Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 15 March 2021 00:46 - - {{hitsCtrl.values.hits}}

As per IATA guidelines on vaccine transportation, airlines and airports would need to take necessary steps of precaution with regards to dry ice storage, and air freight related employees need to be protected against its harmful effects

The success in the development of COVID-19 vaccines has now put the air cargo industry in the spotlight as it is the fastest mode of transportation for the vaccines worldwide. However, the air cargo industry also faces two of the biggest challenges in relation to vaccine distribution – first being the capacity constraints, and the second, and perhaps the biggest challenge, the need for temperature-controlled infrastructure to transport and store the vaccines. As such, the vaccine distribution process presents a significant revenue opportunity for airlines and airfreight companies. However, it also poses one of the most complex logistical exercises the industry has ever undertaken due to the demand and urgency.

The world in pandemic

Towards the end of 2019, the World Health Organisation (WHO) received information regarding a ‘viral pneumonia’ spreading in Wuhan, China. Less than a month later there was clear evidence of ‘at least some human-to-human transmission’ of the virus. By early February 2020, the WHO named the disease caused by a novel coronavirus, COVID-19, and the first dispatch of RT-PCR lab diagnostic kits were shipped to WHO regional offices.

As cases of COVID-19 increased worldwide, guidelines on wearing masks and social distancing measures were applied throughout countries and regions. As healthcare facilities started feeling the strain of treating COVID-19 patients, more stringent measures such as lockdowns and isolating entire regions, were implemented.

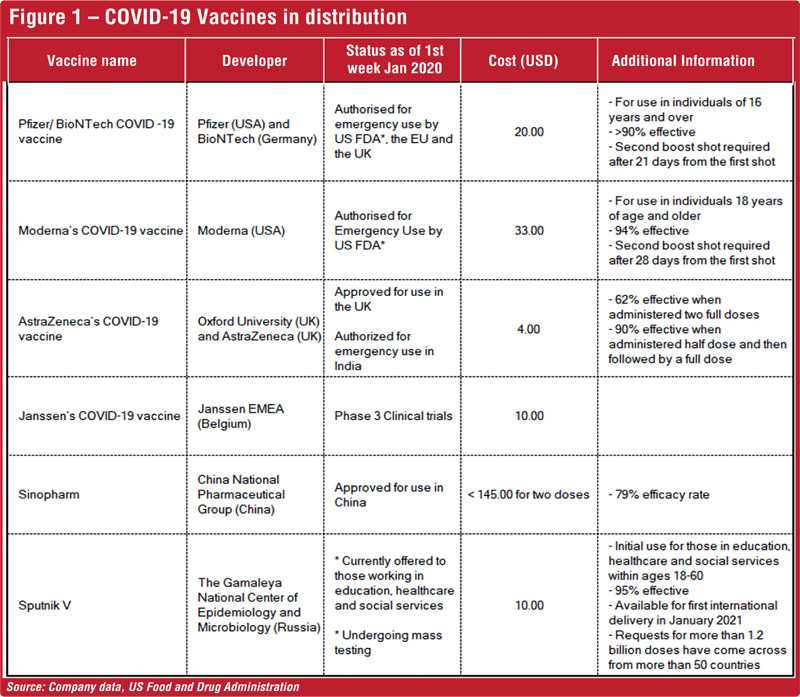

However, it was apparent that social measures were not sufficient to contain the spread of the virus. With no treatment available, what could put a stop to the pandemic was a vaccine, and as such, leading pharmaceutical companies and organisations began working on vaccine development as early as March 2020 (Refer Figure 1).

As COVID-19 vaccines showed promising development, and approval and authorisations for usage came through, the next biggest challenge is how to get these vaccines to a global population of 7.8 billion people.

In order to ensure equitable accessibility of COVID-19 vaccines, WHO launched the COVAX platform under its ACT (Access to COVID-19 Tools) Accelerator initiative, which covers the diagnostics, treatment, and vaccines for COVID-19. The COVAX platform’s aim is to ensure that all participating countries would have access to the vaccines regardless of income levels. WHO aims at distributing nearly 2.0 billion vaccine doses by the end of 2021, while vulnerable groups will have access to the vaccines by first quarter 2021. By mid-December 2020, nearly 190 countries had signed up with COVAX. WHO has advised countries to develop their own national deployment and vaccination plans, which means that each country would have to monitor their readiness and resources needed for the vaccine rollout.

