Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Wednesday, 29 May 2019 00:48 - - {{hitsCtrl.values.hits}}

CCTV footage played the key role in identifying the suicide bombers of the Easter Sunday attack.However, the ways and means of breeding such terrorism on Sri Lanka’s soil is still under investigation.In the aftermath of the Easter attack, there is heighted attention on countering financing of terrorism.Informal/illegal remittance schemes can be seen as one of the main mechanismsused for fund transfers by terrorists.

International soft law making bodies such as the Financial Action Task Force (FATF)and domestic law enforcement authorities make efforts to put frameworks in place to curb informal and illegal remittance schemes. However, reports of investigations into terrorist activities reveal that such systems are in operation parallel to formal financial systems. This article intends to highlight some salient aspects of illegal remittance schemes which pose severe threats to national security, integrity of financial systems and promotion of economic growth.

Informal Value Transfer Systems

According to the Financial Crimes Enforcement Network (FinCEN), any system, mechanism or network of people that receives money for the purpose of making funds or an equivalent value payable to a third party in another geographical location, whether or not in the same form, is considered as an Informal Value Transfer System (IVTS).A system called Hawala in Middle East and Asia, Fei-Chin in China, HuiKuan in Hong Kong, Pei Kwan in Thailand, Hundi in Pakistan and India and Undiyal among Sri Lankan Tamils, black market peso exchange in Colombia and Padala in Philippines are examples of IVTS.

This article will focus on the ‘Hawala’scheme which is considered a widely used form of IVTS.It has originated in the Middle East and South Asia.Although at its origins,the Hawala system facilitated trade and helped to mitigate therisk and inconvenience of physical transportation of money, it is reported that after 9/11 attack Hawalabecame associated with terrorism financing. However, in areas where there is lack of access to conventional banking Hawala functions as an alternative remittance system.

What is Hawala?

In the Arabic language Hawala means ‘transfer’.Trust between the involved parties is the main attraction of the Hawala system.Moreover, the low or no cost for the remitters, speed of the transfer, anonymity, convenience for the recipients and the lack of rigid formalities, suitability for cultural aspects are considered as other attractive elements of the Hawala system. It is also observed that the Hawala is used to evade currency controls, international sanctions, and taxes as well as to transfer criminal proceeds.

Modus Operandi: Moving money without money moving at all

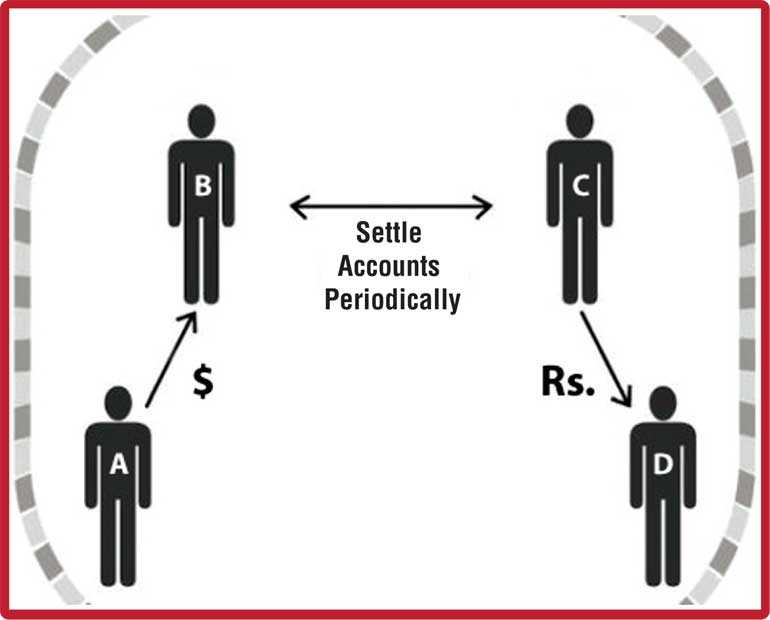

The multifaceted description of Hawala indicates that it is a mechanism of transferring money without physically moving it.The diagram elaborates a simple Hawala transaction.

[A] Customer (usually a migrant worker but it could be any other person) approaches a [B] Hawala broker (Hawaladar) and gives him a sum of money to be sent to a recipient in another country.[B] contacts their Hawala partner [C] in the recipient country via phone or fax or email.[A] gives the information on the beneficiary, amount, name, address, telephone number of the recipient to [B].However, [B] doesn’t remit money to [C].[B] agrees to settle it later and [C] pays to the recipient (D). Therecipient will have a password or code number to get money from [C].No written contract for the transaction is available and the deal is secured by the trust between parties.

