Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 10 September 2020 00:20 - - {{hitsCtrl.values.hits}}

Whilst the world is challenged with the COVID-19 virus attacking over 26 million people with 0.8 million deaths, we see the real impact of from the pandemic is emerging only now. None of us are sure on the originator of the virus but it can be branded ‘economic terrorism by COVID-19’.

Why economic terrorism?

India announced that the economy has contracted -23.9% with unemployment hitting 24% in Rajantan and 20% in Delhi, which means millions of people have lost their sources of income. I guess when an economy contracts at such high proportions it virtually dismantles the total supply chain of a country. This will mean that a V-shaped recovery is almost impossible. I guess time will tell.

Latest research reveal that almost one fifth of the 1.2 billion Indian population has been exposed to COVID-19 and 68,000 have succumbed to it. Chennai is worst hit according to the early reports coming in. The daily COVID-19 patients topping 98,000 last Saturday beating all statistics of any country has placed vaccine makers under severe pressure.

We see a similar situation emerging with Australian economy contracting by -7% and Brazil at -9.7% GDP growth and early reports say that the British economy has spiraled to -20%. I guess the real numbers will emerge soon. Some are calling this ‘economic terrorism at its best by the COVID-19 virus’.

Sri Lanka at -1.6%

In this backdrop the Sri Lankan economy has contracted by -1.6% in the first quarter which factored in only 10 days of the lockdown. This has resulted in the tea harvesting declining by -27.5%, the overall construction by -16% and the apparel industry registering a downward number of -13.6%. This gives us an indication of what can happen in Q2, 2020.

It was in the second quarter that the real impact of the lockdown hit Sri Lanka which is sure going to be severe that can be labelled ‘economic terrorism hitting Sri Lanka’. The overall unemployment rate has increased from 4% to 5.7%. This can be only be a tip of the iceberg to my mind. The real impact of the COVID-19 virus will be seen in quarter 3.

The logic is that the elections injected money circulation to the system that would not be captured by the formal sources of data. The debt moratorium will cease to some sectors in September, and given that the SMEs account for 73% of the economy Sri Lanka’s banking sector will get a better view of the reality by October 2020.

|

President Gotabaya Rajapaksa |

SL consumer already hit?

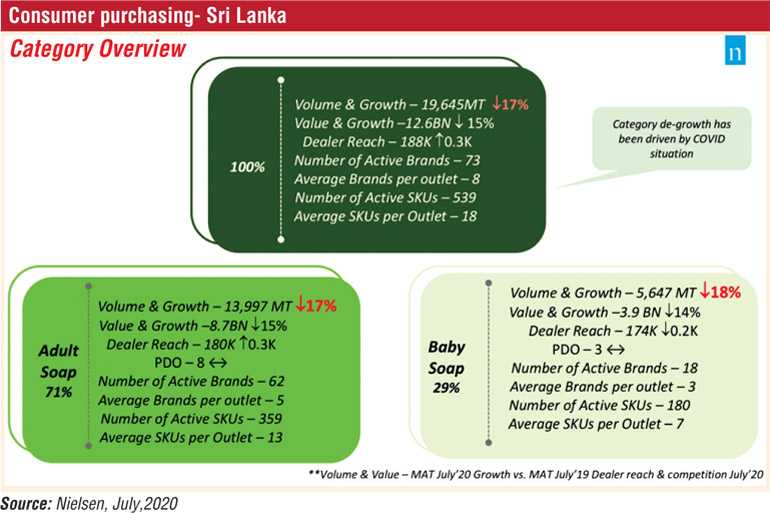

Whilst the macro variables keep getting hit, if we look at the reality at the Sri Lankan household the numbers are not very encouraging. I have taken some public data released by the top research agency Nielsen. MAT, July, 2020 reveal that the overall adult soap consumption has declined by -17% and baby soaps by -18% which means that people are cutting corners given the pressure on the purse. Baby soap in particular dropping at a higher level means that things at the consumer end are getting rough.

Whilst the thrust on busting the ‘drug’ menace can be socially very positive, we need to keep in mind that this fuels the informal economy. Hence there can be ramifications of these actions to the overall liquidity in the market place. But we have no option but chase this strategy as, it is very clear that this will be only way that the COVID-19 virus can leak into the country from India or Maldives which is at community spread.

What next?

Whilst the world is awaiting the launch of the vaccines in the UK and US which is at stage 3 trial, WHO announced that the earliest that a vaccine would be available for people will be in the 2nd Quarter, 2021.

The challenge for Sri Lanka is how the 40,000 waiting to return to Sri Lanka can be managed. Whilst this can be a source of income to the bleeding leisure sector, the fact remains that the PCR tests that must be done on a daily basis can be very costly. To what extent can the Sri Lankan economy absorb such costs is the big question for policy makers.

Good news

The good news is that Sri Lanka continues to the baffle the economic pundits. At the outset the ADB predicted a -6.1% economic downturn whilst World Bank has predicted a contraction of -3.2%. We now see that IMF has revised its number to -0.5% growth for Sri Lanka.

However, the reality on ground is that the exports sector is depicting a V-shaped recovery whilst the Central Bank is confident that we can be at near zero growth which will be interesting given that latest forecast is that India will end the year at -10.9% contraction of the economy.

Key actions SL – reforms

Whilst the world is being challenged by the lethal COVID-19 virus, in my view this is a golden opportunity to bring in the ‘reforms’ to the Sri Lankan economy that has not happened since the 1960s. Already the reforms are kicking in like the ban on vehicle imports and ban on imported shoes just to name a few, which will force the domestic industry to innovate.

The private sector will have to understand the economic policy that will come to play in the November Budget and how it will have to change strategy. The one key reform required is policy consistency.

(The thoughts are strictly the writer’s personal views and do not reflect the organisations he serves in Sri Lanka and the South Asian region.)