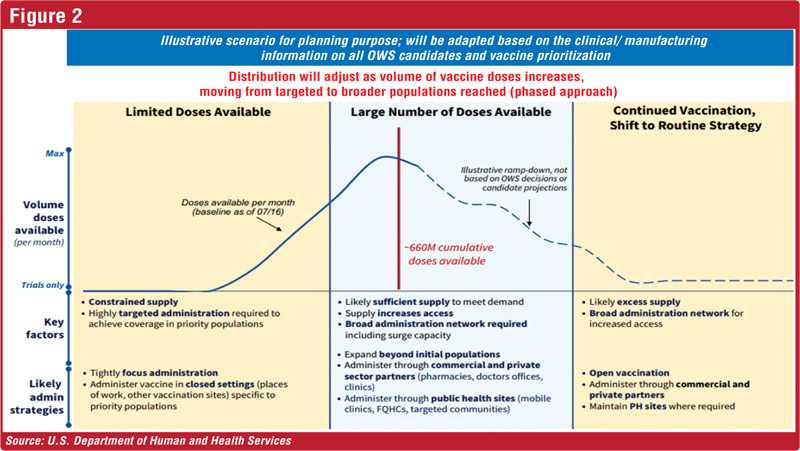

The United States of America (US) rolled out its own vaccine distribution plan early December 2020, where the US Department of Defence (DOD) announced that they plan to administer 44,000 doses of Pfizer’s coronavirus vaccine within 24-28 hours of US FDA emergency use authorisation. The vaccines would be distributed via 16 DOD centres – 13 in the US and three overseas. The US Department of Health and Human Services illustrated the distribution of vaccines in the manner displayed in Figure 2.

Conditions and constraints of vaccine distribution

The initial transportation of COVID-19 vaccines would utilise land and air modes. However, a majority of the vaccines would have to be air lifted in order to reach other countries outside of the manufacturing regions, mainly due to strict storage and distribution requirements. The International Air Transport Association (IATA) estimates that ~8,000 Boeing 747 freighters will be required to airlift sufficient doses of coronavirus vaccines to cover the ~ 7.8 billion global population, within a period of two years. The estimates assume that the vaccination program requires only one dose, while a multiple-dose treatment program would mean added demand for air freight.

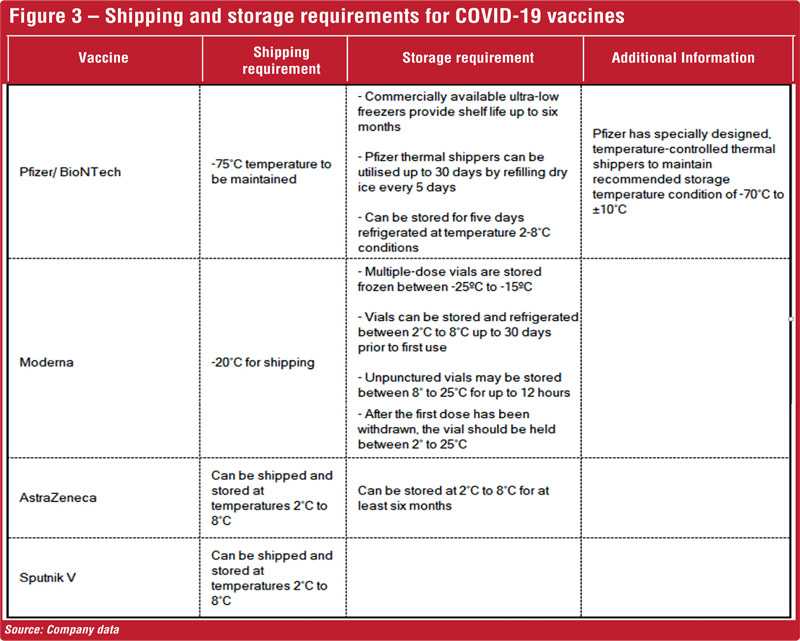

Apart from the limited air freight capacity, one of largest challenges in transporting COVID-19 vaccines is the requirement of extreme freezing temperature conditions in which the vaccines need to be transported and stored (refer Figure 3).