Two Hawaladars i.e. [B] and [C] settle their dues at a later stage through under invoicing, transferring money through banks or cash carriers. Researches reveal that Hawala brokers mostly involved in import/export activities. They charge a modest commission and use a more favourable exchange rate than the mainstream banks.The Hawala broker in the recipient country does the delivery of money free of charge.Since the Hawala does not create a paper trail it gains traction for illicit transactions such as terrorist financing, tax evasion, exchange control violations and import/export frauds.Therefore, the debt settlement can be done by manipulating invoices i.e. under-invoicing or over-invoicing shipments of goods.Smuggling gold and precious items is another way of settling dues between Hawala brokers.

In an article titled ‘A Banking System Built for Terrorism’ published in Time Magazine (2001) the following description had been given for illegal remittance systems. In the labyrinthine depths of Old Delhi, (...) nobody seems to be doing any work, until the phone rings.Then numbers are furiously scribbled, followed by some busy dialling and whispered instruction.Although it’s far from obvious in the innocuous setting, these men are moving money – to exporters drug traffickers, tax evaders, corrupt politicians. And terrorists.The regulatory empowerment in Sri Lanka should also be widened to detect such money movers in the country who are engaged in criminal activities.

Susceptibility ofHawala for money laundering and terrorism financing

It is observed that criminals take advantage of the anonymity of the Hawala system to move the proceeds of illegal activities.Since the documentation involved in the Hawala deals is minimal, it makes the system vulnerable to be abused for money laundering and terrorism financing.

According to Timothy O’ Brien, Al Qaeda has used the Hawala system to fund the American Embassy bombings in Kenya and Tanzania in 1998.Columbian drug traffickers have also used Hawala as their main remittance system.The Irish Times reported (2016) that Hawala was used to fund the Paris attack in 2015.As per the International Business Times (2015) the Boko Haram Organization in Nigeriais known to receive money through Hawala.In 2005, FATF also acknowledged the potential misuse of Hawala by criminals. The FATF states that Hawala, controlled by criminals, functions as networks for other offences including tax fraud, currency offences and corruption. According to the Interpol reports, the Hawala system facilitates money laundering by placing illegal proceeds in formal financial institutions pretending they are earnings of a legitimate business.Front Companies operated by Hawala dealers assist these placements.They complete the layering of criminal proceeds distributing transfers over a period of time.

At the ‘integration’ stage of the money laundering process, illicit money is invested in legitimate businesses, purchase of property or import/export invoices.Netherlands authorities have found out that laundromats, grocery stores and phone shops have been used as illegal money remittance businesses.During 2010-2012 eight million Euros have been seized by the Public Prosecutor’s Office in Amsterdam. In 2011 Manhattan Federal court arrested a person operated an unlicensed money transfer business between the USA and Pakistan.

One of its transactions was used to fund the attempted car bombing in New York City’s Times Square in 2010.The owner of an ice cream shop named Carnival Ice Cream was arrested in Brooklyn, in 2003.He maintained an account in J.P Morgan Chase Bank to collect the funds to be transferred to Al Qaeda. The UAE, in collaboration with the United States Department of Treasury, blocked AlBakarat’s (a Somali based Hawala operation) assets in Dubai.

Discouraging the existence of informal remittance systems

Opportunities available for IVTS operators, such as Hawala, should be restricted through effective compliance with laws applicable to money transfers.In terms of the regulations issued under the Foreign Exchange Act No. 12 of 2017, a person arriving in Sri Lanka may carry any amount of foreign currency in the form of foreign currency notes, bank drafts, cheques, travel cards etc.If that amount exceeds $ 15,000 or its equivalent in any other foreign currency or such a person intends to take back foreign currency notes exceeding $ 10,000, a declaration shall be made to Sri Lanka Customs.

According to available reports, cash carriers facilitate Hawala operations.Hawala brokers can settle each other through cash carriers as well.Therefore, the vigilance of Sri Lanka Customs over currency imports needs to be strengthened.Analysing such cash declaration reports would also facilitate conducting investigations into terrorism financing and money laundering.

Regulations issued under the Financial Transaction Reporting Act (FTRA) No. 6 of 2006 are applicable when funds arechannelled through banks.There is a possibility of detecting bulk remittances by Hawala brokers if such funds come through banks.Both the remitting and recipient banks are required to exercise enhanced due diligence over the source of funds, purpose of the remittance and ultimate beneficiary of a fund transfer.According to Section 7 of FTRA, irrespective of the amount involved, all suspicious transactions (STRs) are required to be reported to the Financial Intelligence Unit (FIU) of the Central Bank of Sri Lanka (CBSL).

