Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 11 November 2019 00:49 - - {{hitsCtrl.values.hits}}

Humans have never liked the idea of uncertainty. More so, they did not like the idea of economic uncertainty. Hence, the need to hedge this uncertainty gave rise to the evolution of derivatives.

Derivatives have been used by mankind for a very long time. It is believed that the first recorded example of a derivative transaction dates back to around 600 BC in ancient Greece, when philosopher Thales became the world’s first oil derivatives trader – olive oil, that is.

Based on his knowledge of the Greek climate, Thales predicted that there would be a particularly good harvest for olives one year. But rather than sit on this information, Thales had taken the next step and paid deposits to all the olive presses (equipment to press oil from seeds) over the preceding winter.

Thales basically cornered the market on olive presses for a small investment. Stated in modern trading terms, Thales bought call options on olive presses. When his prediction of a generous olive harvest did come true, Thales’ bet paid off handsomely. The boom harvest created heavy demand for the olive presses, and because Thales held a virtual monopoly on the presses, he was able to rent them out at a huge profit.

What started as a simple idea in ancient times was later developed into standard contracts. Today, there is a derivative for pretty much everything. According to latest estimates, the total gross market value of all derivative contracts is valued at approximately $13 trillion.

Despite this financial tool being in existence for centuries, the lack of its use by companies in Sri Lanka is startling. We have companies that export and import goods annually with turnovers exceeding a billion dollars. There are finance companies with significant exposures to gold, as a result of their pawning operations. Sri Lanka has bunkering companies having to deal with fluctuating oil prices. These companies are exposed to the volatility of commodities, stocks, bonds, currencies, interest rates or market indices and face price uncertainty in a regular basis. They place a significant bet on their future profitability by not relying on any hedging mechanism.

This column will explain how useful a derivative could be, despite the delusions around it and the value it can bring to Sri Lankan businesses when they are used with the complete understanding of the product.

‘Hedging’ becomes a household term in the country

An oil company in Sri Lanka entered into oil price hedging contracts with several banks in 2007-2008. The hedging was done through a relatively complex derivative called ‘zero cost collars’. The main feature of a ‘collar’ is that it has a ceiling (upper limit) and a Floor (lower limit).

This particular collar had the ceiling of $130 per barrel to hedge the risk of oil prices increasing beyond this price point. It meant that when the prices of the oil rose above $130 per barrel the banks paid the difference between the price and the ceiling to the company. It had a floor of $100 per barrel, which meant that when the prices of oil fell below $100 per barrel the company should pay the banks the difference between the price and floor. Essentially by executing this hedge, the company had the assurance that regardless of the market price, the price it pays per barrel of oil would always be between $100-130 during the effective time period of this contract.

In 2008, the world entered the worst recession in years. In two months of July and August 2008 alone, the prices decreased from a high of over 140 per barrel to a low of less than $60 per barrel. This resulted in the company incurring heavy losses and this ‘hedging deal’ attracted coverage from all local news channels for all the wrong reasons. As a result, the term ‘hedging’ became a household name in Sri Lanka as a financial instrument known to bring colossal losses to companies. Hedging was even likened to gambling after this incident.

What is a derivative?

Hedging is a term, which means ‘to transfer risk’ and derivatives are tools that are used for hedging.

I will explain a few rather simple derivatives that can be easily executed by any commercial bank in Sri Lanka to address a variety of requirements in companies.

Forwards

This is the most basic derivative that can be used to hedge the exchange rate risk. In a forward contract, known simply as forwards, the buyer and seller may have customised terms, size and settlement process applicable in a future date.

For example, imagine a vehicle importing company which will import a fleet of vehicles worth $ 1 million from the USA. The delivery and payment of this shipment will fall in three months’ time. This scenario places the importer on a massive exchange rate risk, until the import bill is settled.

If the USD/LKR rate today is 180, his cost will increase significantly if the rate goes up to 200 on the day he has to settle the import bill. The importer cannot take orders in advance from buyers without knowing the actual exchange rate that will be applied in three months’ time. The LC has been opened with banks without knowing what his final cost would be in Rupees.

To manage this uncertainty the importer can simply fix the exchange rate by using a Forward contract. The importer can ask his Bank for a three-month forward rate. The Bank will provide him USD/LKR rate (e.g.: 182), which will be applicable in three months’ time. By fixing the exchange rate through this contract, the importer would know the exact cost of the imported vehicles in LKR.

Options

An options contract is similar to a forward contract in that it is an agreement between two parties to buy or sell an asset at a predetermined future date for a specific price. The key difference between options and forwards is that, with an option, the buyer is not obliged to exercise their agreement to buy or sell.