Russia’s Sputnik V and UK’s AstraZeneca have the least complexity in transporting the vaccine in terms of necessary temperature-controlled conditions, whereas the initial FDA authorised vaccines Pfizer and Moderna require sub-zero temperature-controlled

infrastructure.

As such, IATA identifies a number of major operational risks and constraints pertaining to the air cargo industry in relation to transporting COVID-19 vaccines. They are;

Scarcity of air cargo capacity

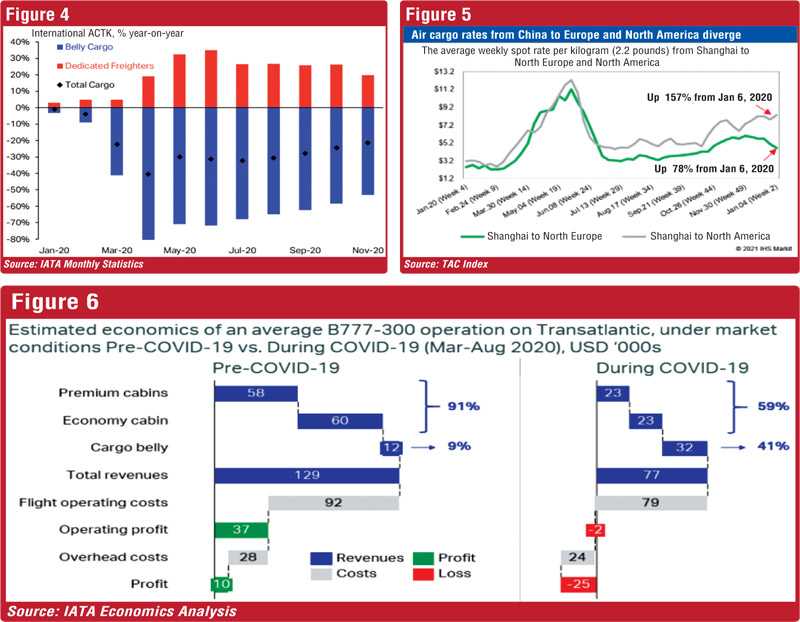

Nearly half of the world’s goods are moved by air and are transported by ~2,000 dedicated freighters, while the remainder of goods are moved using the bellies of ~22,000 passenger jetliners. Due to low passenger air travel during the pandemic, most airlines downsized their businesses and placed many of their air crafts on long-term storage, limiting the availability of global air cargo capacity (refer Figure 4 and 5).

With air passenger transportation facing restrictions and bans due to the pandemic, airlines have turned to air cargo transportation to cut their losses. IATA’s model on a B777-300 transatlantic flight finds that cargo revenues accounts for ~41.0% of total flight revenue during COVID-19 vs. ~9.0% prior to COVID-19, enabling aircrafts to cover their flight specific operating costs. However, despite increased cargo revenues, airlines still find it insufficient to cover operating costs, thereby incurring losses (Figure 6).

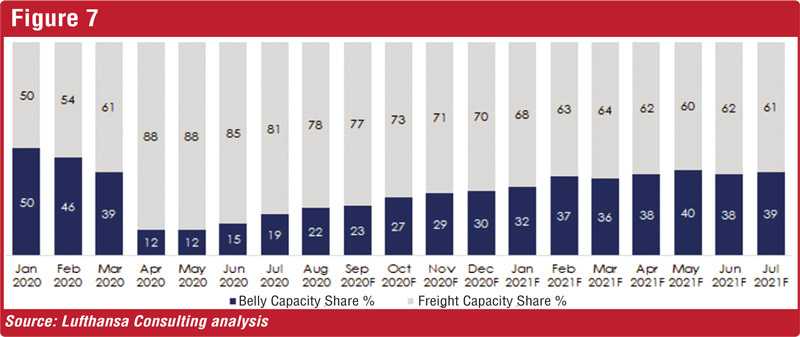

Belly-capacity share in total air cargo transportation is usually at ~50.0% which was still the case at the beginning of 2020. However, as the pandemic continued to restrict passenger air travel forcing airlines to ground their fleet, belly cargo capacity dropped to ~15.0% of total air cargo share by mid-2020.