Any cash transaction or electronic fund transfer that exceeds Rs. 1 million or its equivalent in foreign currency is reported under Cash Transaction Reports (CTRs) to the FIU as per the Section 6 of the FTRA.Compliance of financial institutions with the said reporting requirements and thorough analysis of the patters of transactions, local credits to accounts, inward and outward remittances based on above said CTR and STR is of paramount importance in identifying local cash pools of Hawalabrokers,money launderers and terrorist financiers.

Frankfurter AllgemeineZeitung(2000) reports that it would be difficult to recognise concealed use of conventional banking by Hawala operators as their accounts are registered in the name of individuals, small businesses or the like whose background the bank is unlikely to examine thoroughly.Among the red flags of transaction patterns that are often associated with Hawala systemscredits to the accounts ofbusinesses that do not have an apparent link with other businesses activities, significant deposit activity in cash/cheques, different book keeping methods for customers and transactions that have no commercial or economic sense for a personal account can be highlighted.

Officers of banks and financial institutions have,therefore, a critical role to play in reporting such suspicious transactions. This responsibility to exercise enhanced due diligence over the customers extends to the designated non-finance businesses stipulated under FTRA as well. These include real estate agents, dealers in precious and semi-precious metals, lawyers, notaries, accountants, etc.

Strengthening the legal framework to combatHawala

In terms of the Foreign Exchange Act, foreign currency can be purchased for permitted transactions only from authorised and restricted dealers in Sri Lanka.Licensed banks and authorised money changers function as such dealers in foreign exchange.Authorised money changers have been appointed to enhance the flow of foreign currency into banking channels.If they do not deposit the foreign currency purchased by them as per the conditions stipulated in the Permit issued by the Director/Foreign Exchange of the CBSL there may be possibilities of selling such funds to black market operators, including Hawalabrokers.

The FATF has also revealed that in many countries regulated money transfer agents are reportedly used to conduct illegal Hawala transactions separately and covertly in addition to their regulated activities. Such market structure makes it more difficult for the regulators to implement the law against offenders.

Although the transfer of funds overseas by persons in or resident in Sri Lanka using Hawala system is prohibited under Section 4(3) of the Foreign Exchange Act, there is no prohibition for persons in or resident in Sri Lanka to receive funds through Hawala system, from a foreign entity/person.In terms of the provisions of Section 3 of the Foreign Exchange Management Act of India, receiving funds by a resident via reverse Hawala operations is an offence.Assistance of all stakeholders to expedite the amendments suggested by the Department of Foreign Exchange of CBSL would be important in combating Hawala in all its different forms effectively.

FATF is of the view that completely unregulated remittance operators are particularly vulnerable to money laundering and terrorist financing risks as they permit funds to be sent with no customer due diligence requirements. Funds remitted through Hawala cannot be monitored as there is no paper trail.Such systems can be discouraged by promoting formal remittance channels particularly through reducing transaction costs.

Promoting formal remittance schemes

Enhancing the competitiveness in the remittance industry, in accordance with special recommendation VI of the FATF, would also be helpful in curtailing the use of Hawala operations for money laundering and financing of terrorism.It will also be advantageous to attract worker remittances to legal channels.Such competition should, however, be supported by proper governance and risk management practices. In developed countries Hawala and other informal remittance schemesare allowed to be licensed or registered.

Thisenablesmaking unlicensed/unregistered entities illegal and taking actions against them. According to FATF Recommendation VI, each country should ensure that persons or legal entities that carry out the money transfer service illegally are subject to administrative, civil or criminal sanctions However, such a comprehensive framework to distinguish ‘black and white Hawala’ requires providing adequate resources and securing the assistance of law enforcement agencies for the regulators.

The UAE issued ‘Abu Dabi Declaration’ imposing a licensing requirement while recognising the need for Hawala operation for legitimate purposes of unbanked communities.

The IMF says that informal fund transfer systems declined in the countries where financial systems are liberalised. The provisions of the Payments and Settlements Act No. 28 of 2005 of Sri Lanka provide for licensing money transfer service businesses. However, identifying the dynamics of Hawala and other similar remittance services in the broader context ofthe financial system is important prior to designing anall-inclusive regulatory regime for the remittance market.