For example, if the vehicle importer above buys a USD call option effective in three months’ time for $ 1 million at Rs. 182, it gives him the right to buy $ 1 million at Rs. 182. Assume that the USD/LKR rate went up to Rs. 200, then the importer has the right to exercise the Option and buy the USD at Rs. 182. Alternatively, if the USD/LKR rate falls to Rs. 160 in three months, the importer is not obliged to exercise the option at Rs. 182. He can simply buy the USD from a Bank at Rs. 160, and have the options contract simply expire.

In a forward, if the agreed forward rate is Rs. 182 the importer is obliged to buy the USD at that price even if the rate moves to Rs. 160. In an option the importer will buy only if the rate is advantageous for him. However, while forwards are offered for no additional fee, options have to be bought at a price. Therefore, options can be compared to insurance for which you pay a premium but claim the insurance only when a claim is triggered. The option premium can be compared to the insurance premium.

Swaps

A swap is a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments. Most swaps involve cash flows based on a notional principal amount such as a loan, although the instrument can be almost anything.

In the context of Sri Lanka, I can think of cross-currency swaps and interest rate swaps to have the biggest potential. In a cross-currency swap, interest payments and principal in one currency are exchanged for interest payments and principal in a different currency.

Imagine company A which is an exporter to the USA (therefore the income is in USD) having to buy equipment worth Euro (€) 10 million from Germany. A cross-currency swap can help company A to mitigate the exchange risk.

Company A will receive €10 million from a Bank in exchange for $11 million which implies a EUR/USD exchange rate of 1.10. If the agreement is for 10 years, at the end of the 10 years company A and the Bank will exchange the same amounts back to each other, usually at the same exchange rate. The exchange rate in the market could be drastically different in 10 years, which could result in significant uncertainty if left unhedged. Companies typically use these products to hedge or lock-in rates or amounts of money, not speculate.

Currency swaps also enable to borrow in the cheapest currency. This is done by getting the best rate available of any currency and then exchanging it back to the desired currency.

Similarly, by using interest rate swaps, companies can convert a floating rate loan to a fixed rate loan or vice-versa to reduce or increase exposure to fluctuations in interest rates or to obtain a marginally lower interest rate than would have been possible without the swap.

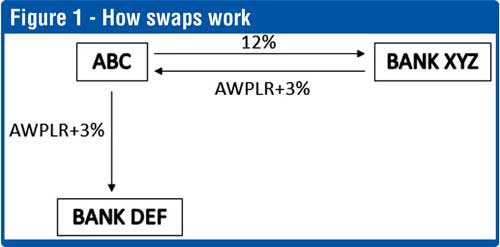

For example, assume company ABC has a Rs. 100 million loan, for which it must pay AWPLR plus 3% every month to Bank DEF. Therefore, this is considered a floating payment because as the AWPLR fluctuates, so does the cash flow. The company decides it would rather pay a constant monthly payment. Therefore, the company can reach out to a Bank XYZ and enter into an interest rate swap contract.

Company ABC agrees to pay the bank XYZ a fixed 12% per month on the notional amount of Rs. 100 million. Bank XYZ agrees to pay bank ABC, AWPLR plus 3% monthly rate on the notional amount of Rs. 100 million. This way company ABC has converted its floating rate loan into a fixed rate loan of 12% (see Figure 1).

Reasons to make better use of derivatives are overwhelming

As shown above, by using a few rather simple derivatives corporates can mitigate or even eliminate a number of risks that could severely impact their profitability and is a useful tool for businesses and investors alike. All these could be achieved free of charge or at a limited cost.

From my experience dealing with corporate treasuries in Sri Lanka, the main reason for not using derivatives seem to be the lack of expertise and knowledge. The negative publicity given through the infamous oil hedge has contributed corporates to shy away from using them. Even the biggest corporates in the country limit themselves to using only Forward contracts, as the lack of expertise and knowledge has created a fear psychosis among the decision makers against using other derivatives to hedge their risks.

Specialised employees who have the expertise to understand these financial instruments, could and they should explain to the hierarchy of the companies the benefits of hedging. In Sri Lanka a couple of internationally recognised qualifications that employers can look for is CFA and the ACI Dealing Certificate to offer in-depth knowledge on derivatives.

I sincerely hope that this column would encourage decision makers in companies, including corporate treasurers to utilise the variety of derivatives explained in order to hedge their risks more effectively as the local commercial banks are fully equipped to facilities these transactions.

The writer is an experienced Treasury & Capital Markets Trader and is a CFA Charterholder. He can be contacted through [email protected]