activity and in 2017 the business survey was done using top class corporate executives. It can be observed from the diagram extracted from this survey that various factors, which consist of range of macro-economic, corporate and external factors that may affect world investments and the intensity level of each factor in deciding future FDIs.

According to this survey it’s evident that signing a FTA is just one factor out of many factors influencing FDIs and even the FTA factor is not considered positively by a majority of executives who took part in the survey. In effect FTA is not a key driver of investments into a country and this is in contrast to Sri Lanka’s position where it’s often said that FTAs will pour FDIs into the country.

However, in the recent past the Sri Lankan Government took some commendable actions such as getting back GSP+, launch of Trade Information Portfolio (TIP) and National Export Strategy (NES) to facilitate exports with the technical support of ITC and World Bank. The designing of National Single Window (NSW) is another positive step taken by GOSL to facilitate trade and we believe this integrated platform is expected to reduce the transaction cost of our imports and exports, giving advantages especially to the SME sector.

FCCISL fully support the efforts of GOSL in achieving the WTO trade facilitation process under each category (A,B,C) and hopes once implemented Sri Lanka will get some advantages over some of its competitors in the region.

(7) Challenge of dealing with bigger and incomparable economies for trade

Defending Sri Lanka’s right to guard its national interest against substandard goods likely to come through FTAs and unfair trade practices of exporters from other countries.

Definition of market economy: A market economy is an economic system in which economic decisions and the pricing of goods and services are guided solely by the aggregate interactions of a country’s individual citizens and businesses. There is little Government intervention or central planning.

Consequences of non-market economy are as follows:

(a) Under the legal structure of the WTO the designation of a particular country as a “Non-Market Economy” (NME) allows importing countries to use a special framework to determine whether the exporting country is selling its products at unfairly low prices and, if that is found to apply special anti-dumping duties, above normal tariffs, on imports that are sold at less than the price in the exporting country, less than the cost of production, or, in certain circumstances, less than third country prices. The purported goal of anti-dumping duties is to reduce the impact of artificially low pricing of exported goods on domestic manufacturers in the importing country.

(b) WTO law further allows consideration of third-country prices when attempting to determine whether a country with NME is dumping its goods in to the importing country. Under this, an importing country has greater flexibility to use arbitrarily selected high third country prices as a reference for determining dumping by exporters from NMEs than it does for exporters from market economies. This greater flexibility makes the comparison with import prices more likely to result in a higher dumping margin and, consequently, allow for a higher anti-dumping duty.

(c) Case of China: As of 2017, China has been the Sri Lanka’s second largest import destination after India. It has a massive production capacity supported by Government subsidies and a large workforce. It is a very interesting topic to study as it also covers the ongoing trade dispute between USA and China. In this context, it is important to understand the concept of market economy – the crux of the matter for the trade dispute between USA and China. China has become the “world factory” and has become the leading sourcing destination for most of the countries. This is a great achievement for China after opening its economy in ’80s. China joined the World Trade Organization (WTO) in 2001 under Article 15 of the protocol and has been subject to a special presumption that it is a Non-Market Economy (NME). Under this arrangement China committed to undertake several reforms, regarding, for example, subsidies, management of State-Owned Enterprises (SOEs), and liberalisation of its banking system, etc. to show that China is transforming the economy into a market economy acceptable to WTO member states. However, there is strong evidence to the effect that, even after 16 years’ accession, China still has not completed its transition process. The World Bank has published a study about China where it affirms that the Government continues to dominate key sectors and that close links between the Government, big banks, and State enterprises have created vested interests that inhibit reforms and contribute to continued ad hoc State interventions in the economy. In truth, China still relies heavily upon SOEs to implement public policies conceived by the Chinese Government. However, this special presumption that China’s Non-Market Economy (NME) status by WTO expired on 11 December 2016, and China argued that it must now be accorded with market economy status.

(d) USA’s stand on China: The US Department of Commerce argued that a 1930 tariff law in the US requires some criteria (convertibility of currency, bargaining right for wages, permitting Joint Ventures or other investments by firms of foreign countries, non-government control production and resource allocation, non-governmental administering authority) to grant the market economy status to a country. Based on these criteria, Department of Commerce of USA has determined that China still does not meet any of these factors and, therefore, cannot be granted market economy status.

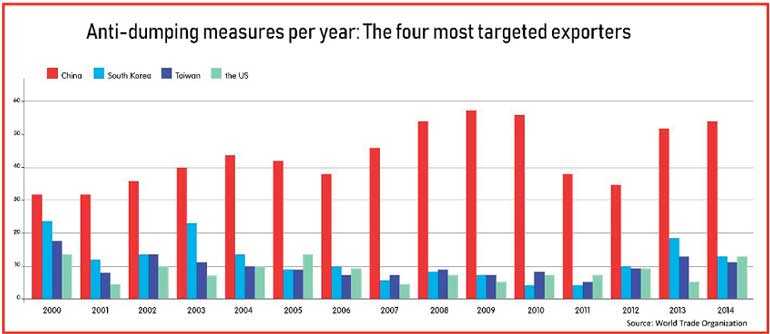

(e) Sri Lanka’s stand on China and implications: Sri Lanka has obviously conceded market economy status for China in the WTO, by desisting from objecting to the lapse of the protocol in 2016. By doing so we seem to have given away the rights to establish a viable anti-dumping duty mechanism on Chinese goods if found guilty for exporting through FTA or outside, which more developed countries as USA, EU and also India are retaining to date. This would severely hamper the effectiveness of the Sri Lankan Government’s much hailed legal enactment – The imposition of anti-dumping law to prevent imports coming to Sri Lanka from a country like China at unbelievable low prices. Now the question is, what is the possibility or quantum of anti-dumping duty that Sri Lanka could ever impose on undervalued imports from China? Anti-dumping duties investigations are by no means easy or always possible to impose because the difficulties arising in proving that the goods are being “dumped” as per the WTO prescribed legislation. Therefore, the status of market economy conceded to China by Sri Lanka puts certainly Sri Lanka at a disadvantageous position. Further, Sri Lanka will also lose the right to compare Chinese export prices with prices of a third country. Sri Lanka will have to accept the subsidised domestic prices given by Chinese companies. Given the Chinese system within the country, the lack of transparency, language barriers, and the centralised protectionist system in China will work against the interest of Sri Lankan domestic manufacturers. Finally, it is noteworthy to say that China is the country which has the highest anti-dumping cases against its exports! (See diagram.)

The Trade Remedy Law in Sri Lanka often touted as the great protector of the local industry against ill effects of FTAs and unfair business practices of importing countries is now broken at the stem and the question is, how can Sri Lanka withstand the onslaught of Chinese products if priced unreasonably under the proposed FTA to Sri Lanka?

(The writer is Secretary General/CEO of FCCISL. He was a member of the NTFC study tour to Australia in 2018 organised by ITC/EU.)

(To be continued.)