The reintroduction of passenger services is expected to be slow, with IATA expecting air travel to see reasonable growth only by late 2021, which would limit belly cargo capacity during the first half of 2021. Thus, the share of belly cargo capacity in air cargo transportation is expected to be less than ~40.0% by mid-2021 (Figure 7).

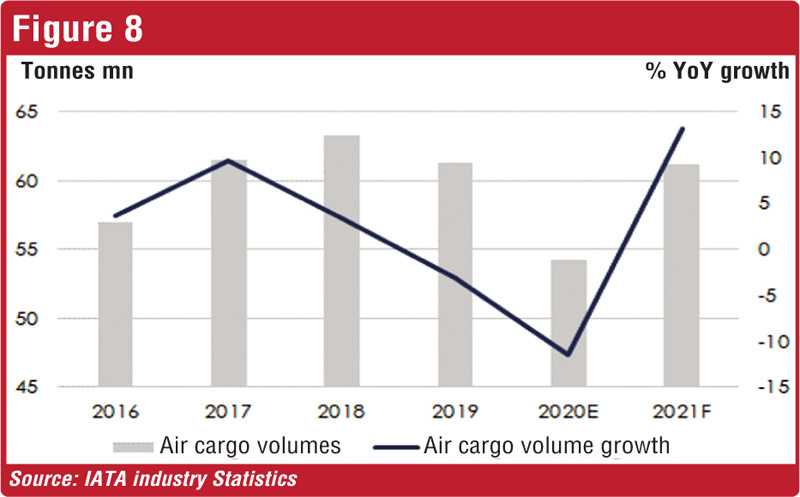

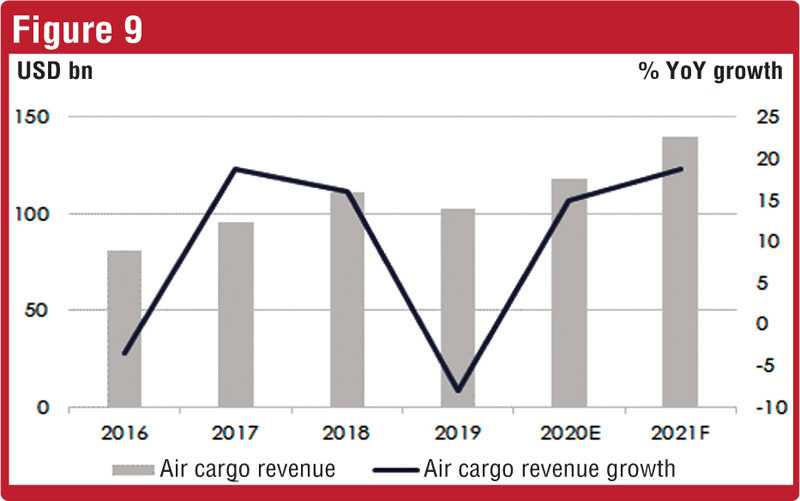

IATA expects cargo volumes to grow to 61.2 million tonnes in 2021, a ~13.0% YoY growth in 2021 due to improved business confidence and taking part in the vaccine distribution process. The capacity crunch combined with vaccine distribution under temperature-controlled conditions are expected to increase yields further by 5.0% resulting in air cargo revenues reaching a historical high of $ 139.8 billion. Cargo volumes in commercial airlines is expected to contract by 11.5% YoY in 2020 and recover by 13.1% YoY in 2021. However, cargo revenues are expected to increase over 2020 and 2021, indicating an increase in airfreight yields (Figure 8 and 9).