Adverse economic impact

Scholars point out that continued existence of Hawala threatens the country’s economy as it is beyond all the standard instruments of macro-economic policy.Informal remittances are not recorded in official statistics or the foreign assets of a recipient country. They are not reflected as liabilities of the remitting countries.Since the informal remittances increase the circulation of cash in the recipient country and affect the composition of broad money there may be an adverse impact on monetary policy.

There may also be a negative fiscal implication as the funds routed through informal channels are not subject to taxes.According to the IMF, accurate compilation of informal fund transfer systems, such as Hawala, in balance of payments accounts is difficult.Studies carried out by the United Nations and Interpol state that the volume of financial transactions in the Hawala network, at times, substantially exceeds that in the formal banking sector.

It is estimated that more than $ 7 billion enters into Pakistan every year through Hawala.Interpol estimates the size of Hawala at possibly 40% of the India’s GDP.It is also estimated that every year approximately $ 200 billion moves around the world through Hawala system without being detected by regulators.

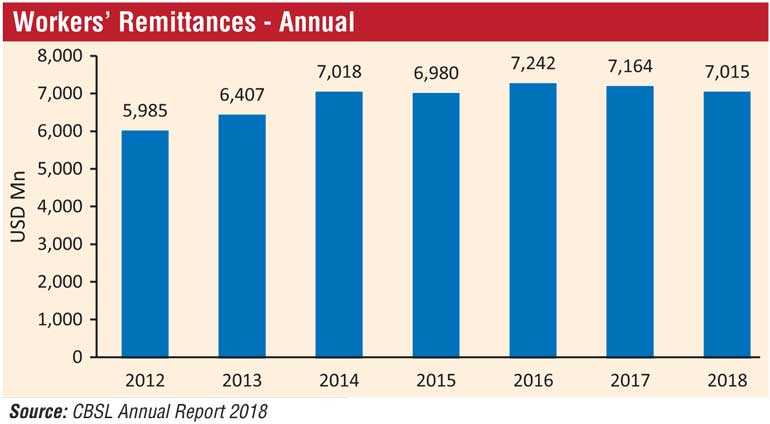

When informal fund transfer systems operate efficiently without any disturbance, tendency to channel legitimate transfers also through those systems maybe created.In 2018, workers remittances to Sri Lanka has declined by 2.1% to $ 7,015million as depicted in the table.

It would be interesting to know whether the decline of the use of banking channels by migrant workers have also contributed tothe reduction of remittances.According to Ratha (2006), the funds remitted to Sri Lanka annually through informal channels, could be as much as half of formal remittances received by the country.Attracting worker remittance through formal channels would be important in discouraging informal remittance schemes in Sri Lanka, particularly in the context of the current elevated threat levels which demand increased vigilance against terrorist financing.

It can be suggested that the Sri Lanka Foreign Employment Bureau can implement a strategic plan in collaboration with banks and the foreign missions abroad to attract remittances by undocumented workers, workers with expired Visa and first time migrant worker to formal channels.It can also be suggested to make the requirement to open a Personal Foreign Currency Account by expatriate workers as a condition at the time of giving approvals for foreign employments.Engaging with the formal sector,however,will be discouraged if the recipients are supposed to travel long distances to collect their money and required to fulfil rigid formalities.In order to expand the access to formal remittance channels by migrant workers and their recipients, the competition in the market needs to be enhanced.New entrants coupled with technological advancements such as digital payments/mobile payments should also be promoted.Financial sector stakeholders will have a role to play in balancing technological development and financial inclusion while preserving the integrity of the system.

Conclusion

Smooth coordination and timely sharing of relevant and reliable information among law enforcement, regulatory authorities and financial institutions as well as the other public agencies are of paramount importance in effective combating of the Hawala system.It reduces the delays in investigation processes and facilitates bringing perpetratorsto book while preserving the public confidence in the legal system.Hawala has proved to be an effective mechanism to hide the illicit origin of money and its destination; and break the audit trail of money.

Therefore, awareness of all the above mentioned stakeholders and the general public regarding the informal remittance systems should be enhanced.Political commitment is also essential to tackle all sources, techniques and channels of terrorist financing. As long as there are ‘safe spaces’ for money launders, terrorist financiers and other criminals they continue to pose threats to the national security, integrity of financial system and accuracy of economic fundamentals.

“We need new partnerships in fighting terrorism and building peace” – Anna Lindh

(The writer is Deputy Director at CBSL. The views and opinions expressed in this article are those of the writer and do not necessarily reflect the official policy or position of any institution.)