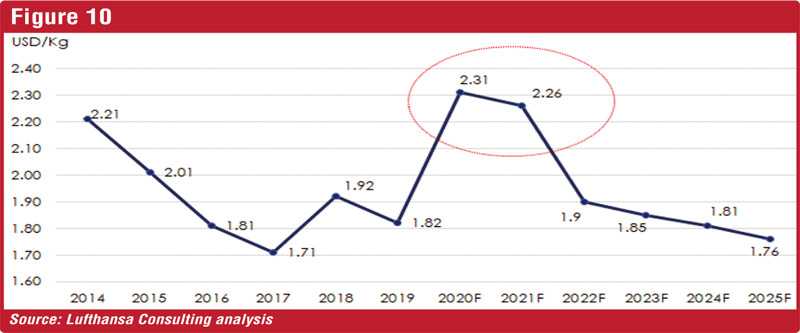

As a result, air cargo yields increased in 2020 due to ongoing capacity constraint growing at ~27.0% YoY to an average of USD 2.31/kg. Cargo capacity is expected to recover in 2021, but yields are expected to remain higher than pre-COVID cargo yields due to higher share of freight capacity, which usually trades at a premium compared to belly cargo (Figure 10).

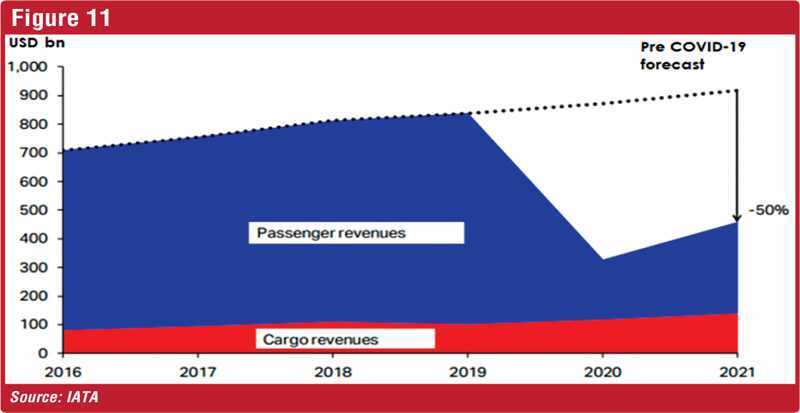

Cargo performance in 2020 and 2021 is expected to be higher than pre-COVID levels, but will not be sufficient to cover the loss resulting from low passenger revenues. IATA expects the overall airline industry revenue to be ~50.0% of pre-COVID revenues at around $ 419 billion (Figure 11).

Unavailability of temperature-controlled facilities and associated risks

New storage and transportation facilities need to be created as no prior approved drug has needed to be stored in such low temperatures as required by COVID-19 vaccines. The COVID-19 vaccine is stored in dry ice in order to maintain required freezing conditions.

As per IATA guidelines on vaccine transportation, airlines and airports would need to take necessary steps of precaution with regards to dry ice storage, and air freight related employees need to be protected against its harmful effects. The significant high levels of dry ice present in storage areas poses the risk of asphyxiation, which may result from elevated CO2 levels.

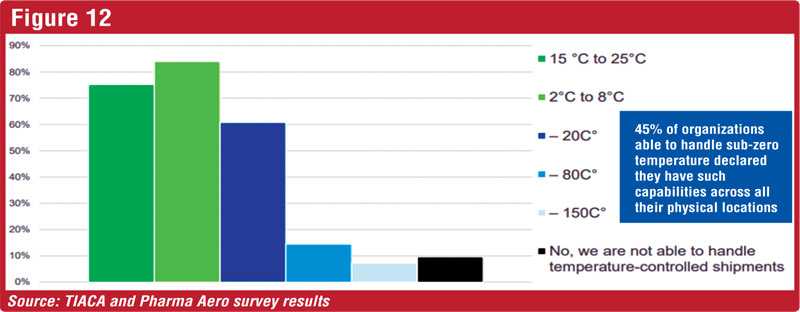

According to a survey conducted by The International Air Cargo Association (TIACA) and Pharma Aero in September 2020, ~87.0% of airfreight companies had the right structure for COVID-19 vaccine transportation and are in close engagement with vaccine manufacturers. By the time of the survey, ~20.0% of respondents were already involved in logistics pertaining to clinical trials of COVID-19 vaccines. In addition, ~45.0% of the organisations already had in place the necessary infrastructure and capabilities to transport vaccines in sub-zero temperature conditions.

The need for temperature-controlled facilities is another factor that contributes towards soaring air cargo rates. WHO’s Chief of Operations Support and Logistics states that quotations received from a leading air freight company for a shipment of dry ice was 20 times higher than the ‘normal price’. However, the cold chain issue along with related high costs is expected to be sorted, especially for developing countries, as vaccines that require storage temperatures between 2°C to 8°C show promising results (Figure 12).

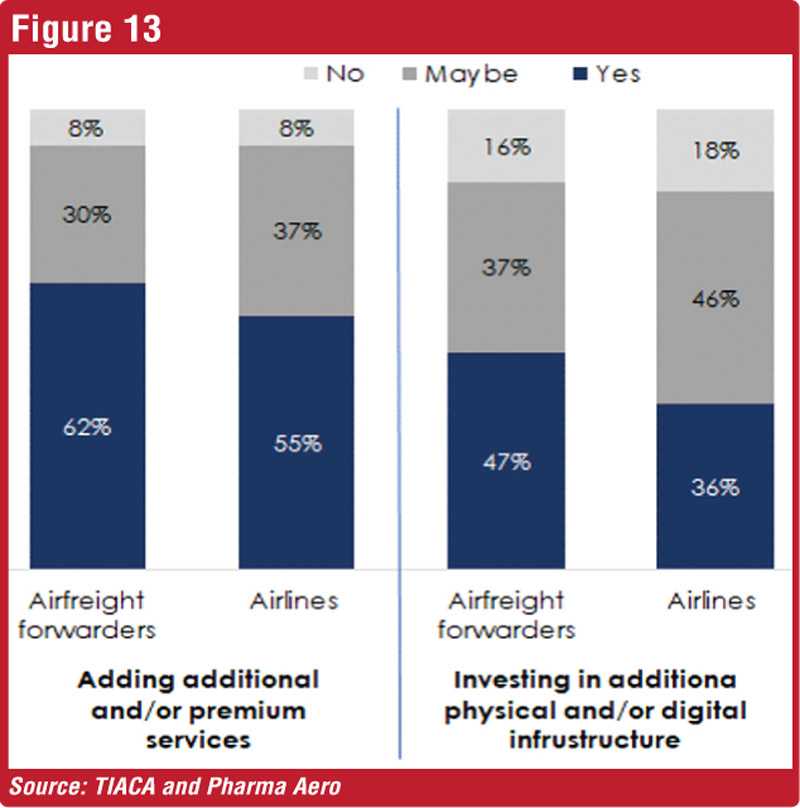

As such, a majority of airlines and airfreight forwarders show willingness to add the required services and infrastructure in order to transport COVID-19 vaccines in a timely and reliable manner (Figure 13).

Further, more than 50.0% of airlines and airfreight forwarders are willing to add additional and/or premium services to clients with regards to vaccine distribution, while a significant percentage of these companies are also willing to invest in additional infrastructure.

Shortage of manpower within the supply chain

The impact of the coronavirus pandemic was immediate on the airline industry with job losses and cost cutting measures being implemented. The aviation labour market experienced reduced manpower in terms of;

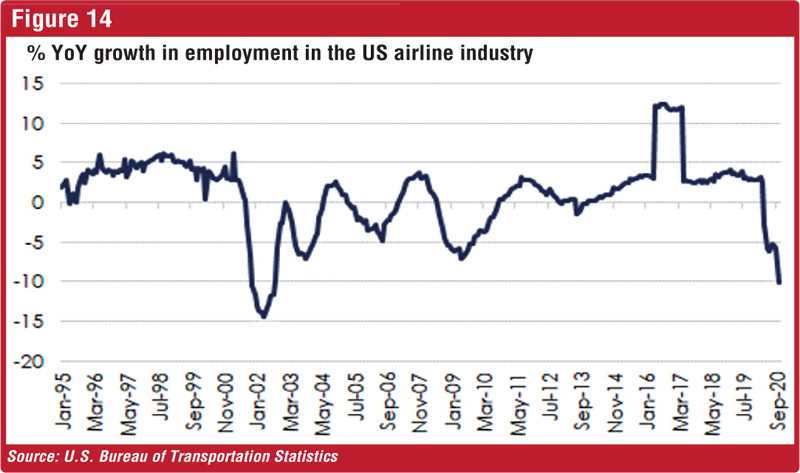

Employment across the US airlines industry in 2020 fell far beyond the contraction experienced even during the 2008 global financial crisis (Figure 14).

As a result of the impact on the airline industry, major airports handling the transportation of the vaccine are faced with labour shortages, particularly with existing workers also having to cater to regular trading activities which have been steadily recovering.

Apart from the airline industry, there are also numerous restrictions across the supply chain. For an example, a COVID-driven bottleneck has hit the supply chain out of China: a severe shortage of truck drivers and air routes disrupted by crew restrictions.

In addition, as noted by IATA, the aviation industry needs its workers to be considered as essential when the vaccine is rolled out across the globe, as they will play an essential role in its distribution.

Government regulations may restrict distribution

Bi-lateral and multi-lateral agreements between countries on air transport and cargo delivery impose restrictions on emergency supply delivery. Furthermore, certain restrictions and regulations in place which control the transportation of certain goods including chemicals and pharmaceutical products need to be considered. Governments will need to relax rules and regulations, as well as grant additional air traffic rights in order to facilitate and prioritise COVID-19 vaccine transportation.

Recovery in global trade key to revival of the air freight industry

Despite the current boost to the air freight industry from the pandemic, recovery in regular economic and trade activities are a necessity for a more long-term and stable recovery of the air freight industry. It is the fastest mode of transport to recover compared to other modes as businesses look to rapidly re-stock inventory in response to anticipated increase in demand.

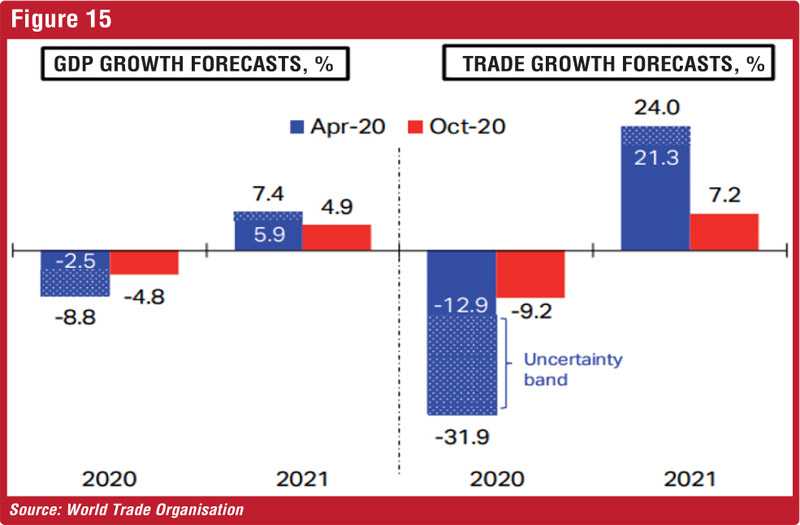

The World Trade Organisation (WTO) in its latest forecast expects word trade to rebound to a 7.2% growth in 2021 following a 9.2% contraction in 2020. Global GDP is expected to grow by ~5.0% in 2021 vs a 4.8% contraction in 2020 (Figure 15).

However, WTO notes that even though the rebound in international trade is usually quite strong following a recession, trade volume forecasts for 2021 will remain below pre-crisis levels as adverse effects of the pandemic on employment and income, supply side constraints and policy on international trade restrictions, would slow trade growth post-COVID-19. Therefore, the recovery in air cargo would be quite slow due to the subdued trade recovery.

That said, the COVID-19 vaccine distribution process would be a definite boost for the global air freight industry. While 2020 was one of the most challenging years globally, 2021 would be the most challenging for the airfreight industry as it partakes and plays a key role in the vaccine distribution process.

(The writer is a seasoned economic analyst with over seven years of experience in capital markets and macroeconomic research. She holds a Masters in Economics from the International Islamic University, Malaysia. The article was written on behalf of ReMAtics, a freelance platform specialising in financial research, writing and analytics.)